The predicted growth in food demand over the coming decades creates significant opportunities for Australian agriculture. The local industry is in a strong position to meet this rising demand and Australia has a comparative advantage in both the production of many agricultural products and our proximity to key markets.

Like many markets, agricultural prices vary between years and cycles — largely reflecting supply-demand economics. However, underlying demand for agricultural real-assets and food products continues to grow and this trend is likely to remain for years ahead.

Agriculture in different economic cycles

Agriculture returns also behave differently to traditional asset classes in various economic conditions and can offer important defensive characteristics to investment portfolios. As an example, during the Global Financial Crisis, not only did the prices of some goods fall much more than others — agricultural products experienced the smallest declines while oil and minerals experienced the largest — but global trade in agricultural products continued to grow over the period of the Crisis and beyond.

When considering the impact of COVID-19, an investment in agriculture is fundamentally linked to demand for food and staple products. Over the past two years, as in previous pandemic events, this demand has remained relatively stable and resilient amongst other economic pressures.

These strong fundamentals point to an asset class that is a valuable long-term investment through any cycle. However, stepping back from the fundamentals and strong secular outlook for agricultural products, this asset class is also becoming an increasingly important option for its low correlation diversification; as an insulator to portfolio volatility; and, as a proven tool to hedge against inflation.

Hedging against inflation

The COVID-19 pandemic pushed global economies into a snap recession unlike any downturn event in history. With varying trends in infection rates and different government policy settings around the globe, the recovery has not been one paced and different sectors have been impacted in different ways. However, a common response was the unprecedented fiscal policy from across the developed world including record-low interest rates coupled with monetary easing.

The fiscal and monetary stimulus that was required to drive a full global recovery, particularly the role of low interest rates, led to a build-up of inflationary pressures which central banks and markets are now trying to deal with.

Long-term investors are looking at their current portfolios, evaluating what the impact of higher inflation and interest rates may be, and assessing new investment opportunities that offer inflation protection and at the same time, potential upside.

With traditional hedges such as government bonds offering relatively low returns in today’s environment, investors are turning to alternatives, such as real assets, as solutions that can not only protect against inflation, but potentially benefit from an inflationary environment.

An increasingly popular investment solution in the real assets sector is agriculture/farmland, which provides investors with three key characteristics to fight inflation pressures within a diversified portfolio:

-

Inelastic demand of food consumption – the unquestionable necessity of food has been further highlighted through the pandemic and more recently, the supply chain disruptions highlighted due to geopolitical events.

-

Inelastic supply of assets – although productivity and efficiency can increase, ultimately the core elements of an agricultural investment (farmland and water resources) are finite and not something that can be manufactured or easily substituted.

-

Correlation to inflation – the commodities underpinning an agricultural investment, themselves, are highly correlated to inflation and product pricing has historically tracked with or beyond high economic growth rates.

Farmland capital returns during high inflationary periods

Although the impacts of inflation on income yield in agriculture can vary, there is a clear trend that in periods of high inflation farmland asset values increase at their highest rates.

In the period between 1978 and 2021, farmland values in Australia increased at the highest rates during periods of high inflation, and in particular when CPI has been above 4.2 per cent.

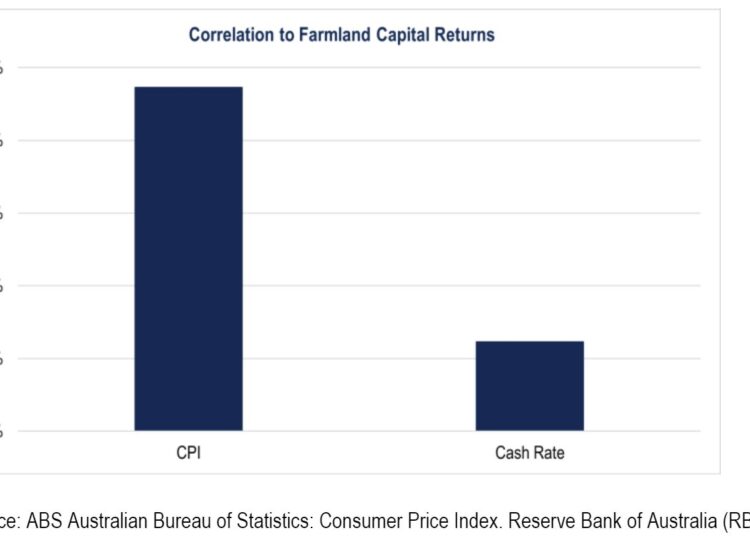

Interest rates can also have a profound effect on property values across all sectors, including farmland, as higher interest rates increase the cost of finance and in turn reduce net operational returns. However, the impact of interest rates in agriculture is not as dramatic as that of inflation, which is more highly correlated to farmland capital returns than the RBA cash rate.

The impacts of high inflation on agriculture income yields

In line with performance through historic events of economic stress, agricultural investment returns have been highly resilient through the pandemic. Unlike traditional inflation hedges such as gold, farmland is also an income-generating asset that can produce a reliable yield.

Specifically for agricultural income returns, moderate to high inflation has different influences on key profit drivers and the impacts depend on relative inflation in agricultural outputs, as well as the economic position of our relevant trading partners.

Making up a large portion of the CPI basket of goods, agricultural outputs such as food and beverages are naturally exposed to inflation. A rise in prices can be indicative of higher revenue for producers of these goods, and if occurring at the same time as a depreciating Australian dollar (AUD), it has the potential to be supportive of agricultural profits.

It must be noted that inflation in goods and services can increase the cost of farm inputs, potentially squeezing margins unless revenue growth fully compensates such extra costs. Upward cost pressures on labour would also be expected in an inflationary cycle. However, agriculture is a much more sophisticated and less labour-intensive sector than it once was, and a continued focus on technology, operating efficiency and automation across the food supply chain has reduced, and will continue to reduce wage pressures over time.

High-quality, well-managed farmland investments offer an attractive alternative to traditional asset classes, which is largely agnostic to economic cycles. Adding or increasing exposure to agriculture within a well-balanced investment portfolio can offer considerable benefits to long-term investors.

Steve Jarrott, portfolio manager, diversified agriculture, Warakirri Asset Management