The year 2022 was an extraordinary investment year. The losses were also unique, with 2022 being the only time in 45 years that stocks and bonds declined in tandem.

That’s a lot for any investor to take in, especially when considering a long-term investment strategy.

But as 2023 has taken shape, so has, in my view, a new reality that could define global markets over the next decade and the investment strategies to consider.

And while many investors are expecting a return to normal after inflation subsides and central banks stop raising interest rates, I believe markets are undergoing significant changes. Investors may need to reset expectations in this new environment.

One change that’s already underway is the shift from narrow to broad market leadership. A handful of tech stocks dominated markets for years, but looking ahead, a much wider range of investments are likely to drive portfolio returns.

And while growth investing isn’t going away, other sectors may have more room to shine — such as health care, where we are witnessing a golden age of drug development.

Global champions

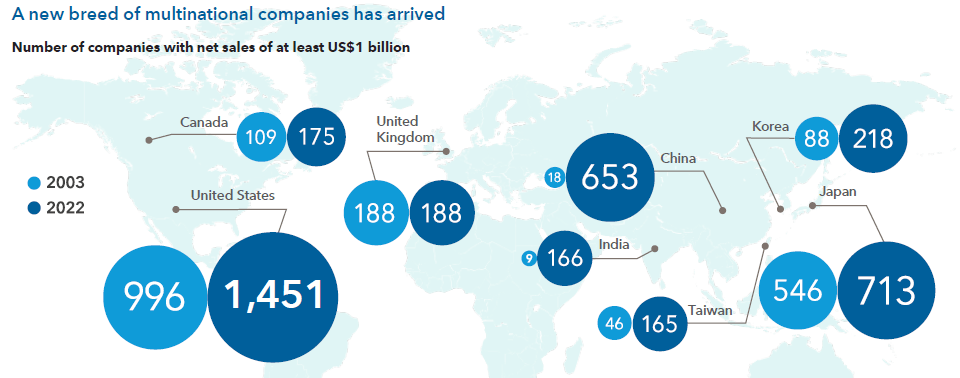

The idea of global champions — industry-leading multinational companies that can adjust to the changing landscape — is still relevant today and should not be dismissed with the notion that growth companies have had their day.

When looking ahead, proven earnings growth is likely to be a bigger driver of returns. And the good news is that companies with this type of revenue and growth potential will probably come from a broader range of industries and regions in the future — not just tech and consumer stocks. New global champions are emerging, and it is usually in challenging environments when the best companies shine.

Some investors are concerned about deglobalisation and assume it is negative for investment portfolios. It can be, but changes in trade patterns generally favour global champions. The COVID-19 crisis shed light on the importance of resilience over efficiency, and companies are responding by establishing redundancies in supply chains. That’s creating opportunities for companies that help build factories and expand supply lines.

Global stocks could also benefit as two notable headwinds dissipate. It appears that the strong US dollar may have peaked, which would support dollar-based returns of US and non-US stocks alike. Also, the reopening of China’s economy may boost global economic growth, especially in emerging markets.

Includes all companies within the MSCI ACWI IMI as at 31/1/03 and 31/12/22. Sources: Capital Group, FactSet, RIMES

Growth stocks have come under intense pressure more recently but for investors, it is essential to differentiate between those companies that have reached the end of their runway or are facing stiffer competition, as opposed to those that are simply in a cyclical slowdown.

Companies that are well positioned to re-accelerate when the global economy improves represent promising buying opportunities. For example, streaming companies and ad-based social networks are facing tough, new competition. This means it is more important to focus on profitability than it may have been in the past.

On the other hand, cloud computing growth has slowed, but this may be cyclical. Arguably, the fundamentals of cloud computing companies remain strong, but the market seems to be punishing them, like troubled tech stocks.

Likewise, the semiconductor industry has struggled with oversupply issues. While it’s not possible to know precisely what will happen over the next 12 or 18 months, the chip manufacturing industry may be set for a powerful cyclical recovery. For an investor, if you are confident that the company you are invested in will survive, the important question isn’t when the cycle will turn, but what’s on the other side. One thing is certain; the global need for computing power is only increasing, and demand for chips will return. Despite the challenging environment, the long-term investment opportunities on the horizon are meaningful.

A golden age for health care

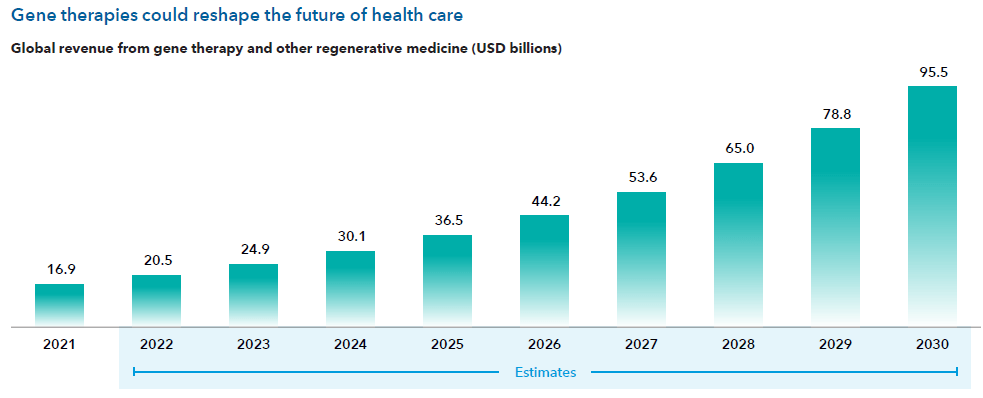

Innovation is at an all-time high in health care around the world and while the macro environment may have been front and centre of investor concerns last year, ultimately it is innovation that drives long-term value creation.

Pharmaceutical companies have invested heavily in drug discovery in recent years and, as a result, deep pipelines of pioneering treatments are being developed to tackle some of the world’s biggest health issues.

For example, Eli Lilly and Novo Nordisk have developed obesity treatments with the potential to reduce body weight by as much as 25 per cent. AstraZeneca has become an oncology leader with advanced therapies for lung, bladder and breast cancer.

Gene sequencing is another key innovation that has major health and investment implications. In the future, we may be able to pair genetic sequencing with gene-based interventions to deliver personalised, precision medicine. Imagine replacing defective or missing genes with normal, healthy ones. That future is perhaps not far off.

For illustrative purposes only. As at July 2022. Source: Statista

Patience and persistence remain a virtue

If there is one lesson that time has taught investors again and again, it is that the key to creating long-term wealth is patience and persistence. And while there are understandably concerns about the impact of inflation, prospects for recession, and weakness in parts of the banking sector, there still remain opportunities ahead. The principle of seeking to invest in companies with superior long-term prospects is as relevant today as it ever has been, and such companies are more likely to survive market downturns and come out stronger on the other side.

Matt Reynolds, investment director, Capital Group (Australia)