Investors are on alert to risk involving the French election. It is a medley of scandal, gaffes and general uncertainty that is spooking markets, as polls show candidates Marine Le Pen and Emmanuel Macron neck-and-neck in the first round of one of the most unusual French elections in modern history.

French spreads are largely tracking Ms Le Pen’s odds of securing the presidency.

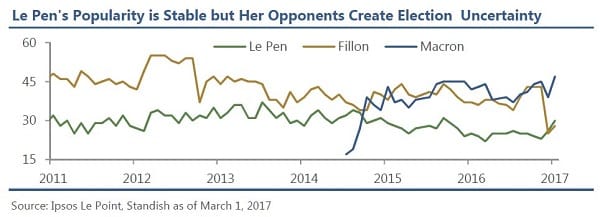

In a sense, the unease is less about Ms Le Pen’s winning the race and more so about her opponents’ losing.

Francois Fillon remains in the race despite a recent scandal tainting his reputation and sinking his voter favourability.

On the other side, Ms Le Pen’s voter support has remained largely stable over time, even weathering such events as Brexit and the US election.

Additionally, Emmanuel Macron’s new candidacy and party presence raises questions as to how well the polls foretell his chances of winning. Uncertainty abounds.

The scenario may be unlikely, but it is not impossible for Ms Le Pen to win this election.

In the event that scandals or lack of emotional appeal push voters farther away from her major opponents, low voter turnout could favour her dedicated base and thereby catapult her to victory.

Thus, Standish currently assigns an 85 per cent probability of Le Pen losing the election, with our base case being that either Mr Macron or Mr Fillon will take the presidency.

We will reassess this probability as time goes on and we gather new information, such as data from the first round of elections.

Nevertheless, we consider the 15 per cent alternative, that Le Pen wins the French presidential election.

In the wake of her shock win, market volatility would surge. She would take office on 1 June and quickly pursue her populist agenda, despite the fact that parliamentary elections would not take place until the middle of the month.

She may first call a European Summit and make nationalistic demands to her European Union (EU) counterparts, but such demands would not likely be well-received.

While she has threatened a referendum on EU membership, support from the Parliament would not likely legitimise any such vote. Even so, the threat of EU/eurozone breakup would be quite real, as the eurozone’s second largest economy and founding nation could stumble towards Frexit.

Therefore, a Le Pen victory would likely result in a spike in sovereign credit spreads across much of Europe, as negative sentiment spills over into vulnerable periphery markets.

On the other hand, if Mr Macron or Mr Fillon were to win, then we would expect French sovereign spreads to fall roughly 30 bps, as the expectation of economic reform would raise potential output growth.

This is our base case. A pro-reform agenda would help France, more so than either Mr Macron’s or Mr Fillon’s pro-EU stance would improve things for the periphery.

We would expect to see some relief tightening in the periphery, but not to the extent as would be seen in France.

As we move towards 23 April – the first round of French elections – any spike in spreads is likely to present an opportunity in either France or related markets once the election outcome is announced.

Rowena Geraghty is a sovereign analyst/economist at Standish Mellon.