Australia’s super funds face severe headwinds in today’s environment.

Weak investment returns, a shrinking workforce and longer life expectancy of retirees have left many facing a growing funding gap.

Meeting the fundamental objective of helping Australians maintain an adequate and comfortable standard of living in retirement is becoming a big issue.

These challenges are driving super funds to strike a new balance on risk and return.

A State Street survey of 134 pension funds globally, conducted by the Economist Intelligence Unit, found that 86 percent of respondents based in Australia expect their institutions’ investment risk appetite to increase over the next three years.

That’s compared with 77 percent of respondents globally.

Pension funds are undertaking a root-and-branch reassessment of their portfolios.

They are looking to find the right mix of assets to drive higher returns, while also keeping costs under control and minimising their overall risk exposure.

It is a delicate balancing act.

The big move into alternatives

Alternatives traditionally made up just a small part of funds’ portfolios compared with equities and fixed income products.

Now, the funds in our survey intend to increase their exposure to alternatives.

This asset class is increasingly seen as an effective investment strategy for enhanced returns and diversification.

The total global alternative assets under management reached US$5.7 trillion in 2013, according to a 2014 global alternatives survey produced by Towers Watson.

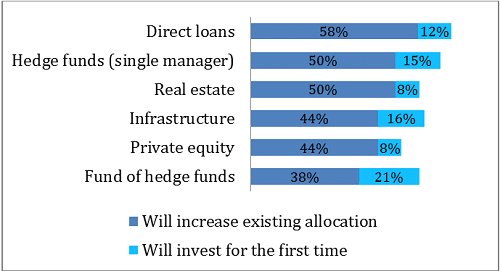

State Street’s survey shows that direct loans are the top priority of all alternative asset types, with more than two-thirds (69 per cent) of respondents based in Australia planning to increase existing allocations as well as invest for the first time into this area.

In Asia Pacific, pension funds are becoming the alternative source of financing as banks rein in lending because of new capital requirement regulations, according to a June 2014 report by the IMF.

Private financing to companies has the potential to provide attractive returns.

A significant proportion of super funds in Australia also intend to invest more in single-manager hedge funds (65 per cent) and infrastructure (60 per cent).

Infrastructure is popular because, as a long-term asset type that delivers returns over its life cycle, it matches well with pension funds’ long-term objective of ensuring retirement adequacy for Australians.

Funds are targeting single-manager hedge funds for investment even as the California Public Employees’ Retirement System (CalPERS) decided in September 2014 to pull US$4 billion from its hedge fund investment program — an announcement that sparked speculation other pension funds might follow suit.

But the general trend still looks positive for the hedge fund managers who are able to offer a reliable source of alpha returns.

Source: Data from Australia-based super fund respondents in the State Street 2014 Asset Owners Survey conducted by the Economist Intelligence Unit.

A new approach to risk management

The surge in investment into a range of alternatives has significant implications for Australian super funds in terms of risk, operational efficiency, recruitment and measuring performance.

Understanding how different combinations of alternative and traditional asset classes affect total risk exposure remains difficult.

Many alternatives also require a different approach to risk modeling.

Super funds will need to factor these complexities into their calculations as they adopt a new risk budgeting model.

The ability to evaluate risk-weighted performance at multiple levels – from individual asset classes and instruments right up to a total fund perspective – will increasingly distinguish the leaders in the industry.

Super funds need to invest in analytics technology that can provide a coherent view of risk and performance across a multi-asset portfolio.

At the same time, far greater emphasis will need to be placed on strong data governance and ensuring better quality of data.

To fully benefit from these improved tools and data, super funds will need to bring in specialist skills.

The shift to alternatives is gathering pace.

And super funds must respond with new ways of allocating their risk budget if they are to achieve the right balance of risk and return across an increasingly complex mix of asset classes.

Daniel Cheever is vice president and head of superannuation at State Street, Australia.