When it comes to emerging markets, we think the value lies under the surface.

Since mid-2011, emerging-market equity returns have essentially been flat through the first quarter of 2015, even as the MSCI World Index, which represents developed-market stocks, posted a cumulative return of about 50 per cent.

At this point, we’ve seen almost four years of declining profit margins in emerging markets; we think we’re fairly close to the bottom.

Also, many emerging-market currencies have collapsed versus the US dollar, and credit spreads on emerging high-yield bonds are elevated compared to history.

On the face of it, there seem to be value opportunities in emerging markets.

But just looking at average returns or average valuations can be misleading – and the time frame you use to evaluate opportunities makes a difference.

Equity valuations diverging

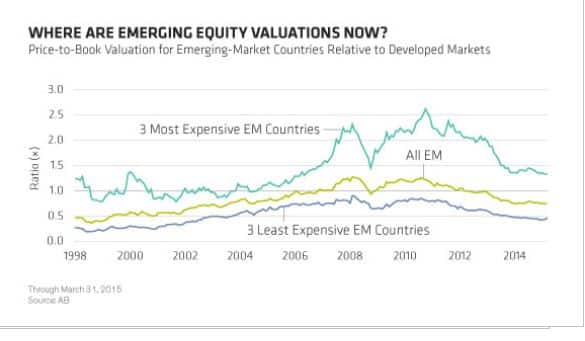

In the case of emerging-market equities, average valuations, as measured by price-to-book-value ratio, are down significantly from where they were in 2011.

We’d call them moderately attractive. But they’re still only modestly below their longer-term averages.

Looking deeper beneath the surface, we see substantial divergence among emerging-market valuations.

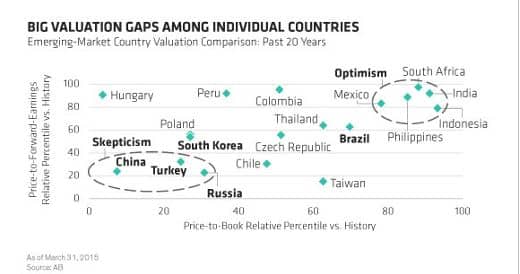

The most expensive countries are still trading at fairly high price/forward earnings ratios relative to history, while the most distressed countries are trading at historically depressed valuations.

So, in terms of valuations, there’s a big gap between the haves and have-nots.

From an investing perspective, this raises a question: Does it make more sense to stick with the perceived winners that have good fundamentals and are undergoing structural reform?

Or is it better to invest in distressed countries on the assumption that mean reversion will lead to a rebound?

We don’t think aggregate valuations are compelling enough to increase overall exposure.

So far, it seems reasonable to maintain exposure but tilt it toward countries with stronger fundamental trends, including Asian emerging-market stocks.

With valuation spreads so wide, we see a lot of potential upside from actively managing exposures within emerging-market allocations.

Selective opportunities include China, Brazil

China is an example. It has gone from trading at a multiple in the neighborhood of seven times earnings to maybe 10 or 12 times earnings, so there’s been a significant appreciation.

But we think some of the policies being rolled out could promote growth stabilisation.

Yes, growth will be lower than it’s been in the past, but the growth should be stable, as it’s coming from diverse sources, which create a much more stable platform.

Dynamics in bond markets are different than those in equity markets, but the basic conclusion also holds true in fixed income: active management presents opportunities to add value by exploiting massive differences in interest rates and yield spreads.

In Brazilian credit, for example, high interest rates already reflect the turmoil that has gripped this South American country.

We believe that some policy changes could be a positive influence both in stabilising the currency and potentially reducing interest rates.

The bottom line is that you can’t view emerging-market opportunities as a simple binary decision to raise or lower allocations.

The opportunities are very real, but they require a deeper analysis and a selective eye.

Vadim Zlotnikov is chief market strategist, co-head of multi-asset solutions and chief investment officer systematic and index strategies at AB (AllianceBernstein).