The Federal Reserve’s (Fed) resolve to maintain the downward trajectory of the US inflation was reiterated at the Jackson Hole symposium. Fed Chair Jerome Powell stole the headlines announcing that “pain” was likely going to be experienced in this process. Otherwise, though, his speech broke no new ground. The constantly reiterated refrain from all Fed governors continues to be that inflation is unacceptably high.

The more interesting message is that policymakers want to maintain policy rates in a restrictive stance for an extended period of time, allowing inflation to come down gradually.

As monetary policy acts with a lag, the effect of the rate hikes, and higher Treasury and market yields are already going to have a further tightening effect. With the downward trajectory of inflation now firmly in evidence, a policy rate of 3.50 to 3.75 per cent held for a sustained period appears to be a reasonable base case.

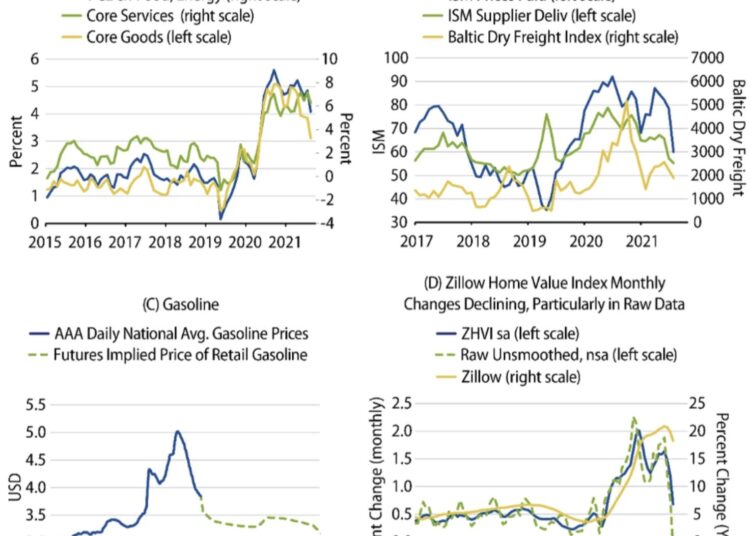

Exhibit 1: Inflation pressures abate

Source: (A) BEA. As of 31 Jul 22. (B,C) Bloomberg. As of 31 Jul 22. (D) Zillow. As of 31 Jul 22.

One of the acute challenges in the inflation debate is whether to look at forward indicators of inflation, which are slowing sharply, or the more notable Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) inflation measures, which tend to be lagging indicators. Exhibit 1 illustrates a broad array of inflation measures. Core PCE has finally hooked down, having both the goods and services components. Bottleneck pressures are easing meaningfully. Energy and food prices are declining. And recent prints from Zillow support anecdotal evidence that housing prices are also in decline.

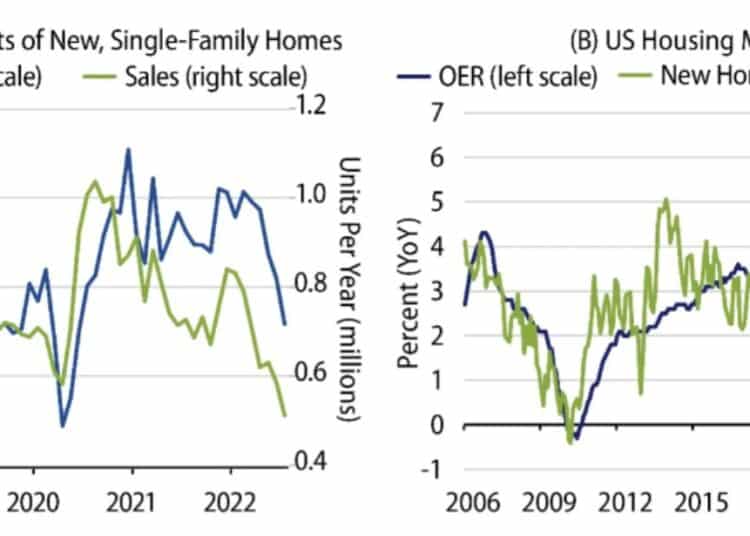

A key point here is housing. The run-up in home prices is still working its way through the official statistics — keeping the owners’ equivalent rent (OER) elevated. On the ground, new home sales and starts have plummeted and prices are rolling over (Exhibit 2). As housing continues to weaken, consumer sentiment and spending will remain subdued, and the need for restrictive policy will eventually diminish.

Exhibit 2: Housing activity and prices deteriorate

Source: (A) Census Bureau. As of 31 Jul 22. (B) Bloomberg. As of 31 Jul 22.

