Historical levels of achievable income have plummeted in recent years as official interest rates have been slashed in the wake of the global financial crisis. Replacing those once-healthy cash flows is set to become a major challenge for investors as the highly levered global economy ensures interest rates stay lower for longer.

Many investors are still trying to generate lifestyle-supporting levels of income by parking their funds in low-interest-bearing term deposits. It is a strategy with its own peculiar set of risks and one which bypasses the far larger and more diverse bond market.

For investors with short time frames – less than 12 months – term deposits, which carry a government guarantee, may be a good match, but those with longer investment horizons may want to consider bonds, which may offer the potential for higher yields than term deposits and lower volatility than equities. Of course, unlike bank term deposits, bonds are not subject to a government guarantee (up to $250,000).

Rising rates, misplaced fears

Average five-year term deposit rates of 7.5 per cent – 8 per cent (which investors were receiving as recently as 2010) have become a relic. Investors rolling out of term deposits are now faced with the stark reality of rates around half those levels.

Many are sitting on the sidelines of the fixed income market due to concerns about low bond yields and the impact of potentially rising interest rates. While we believe that interest rates will remain low to support the global economy for an extended period, a skilled active bond manager can deliver above-average returns through the market and interest rate cycle while lowering overall portfolio risk.

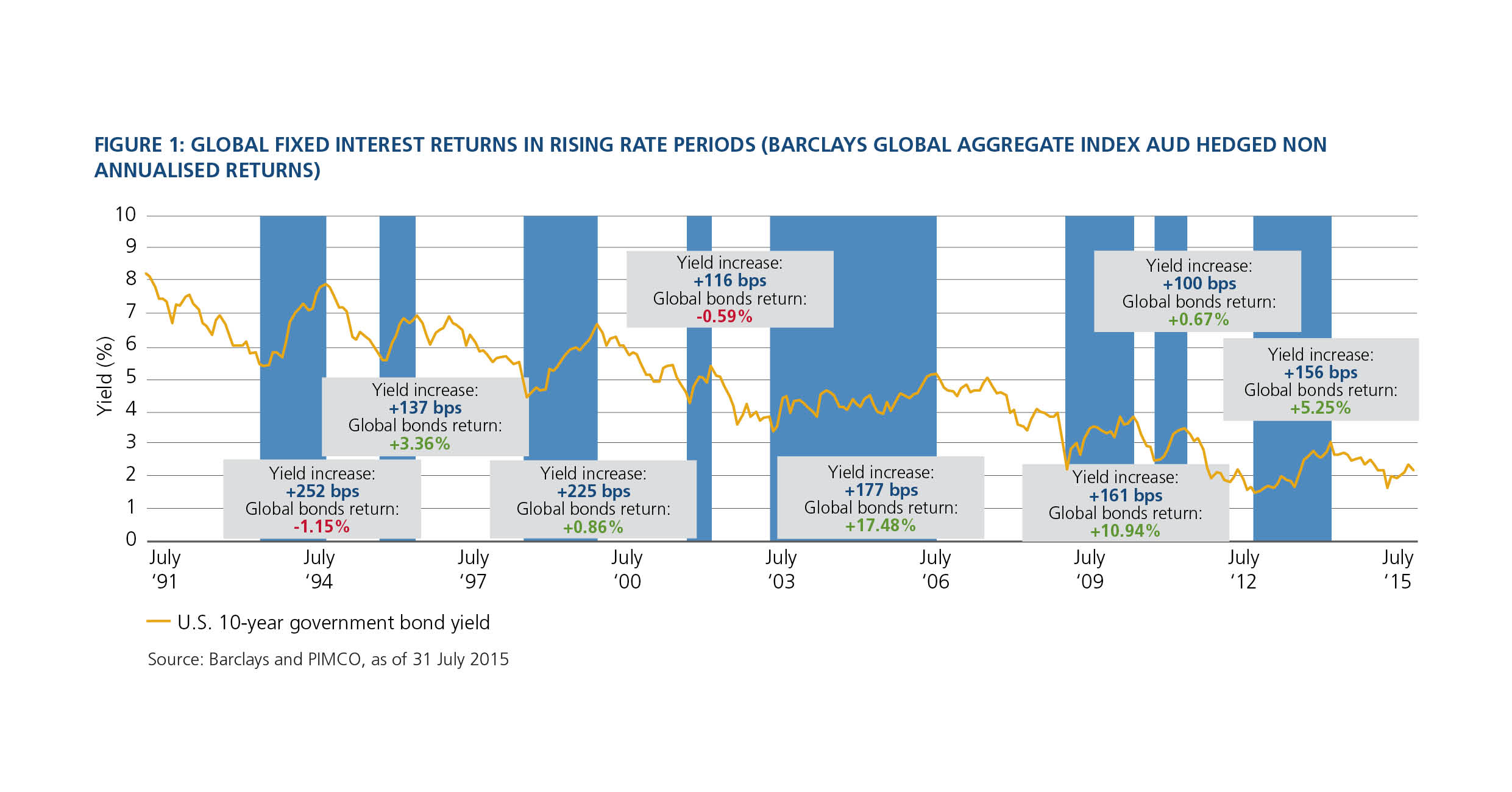

When interest rates rise, the capital value (or price) of fixed interest securities typically falls. However, history tells us that a well-diversified bond portfolio may provide positive returns for clients in such an environment, as shown in Figure 1.

