What’s happening?

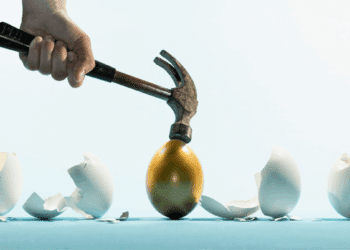

Under the ‘Better Targeted Superannuation Concessions’ rules, the Government has reduced the tax concessions available to individuals whose total superannuation balances exceed $3 million at the end of the financial year.

An individual with a balance over this threshold will be subject to an additional tax of 15 per cent on the earnings on any balance that exceeds the $3 million threshold. This change broadly brings the headline tax rate on the portion of earnings above $3 million to 30 per cent.

The implications

One potential effect of this change is that earnings on investments may be less lucrative than before, once tax is considered. Investors relying on capital gains from equity investments may find these gains are reduced after factoring in the additional, immediate tax burden on unrealised, future (and potentially, momentary) gains. To achieve optimum results in terms of earnings, growth and tax liabilities, it may be useful to consider adding asset classes beyond equities, including alternative investments, such as private credit.

Why private credit?

Private credit is an increasingly popular asset class owing to its potential to deliver predictable income combined with security in the form of registered mortgages over real estate assets.

CRED investment manager and non-bank lender, Zagga, provides loans to commercial real estate market participants, for purposes such as acquiring properties, building new housing, or holding recently completed stock. By privately negotiating these loans, Zagga can rigorously assess the borrower and their assets, control the pricing (i.e. interest rate) of the loan and ensure it conforms to an appropriate risk level for the type of loan. Private credit can avoid the volatility often seen in public markets for products such as bonds – which are extremely sensitive to interest rate movements and sentiment – instead, providing a predictable income stream based on the loan’s interest rate and duration.

In a self-managed superannuation portfolio, this combination of predictable income, asset security and predictable yield means private credit can play a useful role in meeting income needs. And with the Government’s new super rules in place, it may be timely to talk to a financial adviser about how to diversify income sources while bearing in mind the tax implications of different investments classes.

ABOUT ZAGGA

Incorporated and licensed in 2016, we are a well-established, Australian boutique investment manager and non-bank lender, specialising in the private credit real estate (CRE) sector. A leader in our chosen niche of mid-market loan sizes ranging from $5M to $50M, we boast a team with over 200 years’ combined experience in credit, property, and investment management.

Our investor base spans high net worth individuals, family offices, and quasi-institutional funders from Australia, China, Hong Kong, Israel, Japan, Mauritius, Singapore, South Africa, Switzerland, the UK, and the USA.

We focus on generating stable, fixed-income style, risk-adjusted returns through CRE investments secured by high-quality Australian assets. To date, we have funded close to $2 billion across more than 250 loans, and repaying more than $1 billion to investors, without any losses of principal or interest.

Committed to excellence in real estate private credit.