You can’t hear opportunity knocking if you are running for the exit with the herd. Diversification and a balanced portfolio are important to protect against giving into emotion and selling at the worst time.

The growing field of behavioural finance teaches us that investors are hardwired to be their own worst enemies. A striking example of this is a tendency to sell at inopportune times during market corrections.

It’s human nature, irrational though it may be in many cases. These all-too-human tendencies were exacerbated by the 2008 credit crisis, which left many investors permanently scarred.

Indeed, panic selling is one of the worst mistakes any investor can make. The good news is there are ways to avoid it.

A diversified portfolio that matches up with an investor’s risk tolerance is obviously an important first step, but maintaining that allocation through market cycles can be equally important.

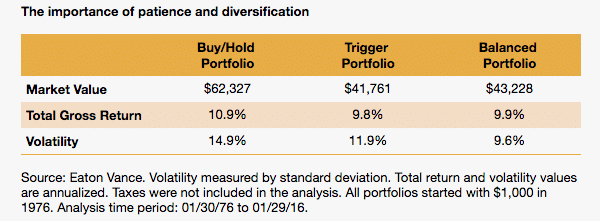

A research study conducted by Eaton Vance showed how much panic selling can cost investors in the long run.

Quite simply, when investors exit the stock market during weak periods, they aren’t likely to be around to participate in the recoveries that follow. Missing market recoveries should actually be an investor’s biggest fear, not avoiding short-term volatility.

In our back study, we compared the returns of three hypothetical portfolios, each invested with US$1,000 in 1976, with these allocations:

Buy/Hold Portfolio: Stays 100 per cent invested in the S&P 500 Index.

Trigger Portfolio: Invests either 100 per cent in the S&P 500 Index or cash. Sell and buy “trigger” events are determined by market returns.

Balanced Portfolio: Rebalances monthly to maintain a 60 per cent allocation to the S&P 500 Index and a 40 per cent allocation to the Barclays U.S. Aggregate Bond Index.

The Trigger Portfolio sold stocks at the end of a month that saw a 10 per cent or more correction in the prior 12 months. It bought back in once stocks recovered 10 per cent from the bottom and there was a positive S&P 500 Index return streak in three of the previous four months.

The Trigger Portfolio was not invested in stocks about 20 per cent of the time during the 40-year period.

On a total return basis, the Buy/Hold Portfolio outperformed over the long term, with the Balanced Portfolio finishing slightly ahead of the Trigger Portfolio.

Although the reactionary selling of the Trigger Portfolio allowed it to sidestep the 2001 and 2008 drawdowns, the vast majority of missed returns were positive.

In the 13 missed periods, 10 were periods of gains, averaging +13.8 per cent, while only three were periods of losses, averaging -15.7 per cent.

One final note: the Balanced Portfolio had much lower volatility than the Buy/Hold Portfolio, leading to attractive risk-adjusted returns.

This is because bonds can bring protection and diversification during stock corrections. Therefore, we believe an allocation to bonds can potentially provide balance and help prevent investors from succumbing to panic selling.

Bernie Scozzafava is a diversified fixed-income portfolio manager at Eaton Vance