When interest rates rise, the capital value (or price) of fixed interest securities typically falls. However, history tells us that a well-diversified bond portfolio may provide positive returns for clients in such an environment, as shown in Figure 1.

Additionally, active bond managers can generate income above typical cash and term-deposit levels by adjusting a number of levers.

These include shifting the portfolio into parts of the bond market less affected by rising interest rates. This can mean investing in different sectors, such as corporate bonds or the mortgage sector, and investing in bonds from regions where we consider rates are less likely to rise, such as Europe or Australia.

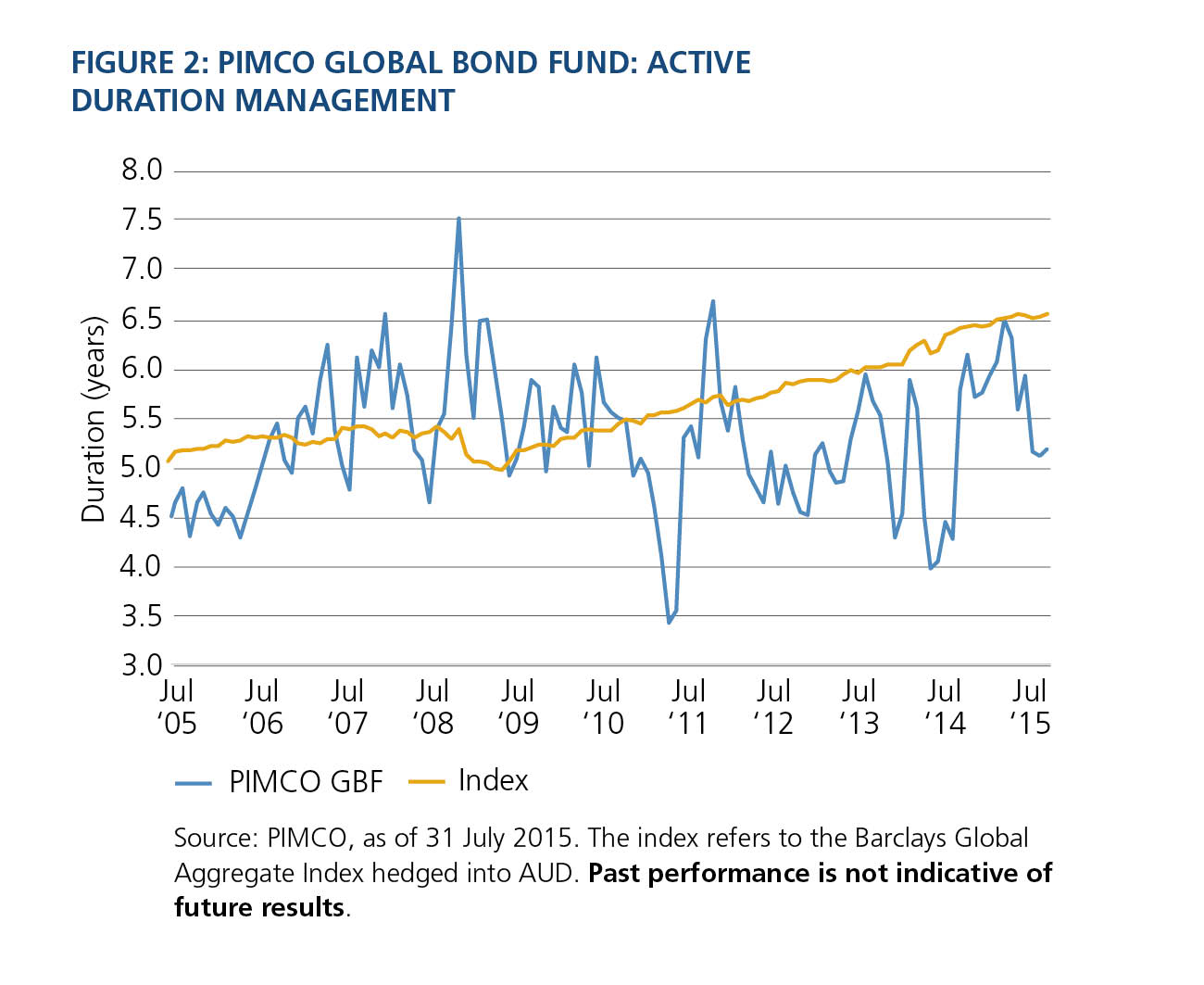

Bond managers can also reduce a bond portfolio’s sensitivity to changes in interest rates, or its duration. One way of reducing duration is to increase a bond portfolio’s allocation to shorter-term debt securities. As an example, Figure 2 shows the impact of managing duration in rising rate environments in PIMCO’s Global Bond Fund.

