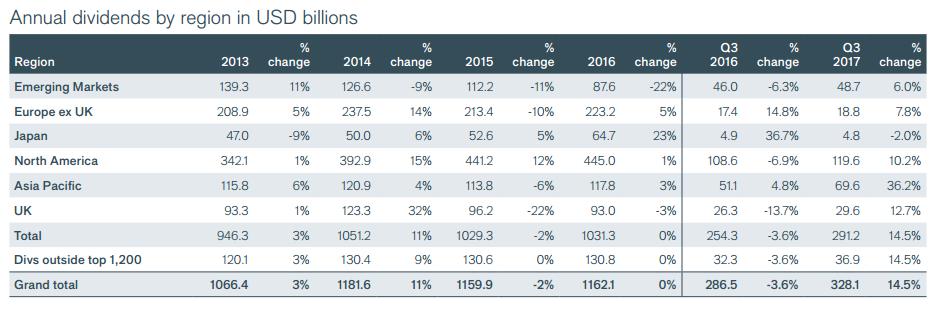

Data in the latest Janus Henderson Global Dividend Index report has revealed the growth rate of global dividends for the third quarter of this year was the fastest seen in three years, with the level of growth a record for third quarter dividend payments.

Underlying growth also jumped 8.4 per cent, the fastest growth in two years, according to the report.

While every region saw global dividends increase, payment records were broken in Australia, Hong Kong and Taiwan.

Headline growth in Asia-Pacific (excluding Japan) leapt 36.2 per cent to $69.6 billion with higher special dividends playing a role in the surge.

“The third quarter marks Asia-Pacific’s seasonal dividend peak,” the report said.

“China Mobile accounted for almost half of the region’s headline increase and three-quarters of Hong Kong’s with a huge $8.4 billion special, the largest single payment in the world in Q3, helping Hong Kong’s total dividends reach a record $25.2 billion.”

Australian dividends typically peaked in the third quarter and this year was no different, exhibiting “excellent growth”.

“Payouts jumped to a record $22.8 billion, up 17.0 per cent on a headline basis, boosted by a stronger Australian dollar,” the report said.

However, aside from the resources sector, dividend growth in Australia was “growing slowly”.

“Australia’s banks pay $6 out of every $11 of the country’s dividends each year but dividends are growing slowly given already high payout ratios,” the report said.

“Commonwealth Bank is comfortably the largest contributor and raised its per share payout 3.7 per cent on the back of steady profit growth, but rivals National Australia, Westpac and ANZ have all held their dividends flat for some time.”

CBA and Westpac were identified in the report as the world’s fourth and sixth biggest dividend payers respectively, with Chinese and Taiwanese technology and manufacturing companies taking the top three places.

More broadly, the report pointed to “broad and synchronised global economic growth” driving the high global dividend growth rate.

Janus Henderson head of global equity income Alex Crooke said it was rare to see dividends growing in every region across the world at the same time.

“As the global economy continues its long-awaited post-crisis normalisation, confidence is improving, and company profits are rising,” Mr Crooke said.

“Income investors are enjoying the benefits of this growth, as it feeds through into higher dividends.

“After record second and third quarters, the world’s listed companies are comfortably on course to deliver the highest ever annual total this year.”