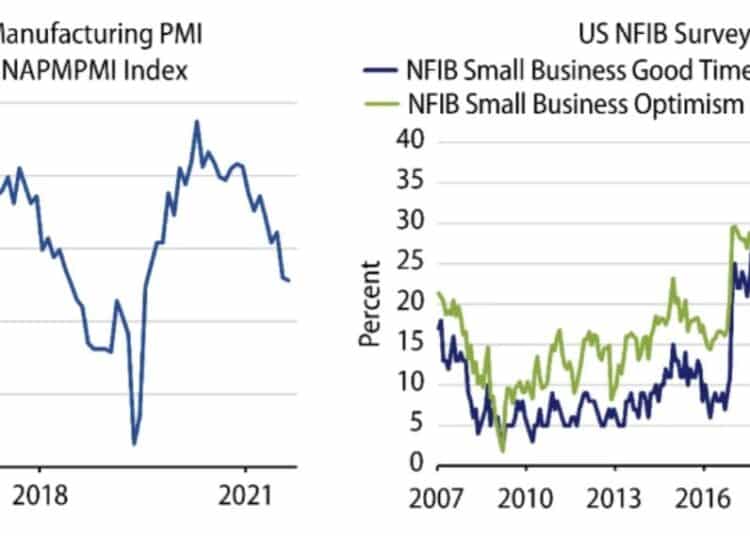

Similarly, the growth outlook for business is likely to remain sluggish. Inventories have increased substantially, putting downward pressure on goods prices. The Institute for Supply Management (ISM) manufacturing Purchasing Managers’ Index (PMI) has turned downward as has business confidence (Exhibit 3). Service sectors, rebounding from the COVID-19 period of weakness, are still exhibiting strength. Fortunately, cash flow and earnings have held up reasonably well. The robust credit metrics currently enjoyed by corporations broadly is a result of conservative balance sheet oversight and the excellent growth coming into 2022. The repricing of risk reflects the fear that may result from the Fed’s tightening cycle. But current credit metrics stand out in sharp variance to these expectational distressed scenarios. Management teams have proactively pushed out their amortisation schedules, leverage remains low, while free cash flow generation and cash positions are elevated. Our view is that corporations should be largely able to weather a growth slowdown.

Exhibit 3: Manufacturing prices and confidence wane

Source: Bloomberg. As of 29 Aug 22.

A more concerning outcome, of course, would be a severe recession. Here, risk markets again are repricing for potential Fed over-tightening that leads to a deep recession. Given the Fed’s history, this is a non-negligible outcome. A key element of this process is the Fed’s time frame. A gradual diminution of inflation is very likely — particularly under a restrictive monetary policy regime. The headline and core PCE inflator (the Fed’s preferred inflation measure) have only recently rolled over. But market conditions are tightening and the yield curve remains inverted.

Fed president John Williams’ comments in this regard are instructive. Working the core rate of inflation down over a three-year period is a reasonable and not overly heroic goal. Policy rates have to remain restrictive, but perhaps not overly so. The six-month core PCE inflation rate is already down to 4.1 per cent. A goal of getting this annualised rate below 4 per cent by year-end, and below 3 per cent by year-end 2023 seems eminently achievable. If this strategy remains in place, short-term rates above the base case would be unnecessary.

Many pundits — perhaps encouraged by Powell’s numerous references — point to the deep recession after Volcker tightened precipitously in the early 1980s. But, there are profound differences between now and then. Then, the inflation challenge was two decades in the making by 1980. Inflation expectations had ratcheted up progressively for years, and changing such entrenched psychology required severe medicine. Even with the initial recessionary pain, the long-term battle against inflation was fought over numerous business cycles. The key was that each business cycle inflation peak was lower than the last, as was each business cycle trough. Double-digit core inflation was reduced steadily to the Fed’s 2 per cent target by the early 2000s.

Now, the challenge is in crafting a response to this one-time pandemic/war event. The rise in inflation expectations is barely two years old. Core inflation can and needs to be whittled back to 2 per cent over time. But once confidence in this process is restored, markets may quickly recalibrate to a less precarious future.

It’s interesting that the discussion of Volcker often centers on the initial years of higher short-term interest rates and a deep recession. Another point worth considering is the environment experienced in not only the immediate but long aftermath. That was one of disinflation, exceptional returns for bond markets and heady times for risk assets. The path to much lower inflation rates is now visible. It will be bumpy and it may take time. But markets are forward looking and lower inflation underpins the case for all financial assets.

Ken Leech, chief investment officer, Western Asset