Reliable and consistent income used to be a feature of higher interest rates and deposits. But that is certainly no longer the case. While many investors struggle to identify a replacement source of income, sophisticated investors increasingly recall that there is another asset class that provides just this – and that is why there has been record capital flowing into infrastructure funds .

Investors allocated US$85 billion to unlisted infrastructure funds last year, up $10 billion on 2017, according to Preqin. This was the third annual record amount of investment in the asset class. Preqin forecasts the amount invested in unlisted infrastructure funds to rise a further 10 per cent.

Investors like unlisted infrastructure diversification, inflation-hedging and income stream potential, especially given the concerns many investors have about a prospective market downturn.

Australia’s larger industry superannuation funds have invested in unlisted infrastructure since the mid-1990s, accessing the benefits and diversification provided by these real and reliable income-generating assets.

In contrast, the nation’s smaller institutional investors, high-net-worth individuals (HNWIs) and close to 600,000 SMSFs have traditionally been excluded from this market.

However, volatile equity markets coupled with low interest rates and term deposits are prompting smaller investors to seek new ways to generate returns, beyond their traditional allocation concentration to Australian equities, cash and property.

And this is extending to unlisted infrastructure. Infrastructure, and particularly unlisted infrastructure is attractive due to its typically stable, reliable returns and low correlation to equities.

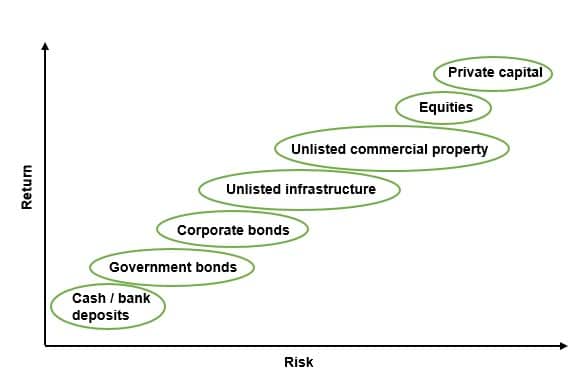

Infrastructure in a portfolio sits between government bonds and equities in terms of risk return, making it an excellent portfolio diversifier, (as shown below).

Infrastructure’s potential for stable, reliable income and capital growth is derived from long-term, stable and predictable cash flows, typically underpinned by long-term contracts or a regulated asset base; with high visibility of income and revenues often linked to inflation.

This is one reason why unlisted infrastructure investments accounts for between 7-12 per cent of major institutional investor portfolios, with the Future Fund having some 7 per cent allocated to infrastructure and Australian Super 12 per cent, as at the end of 2017.

Why the increase in investor demand?

Unlisted infrastructure is renowned for its ability to provide consistent, reliable long-term income and capital gains through the stable and predictable cash flows from diversified assets such as airports, seaports, power generation utilities and more.

Total returns have historically delivered 10 per cent per annum-plus over a 20-year timeframe. Couple this with the recent uncertainty over the future of franking credits and dividends and it is little wonder that more investors are increasingly considering an allocation to unlisted infrastructure. All without the associated market volatility of listed investments.

That is not to say that the asset class isn’t without risk. For example, the regulatory environment in the Australian energy sector has contributed to downward pressure on the valuations of some of the network distributors recently. The upside of this, however, is that the regulated return for these assets for the next two regulatory periods has been largely determined which will provide a level of consistency for a period of time.

The key is to determine which assets and projects will provide the greatest, and most consistent, returns and to have a diversified portfolio of infrastructure assets across sectors and regions.

Risk return profile of infrastructure

Source: IPIF August 2019

Nicole Connolly, chief executive of Infrastructure Partners Investment Fund (IPIF)