Sixteen years ago, bitcoin emerged as a niche online phenomenon. Today its market capitalisation exceeds US$2 trillion, representing roughly 60 per cent of the global cryptocurrency market. What explains this meteoric rise—and what does it mean for investors?

Bitcoin’s journey has been extraordinary. Despite periods of extreme volatility, including drawdowns of more than 50 per cent, it has delivered an annualised return of around 75 per cent over the past decade2. For investors, the question now is: what drives these returns, and what role could bitcoin play in a multi-asset portfolio?

The forces behind bitcoin’s growth

Bitcoin sits at a cross-current of social, financial and technological trends propelling its rapid rise in popularity.

As a borderless, decentralised currency with a fixed supply, bitcoin appeals to those seeking alternatives to traditional systems—particularly amid geopolitical tensions and fiscal uncertainty. Built on blockchain, bitcoin also enables secure peer-to-peer transactions without intermediaries, positioning it as a long-term beneficiary of financial system evolution.

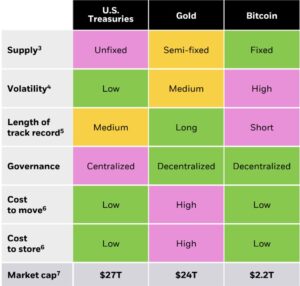

These themes resonate in today’s current environment of ongoing trade uncertainty, geopolitical conflicts, and fiscal concerns raising questions around the US dollar’s historic status as the world’s reserve currency. Like other traditional safe havens like gold, bitcoin has also shown generally low correlation with equities, with some brief periods where performance of the two asset classes moved together.3

Bitcoin compared to other global money alternatives

Built on blockchain

We also see bitcoin as a long-term beneficiary of one of the mega forces reshaping the global economy: the future of finance. Advances in financial architecture and technology are disrupting traditional models, driving innovation and new ways for consumers and businesses to meet financial needs.

At the core is blockchain technology, which enables secure, peer-to-peer transactions without central intermediaries. The simplicity of this technology sets bitcoin apart from other cryptocurrencies like Ethereum, where designs are more complex to allow for additional software development and has supported its widespread adoption.

Ultimately, bitcoin is viewed as a bet on the growing use of blockchain and the broader adoption of digital assets as the financial system evolves.

Demographics driving adoption

Younger, digitally native investors have also helped to accelerate bitcoin’s broad adoption and acceptance. In the US, around 20 per cent of Millennial and Gen Z investors own cryptocurrency, while this number increases to over 80% for Millennials who are millionaires.4 In Australia, data indicates that over 50 per cent of investors aged 25-34 own cryptocurrency, with bitcoin being the most commonly held.5

Given the tens of trillions of dollars expected to be transferred to these younger generations in the next two decades,6 bitcoin’s take-up may continue to be fuelled by demographic preferences.

The percentage of investors who do not believe it is possible to achieve above-average returns investing solely in traditional stocks and bonds stands at 72 per cent for investors aged 21-43, according to Bank of America, compared to 28 per cent of those aged older than 44.

Bitcoin investing – where, how and why

As bitcoin continues to evolve its prospects as the digital currency of the future, ETFs offer a simple way to gain exposure alongside traditional assets. Direct ownership via a crypto wallet can be costly, complex, and vulnerable to hacking, while ETFs provide regulated access to the spot price of bitcoin, outperforming indirect options like mining stocks or futures. 7

Volatility remains the key consideration. Bitcoin has experienced severe drawdowns, sometimes taking years to recover. While long-term tailwinds make a compelling investment case, not all investors will be comfortable with the rapid price swings.

For investors with a longer time horizon, the fast-growing Magnificent 7 stocks8 may make a useful comparison when sizing potential a bitcoin allocation. The level of volatility displayed by bitcoin today, as it becomes an increasingly mainstream part of the financial system, is similar to mega-cap tech names such as NVIDIA, Meta and Tesla.9

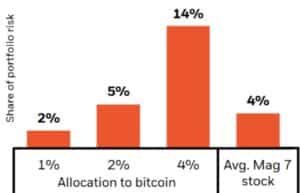

BlackRock analysis indicates that a typical 60-40 stock-bond portfolio with a slight overweight to the Magnificent 7 would generate a similar level of, portfolio risk to a 1-2 per cent allocation to bitcoin.10 The chart below illustrates this point – an investor with a balanced portfolio and 4 per cent weighting to a single US mega-cap tech stock such as NVIDIA may only experience slightly less volatility than an investor with a balanced portfolio and a 2 per cent allocation to bitcoin. However, if the bitcoin allocation is increased to 4 per cent within that balanced portfolio, the level of risk increases considerably.

Sizing bitcoin in portfolios

Estimated contribution to risk in a 60/40 portfolio

The Growth of Bitcoin ETFs

Bitcoin ETFs have surged in popularity, offering investors easy access through local exchanges and removing the operational complexities of direct ownership. Globally, bitcoin ETFs hold about US$160 billion in assets under management, with around half of those managed by iShares.11

Demand continues to rise—iShares crypto ETFs have attracted nearly US$40 billion in flows this year12 , making them one of our top three product categories worldwide, despite launching only in early 2024.

Overall, as investors face into risks including rising geopolitical tensions, government debt concerns, and increased political instability around the world, we believe bitcoin’s unique risk and return drivers are worthy of pause for consideration by investors.

Tamara Haban-Beer Stats, Director of Institutional Client Business, BlackRock Australia