Over September alone, investors pumped a record $1.62 billion of net flows into the market. ETPs are on track for a record year and a market capitalisation of $60 billion by 31 December. Over the 12 months to 30 September, Australian equity ETPs led net inflows at $3.13 billion. That pipped the $3.06 billion that flowed to international equity ETPs.

Combined, cash and fixed income ETPs were very popular, drawing almost $4 billion in flows over the year. Australian fixed income ETPs alone attracted $2.50 billion in flows, while international fixed income ETPs drew $482.5 million. Cash ETPs also attracted $933.3 million in net flows. ETFs make up around 90 per cent of total ETP assets under management (AUM).

That highlights an important point – ETPs are being used by investors not only to grow their exposure to growth assets such as shares, but also to build out the defensive part of their portfolios. This is unsurprising given ongoing equity market volatility and fears of a global economic slowdown amid the ongoing US-China trade war. Slowing growth around the globe has fuelled recession fears, pushing people into defensive assets.

Also pushing investors into ETPs is the expanding diversity of the market. People can now invest in ever-expanding range of assets, including developed and emerging market shares or debt, and alternative assets such as infrastructure and property. As that choice of assets grows, even more funds will flow into the market.

But local shares are still a big draw. Investors are more confident that Australia’s economy is stabilising after three interest rate cuts this year from the RBA, which has boosted flows into local equity ETFs. Reflecting that, Australian equity ETPs attracted the greatest net monthly flows of $658.7 million in September, well ahead of international equities at $328.4 million. Australian equities too have outperformed over the six months to 21 October, returning 5 per cent versus 2.7 per cent for the S&P 500. As local shares rally, this could spur an outperformance of offshore share markets in coming months.

Smart beta growing quickly

Smart beta ETFs have grabbed market share since 2015 as investors chase more targeted investment outcomes, as well as asset and geographic diversification. Total smart beta assets under management (AUM) stood at $8.5 billion as at 30 September, up 50 per cent from a year earlier. That compares to market capitalisation ETPs with AUM of $40.3 billion as at 30 September, up 29 per cent from a year earlier. Smart beta ETFs now account for 15 per cent of the overall ETP market.

According to VanEck’s 2019 annual smart beta survey, financial professionals using smart beta strategies overwhelmingly believe they represent good value for money, while almost two-thirds (62 per cent) believe smart beta strategies will outperform active strategies.

The majority of advisers (66 per cent) use smart beta strategies to replace actively managed funds and most (68 per cent) are very or extremely satisfied with their investments. This highlights that the movement towards smart beta ETFs – which deliver targeted investment outcomes through rules-based investing – is taking hold of the Australian investment market and becoming mainstream.

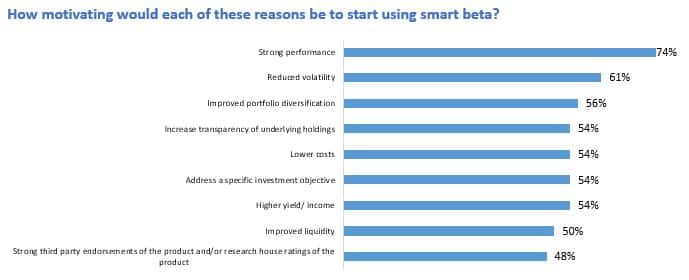

Strong performance is the number one motivating factor for financial professionals to use smart beta strategies. Investors and their advisers are realising that active funds often underperform their benchmarks, so investors are shifting to smart beta to seek strong performance outcomes for much lower fees. Other motivating reasons to use smart beta include reduced volatility, improved portfolio diversification and increased transparency as the chart below shows.

Source: VanEck Fourth Annual Smart Beta Survey, August 2019

Downward pressure on fees

The persistent underperformance of active managers is backed by research from S&P Dow Jones Indices. The SPIVA Australia Scorecard recently found that over the one-year period ending June 2019, 93.2 per cent of Australian large-cap equity funds underperformed the S&P/ASX 200 index. The scorecard has observed consistent underperformance for the majority of Australian active funds in most categories over the longer periods (5-, 10-, and 15-year periods).

Those are staggering numbers and explain why active managers are losing market share to smart beta strategies. A recent VanEck white paper, When are fees too high? A study of Australian equities management, found most Australian active managers will be forced out of existence by disruptive smart beta investment strategies, which offer the same or better outcomes for a lower cost.

The white paper found that most Australian equity funds should be charging fees between 0.35 per cent p.a. and 0.50 per cent p.a. as most of their performance can be explained by factors, the same factors used in smart beta strategies. Unless their performance improves, active managers are likely to keep losing market share to smart beta ETFs. The lower fees that ETFs have introduced will continue to force active fund managers to question their own fees as they risk losing more mandates to ETF providers.

Arian Neiron, managing director, head of Asia Pacific, VanEck