The increasing popularity of passive strategies for equity investment raises the question of whether similar approaches can and should also be applied to fixed income markets.

While passive strategies’ promises of reduced costs may seem attractive in the current low-interest rate environment, we believe that the size, variegated nature and inefficiency of the $46 trillion global bond market offers opportunities that astute active managers are uniquely able to capture on behalf of their clients.

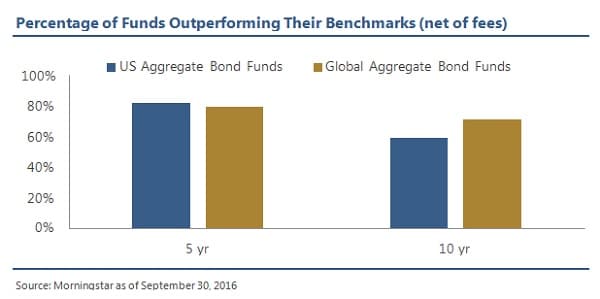

The ability of fixed income managers to deliver alpha over time shows up clearly in performance data. As the chart below indicates, active managers of US aggregate and global aggregate portfolios have outperformed their benchmarks on a net-of-fees basis over the 5 and 10-year periods up to 30 September 2016.

Active fixed income managers especially stand out in the corners of the market that are more niche, and hence less followed.

In fragmented and inefficient categories — such as US municipal bonds, securitised bonds and emerging market debt — the rigorous research and security selection practiced by active managers are indispensable in achieving return while managing risk.

In markets such as these, where the quality and quantity of information about issuers’ creditworthiness varies widely, active investment managers have a clear advantage over index-based strategies that may overlook entire sectors of the investible universe.

The Barclays Capital Aggregate Bond Index, for example, doesn’t include high-yield bonds, inflation-linked securities or floating rate debt.

Like trawler nets scooping up debris as well as fish, index investing in fixed income pull in all sorts of things an investor might prefer to avoid (bycatch), including large quantities of sovereign bonds whose prices have been inflated by central banks’ policies of buying up large swathes of debt without concern for price.

This problem is an especially serious one for passive strategies investing in global bonds. Consider the makeup of a passive ETF based on the Barclays Global Aggregate Index: at present, 25 per cent of its holdings are bonds with negative interest rates and nearly 40 per cent are securities with yields of fewer than 50 basis points.

Even when rates increase, this bycatch will remain in the portfolio, placing a drag on overall return.

While index-based strategies expose investors to securities they might prefer to avoid, they can also deny them opportunities for exposure to securities they might otherwise consider.

A passive strategy may, for instance, have index rules that prevent exposure to so-called “fallen angels”; on the other hand, the manager of an active strategy may thoroughly research the fundamentals of these issuers and identify value.

Index-based investing will include or exclude securities based on the judgment of ratings agencies, which alone can be inefficient.

It may be worth considering that the rise of passive equity investment has not been driven by passive strategies’ track record of success at generating alpha, rather it reflects a lowering of expectations on the part of investors who have lost confidence that active management can deliver consistent outperformance.

While this lower-cost, lower-expectation passive approach may make sense in today’s highly- efficient equity market, adopting a similar approach to the far larger and more diverse fixed income universe would mean trading away proven tools for generating alpha and managing risk in favour of a false economy and diminished expectations.

Raman Srivastava is the deputy chief investment officer at Standish Mellon Asset Management