Many either fail to thrive or continue to underperform. However, focusing on high-quality small caps with strong competitive advantages can yield significant long-term value for shareholders.

So, how do you identify the winners?

The importance of careful stock selection

With approximately 200 companies in the ASX Small Cap Index, along with many more outside this index, careful stock selection is crucial to investment success. While the S&P/ASX Small Ordinaries Index serves as a benchmark for small cap Australian equity portfolios, it only includes companies from the S&P/ASX 300, excluding the top 100.

Identifying tomorrow’s top companies requires meticulous research to avoid mediocre and poorly performing companies. Nonetheless, there are outstanding investment opportunities within the small-cap space, making a bottom-up approach to selecting the right companies vital.

Examples of small caps that have successfully transitioned into top 100 companies include Carsales, Technology One, ResMed, and REA Group.

What makes a great small cap?

Small-cap companies carry unique risks compared to their larger counterparts. They tend to be less mature, can exhibit more volatile earnings, and often lack the resources that large caps possess for marketing and operations. Moreover, their markets can be less stable overall.

However, small caps are often more agile which can allow them to respond quickly to trends and opportunities, which can, in turn, lead to faster growth. When they succeed, the rewards can be much larger.

Very favourable risk-adjusted returns in small-cap investing can be found within a high- performing subset – a “sweet spot” of potential future top 100 companies – those with robust business franchises.

Business franchises are characterised by several key features:

- An economic moat around the business that protects revenue from competitors.

- Difficult to replicate assets, such as licences and brands.

- A good quality management team.

- An entrenched customer base that faces obstacles in switching to competitors.

- A sustainable competitive advantage.

- Barriers to entry for new competitors.

- Pricing power.

In essence, these are quality businesses poised for durable growth.

The underlying belief is that companies exhibiting these business franchise characteristics are more likely to achieve superior profit and share price growth over the medium to long term, outpacing lesser-quality small caps and even large caps.

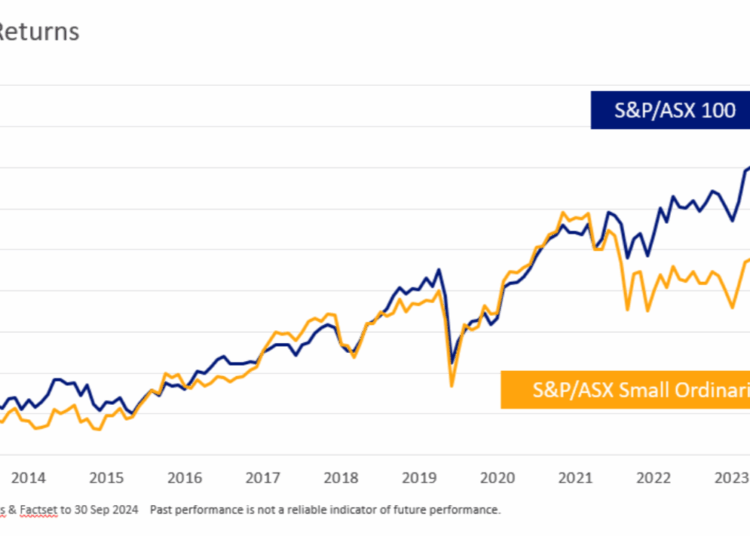

Small-cap dislocation evident

Despite the potential, the S&P/ASX Small Ordinaries Index has shown significant underperformance since early 2022, as highlighted in our recent analysis between the S&P/ASX 100 index and S&P/ASX Small Ordinaries and this dislocation remains in place.

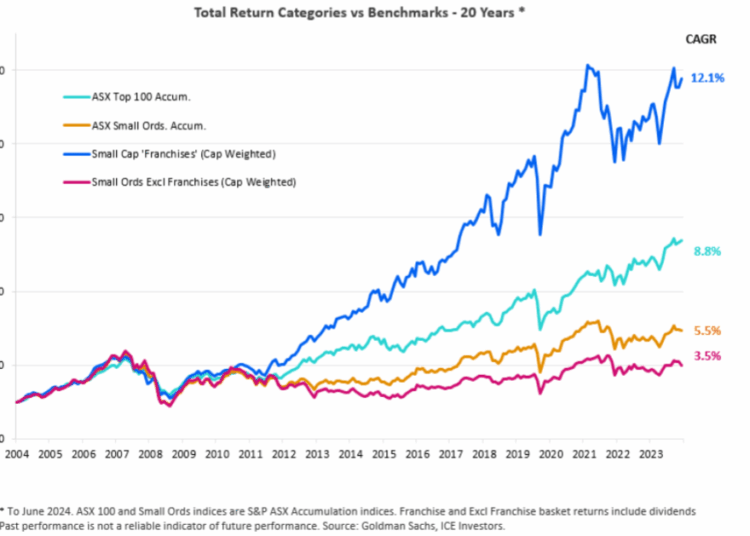

However, investing in companies with strong business franchises can yield dramatically different outcomes. As shown in the chart below, data over the last 20 years shows that these franchises consistently deliver superior returns compared to the broader small-cap universe.

CAGR = Compound annual growth rate

Small-cap businesses with solid franchises, represented by the blue line in the graph above, provide superior risk-adjusted returns due to their robust business models and consistent earnings growth. In contrast, lower-quality small caps, represented by the red line in the graph above generally exhibit weaker prospects and less-durable growth – in fact, the difference makes the small caps excluding franchises appear like dead weight.

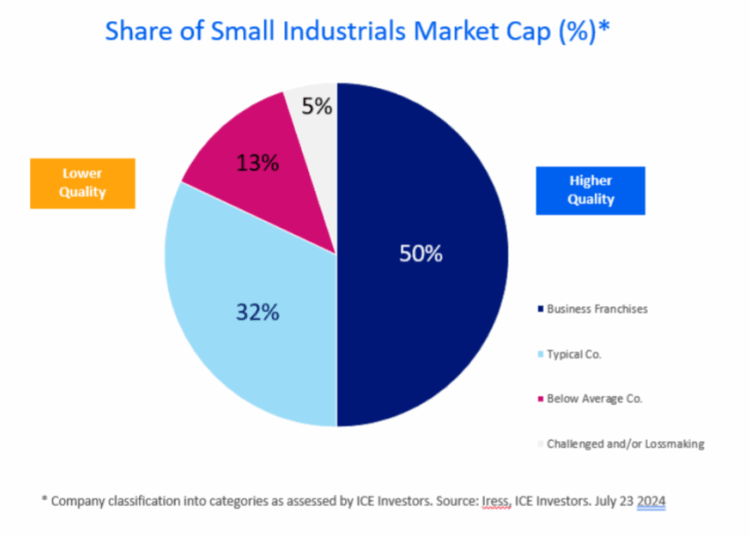

As demonstrated in the below chart, currently, about half of Australia’s small industrials market cap is comprised of higher-quality business franchises – representing a great opportunity for investors, with the other half consisting of lower-quality companies. This illustrates the breadth of companies available that require careful analysis to extract value.

Uncovering the next gem – the effort makes the difference

In the realm of small-cap equities, strategic stock selection remains paramount, and investors should undertake comprehensive research and proper due diligence, to be better equipped to identify tomorrow’s top 100 companies. With a focus on firms with strong business franchises, investors can tap into the potential for substantial outperformance within this dynamic segment of the market and avoid lower quality companies that may lead to underperformance and ultimately, poor returns.

Callum Burns, managing director and portfolio manager, ICE Investors