Retirement crystalises many fears for older Australians. Chief among them is the fear of running out of money – a fear which encourages frugality and lowers living standards.

Driven by the Financial System Inquiry, the government has one part of the answer: comprehensive income products for retirement.

But the construction of these new default post-retirement income products represents one of the most complex tasks that super trustees will tackle as investors face significantly higher risks in retirement, have disparate goals, and a wide range of personal circumstances.

The retirement goals of members

Retirees need secure income to last throughout their lives, effective risk management to protect their savings, and flexibility to pay for unexpected events such as deteriorating health.

Unfortunately, many retirees choose to hold account-based pensions and draw down benefits at the minimum allowable rates, according to the Financial System Inquiry, a key reason why the Inquiry recommended the creation of CIPRs as a way to encourage and boost retirement income levels.

But defining an appropriate retirement income stream and how it should be measured across a disparate membership base is a difficult task.

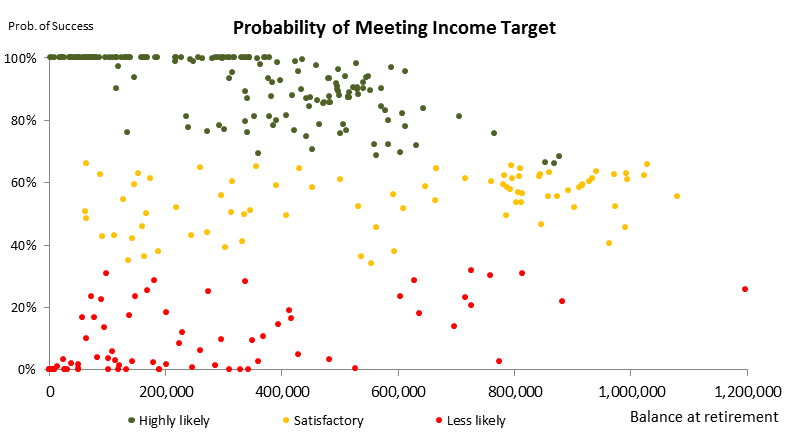

Figure 1. Probability of Meeting Income Targets – Sample Fund

Source: Milliman analysis based on sample super fund.

Trustees will need to decide whether a specific target income level can be expressed:

- Relative to external benchmarks. For instance, considering some basic spending needs in retirement such as the ASFA Retirement Standards.

- As a percentage of projected assets.

- Relative to the current income levels of members.

- As a simple fixed or increasing amount, or varied depending on life stage needs.

This represents a significant shift in thinking from the traditional investment objective of maximising returns and the pot of money accumulated at the date of retirement, relative to some investment risk constraints.

While funds typically aim to outperform the rate of inflation by a certain percentage while members accumulate assets, a more appropriate objective during drawdown may be to provide a set annual income lasting for a pre-defined number of years.

Income is, however, only one part of the needs of members in retirement.

Trustees will also need to consider providing a measure of liquidity and capital protection to allow for uncertain retirement needs (such as aged care expenditure) or other goals (such as bequests).

These potentially conflicting objectives need to be combined and measured through a single coherent framework.

What do we know about super fund members?

Funds now know a lot about their members thanks to the brave new world of ‘big data’. However, what they don’t know is at least as important.

This can include other sources of funds, assets, and income, from which the member and their family can draw upon for retirement needs, as well as their personal circumstances.

These play key roles in determining the potential value of the longevity insurance provided by the age pension and other government benefits.

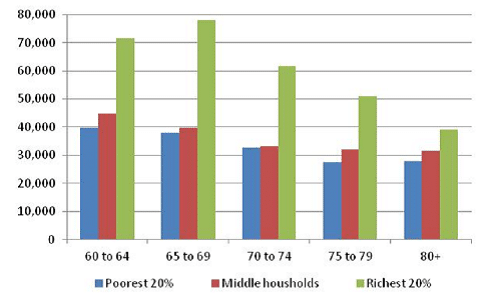

Figure 2. Average Yearly Expenditure in 2009-10 ($) by Wealth Percentiles, Couple Households

Source: Milliman analysis of Australian Bureau of Statistics data.

Retirement is a vastly more complex period than accumulation and retirees face many risks. Members have vast differences in their capacity to accept risk (often depending on the size of their retirement savings relative to their needs) as well as how willing they are to accept risk – the more familiar concept of risk tolerance.

Trustees will need to consider how their CIPR will tackle these risks including:

- The variability of members’ retirement time horizons, and how various forms of inflation might affect member outcomes over this time.

- Longevity risks of the broader population and the fund.

- Investment risks, in particular balancing the need for growth with sequencing risks introduced during retirement drawdown.

- Flexibility risks: retirees’ health needs and personal circumstances can fluctuate wildly without the natural shock-absorbing capacity afforded by time in the workforce.

- Member expectation risks: managing the risk that an individual’s income is too low, doesn’t last as long as expected, or doesn’t meet their level of certainty.

- Member behavioural risks: managing the risk of customers acting irrationally (eg, by making poor investment timing decisions following a market crash), aggressively (eg, taking excessive investment risk) or conservatively (eg, drawing income too slowly).

While CIPRs will need to balance the needs, wants, aims and risks of all members there is significant risk in assuming that large groups of members are alike – particularly given the disparity of retirement expectations that can exist.

Available member data and predictive analytics can help trustees better understand the potential outcomes for members that various CIPRs can provide.

A CIPR development framework

Taking this complex range of considerations into account, we can define some key principles which will guide the development of a CIPR:

|

Principle 1: |

Above all else, CIPR design should be guided by the benefit delivered to members. |

|

Principle 2: |

While a default structure needs to address the needs of many members, the specific and complex nature of retirement requires an analysis of the individual. |

|

Principle 3: |

Multiple CIPR designs may be required for different cohorts of members. |

|

Principle 4: |

Any CIPR design needs to provide a structure which can last from the point of retirement for the remainder of a member’s life. |

This allows us to create a step-by-step analytic framework which can underpin the construction of an effective CIPR:

Step 1: Determine the specific goals and objectives for members.

Step 2: Gather information and make other assumptions on the position of every member.

Step 3: Define a universe of potential CIPR products and strategies to consider.

Step 4: Define what is meant by success and risk – how to evaluate all strategies.

Step 5: Simulate and measure how well each strategy meets those success and risk measures.

Step 6: Evaluate, sensitivity test assumptions, refine and revisit.

Efficient implementation of such a framework requires rigorous analysis, and key decision makers will need to understand the implications, as well as pros and cons, of any given strategy in order to make suitable decisions about the inevitable trade-offs involved in landing on an appropriate CIPR offering.

Craig McCulloch is a principal and head of analytics at Milliman.