Speaking to InvestorDaily, David Middleton said investors are currently navigating a difficult period.

“The hardest weather to predict is when there’s a change coming through,” he said.

Mr Middleton said in a report that investors should be wary of low interest rates and the possibility of rising inflation as a preface to his top five ‘loser’ investments to avoid next year.

Government bonds

“We have had a negative view of government bonds for many years and we have been wrong every year,” Mr Middelton said in his report. “It’s counter-intuitive, but you actually make money out of government bonds when interest rates fall.

“When interest rates fall, it simply means that investors are paying more to buy existing bonds, so you make a capital gain,” he said.

Interest rates have been falling steadily throughout 2013 and now sit at 2.5 per cent.

The longer this goes on and the lower rates go, the greater the potential for loss when rates start to move up again, the report said.

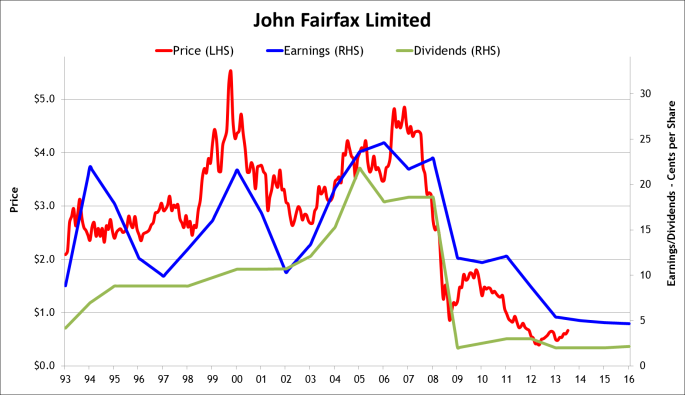

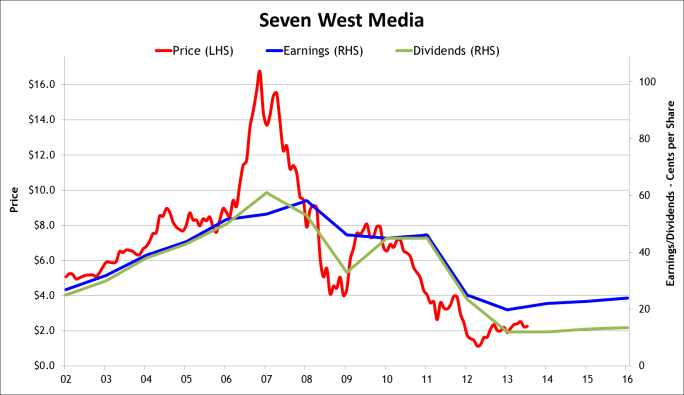

Traditional media

Mr Middelton’s bearishness towards traditional media is driven by dwindling print advertising sales, a shift to digital platforms and the rising cost of content..

“No-one buys the paper to look up job ads, car ads or real estate ads anymore,” he said.

“With the exception of the Murdoch media (the pricing of which we have never been able to understand), traditional media is currently very cheap.

“If a solution is found or the situation doesn’t deteriorate further this might be the buying opportunity of the century – the jury’s out though!”

Source: Middletons Securities

The franked yield trap

Investors can overpay for stock in “good companies” as the euphoria about the yield mantra and the disappointment at falling interest rates lures them into investing in blue chips, Mr Middelton said.

“There are no blue chips by the way, most of the high profile disasters of the global financial crisis were regarded as being safe before they weren’t,” he said.

“In the last two months of 2013, the Australian market retreated by over 6 per cent with the retreat largely led by the blue chips.”

ANZ Bank shares fell by 10 per cent and Commonwealth Bank shares by 7 per cent during this period, according to the report.

However, the greater risk to investors is if interest rates rise, Mr Middleton said.

“You can lose money on shares in much the same way as you can lose money on long-dated government bonds when this happens,” he said, citing the bond crash of the mid 1990s as an example.

Fancy income investments

“Another phenomenon that bemuses us is the enthusiasm for the new breed of listed income securities being issued by the major banks and that get gobbled up by the market, and largely by private investors,” Mr Middleton said in his report.

“Investors, in their enthusiasm for yield and buoyed by the view that our banks are the best in the world, have ignored the obvious trap,” he said.

“These new securities offer the worst of all words, you have the low returns of a defensive asset when you would really like to own shares and the risk associated with owning shares when you would really like to own defensive assets.”

Middletons prefers old income securities that can be bought at a discount due to the low margin over bill rates and that never mature.

“You can get a similar running yield out of these at current prices and because of the discount you will have substantial leverage when interest rates start to rise,” Mr Middleton said.

Overpriced building suppliers

The logical first reaction to a projected lift in home building would be to buy the major supply firms, like Boral GWA Group. However, there are two major problems with this approach, Mr Middleton said.

“The first is that these are cyclical stocks that go up and down through the business cycle,” he said.

The second is that early movers have already pushed the share price of these companies up more than 20 times their earnings in anticipation.

“Boral is currently trading at almost 24 times the anticipated earnings for this financial year and any increase in profits over the next three years seems well and truly built into the price,” Mr Middelton said.

“If earnings disappoint, the price will fall substantially.

“Our approach to all share investment is to concentrate on what we call ‘evergreen businesses’ – businesses that should do well in all stages of the economic cycle,” he said.