The 2021 surge in growth was fuelled by:

- Low interest rates

- High household savings

- Government stimulus

- Low listings

These market forces losing their fuel

And while 2022 has kicked off strongly, the market forces that fuelled the fire are losing their strength with forecasters predicting more modest growth somewhere between 5-7per cent in the market. This slowdown in growth is being driven by:

-

Affordability constraints with surging prices and modest income growth

-

A surge in listings

-

Tightening credit policy and increased buffer rates

-

Higher mortgage rates

-

And as reflected in the recent noise around interest rates – the wildcard is the economy and inflationary pressures and the RBA’s employment targets – with the RBA indicating rates would not move to 2024, and with their recent shift in language triggering a raft of fixed rate increases from providers.

Dynamic time – key take-outs from February’s RBA meeting

The Australian economy is going through a dynamic time resulting in a combination of inflationary pressures and low unemployment – in fact unemployment is at a low of 4.2 per cent and forecast to be less than 4 per cent by end of 2022. The key components driving inflation are:

-

New dwelling construction costs

-

Labour services

-

Petrol

-

Food and retail

-

Furniture

-

Rents

So, with the economy strengthening faster than the forecasts, the RBA is reacting to these pressures and there were some key take-outs from the RBA’s February meeting:

-

A clear change in messaging from the governor – even though they are holding steadfast to their employment target and wages growth target of 3 per cent, rates staying put to 2024 clearly appears off the table now.

-

A rate hike now seems likely at the end of 2022 or early 2023 – quite a change

-

The governor signalled the end of quantitative easing as of 10th February 2022 – with the RBA no longer buying government bonds which had been supporting the economy and low rates.

The providers have reacted to this recent meeting with fixed rates again increasing, and variable rates remaining put or some in fact falling – more closely tracking the actual cash rate.

Is there a misalignment?

The board is showing some patience – arguably trying to hold out as long as they can until they see some consistency and stability and wages growth. However, the rhetoric around rates has changed with the impact of inflationary pressures, influenced by:

-

The Delta and Omicron waves impacting global supply chains and costs of shipping

-

Unemployment dropping well below where the RBA was thinking – being about 12 months ahead of their 2021 November forecast – and labour market indicators such as job ads remaining strong, with, for example, SEEK job ads approximately 50 per cent higher than average.

-

There are strong accumulated savings, with households saving approximately 242 billion since the pandemic began – all of which will flow into the market as at some stage.

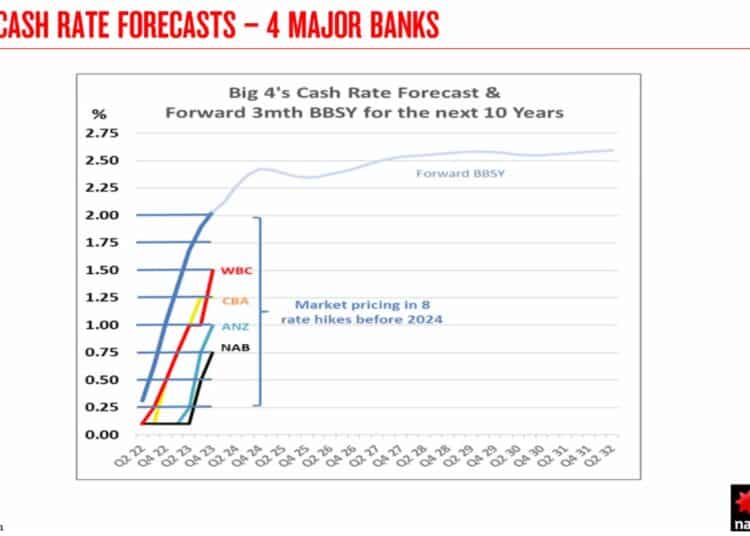

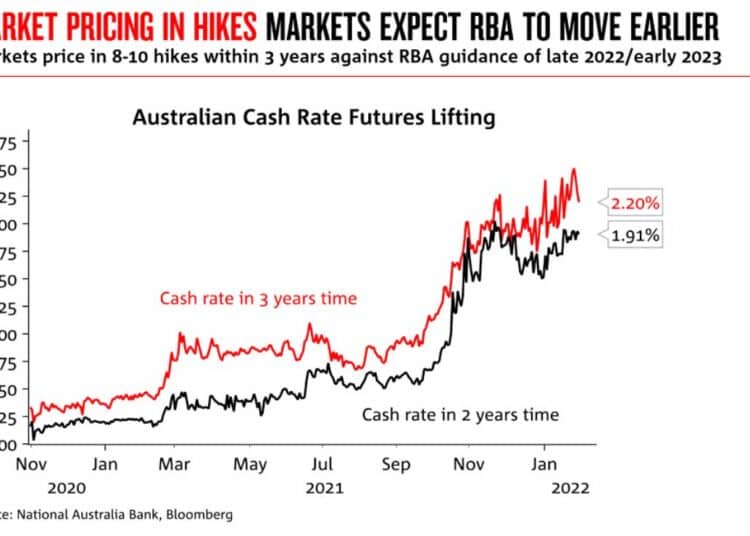

With this backdrop, bond markets are starting to price the chance of rates lifting higher than forecast – for example, the US Federal Reserve is pricing rates in to be around 2.5 per cent – where policy settings have a ”neutral” impact on the economy, noting inflation in the US is currently around 7 per cent and in Australia, banks are already pricing in around 8-10 hikes over the next two years.

So, it appears the time of low rates is over, and the questions remain, when will they rise and how high and how quickly will they go – with the perspective of coming off a very low base.

In Australia, the majors have indicated they feel the Australian neutral rate may be around 2-3 per cent.

If there is a misalignment, it appears to be that financial markets want to get on the move, while the RBA wants to support the consumer by holding back until the wages move as well.

The impact

For consumers – the impact is already flowing through with increasing fixed rates flowing through the providers – and variable rates likely to more closely track the RBA cash rate.

For investors – while interest rates are expected to increase, this, along with other factors should soften the property price growth. At the same time, rents are on the increase.

For small businesses – they will face increased costs to funding investment and growth and there may also be some impact on “interest sensitive” businesses such as capital equipment and car sales.

Anthony Landahl, managing director at Equilibria Finance.