Another way to adapt to rising interest rates is to invest in credit sectors, such as corporate bonds, or in countries where interest rates are not expected to rise. Active investing such as this may support income levels when rates do rise. Active managers with expertise in risk management instruments, such as interest rate swaps, can also use these tools with the aim of protecting a bond portfolio from the impact of rising rates.

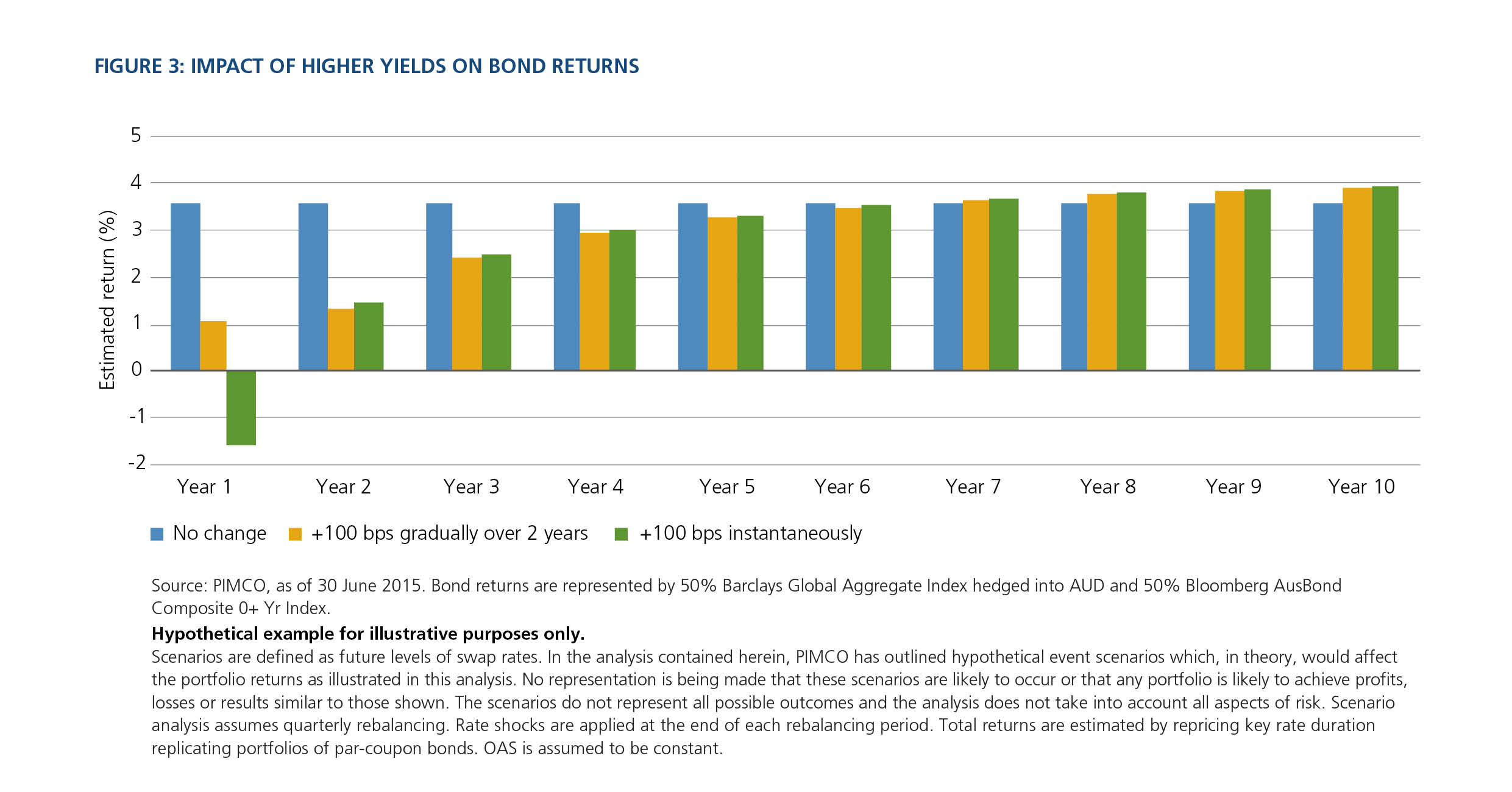

Investors should be mindful that falling bond prices have no effect on returns when bonds are held to maturity: At that time, the initial capital, or principal, is fully returned. In fact, bond portfolios ultimately benefit from rising yields as the cash flow from maturing bonds can be re-invested at higher interest rates, increasing the overall yield of the portfolio (see Figure 3).

Bonds can also help reduce risk within an investment portfolio by providing a buffer in times of market stress in a way that term deposits cannot.

How? In general, bond returns are negatively correlated with riskier assets, notably equities. So when share prices are falling, high-quality bonds typically rise in value given their higher ranking in the capital structure and as investors shift their assets away from risk and into relative safe havens. Term deposits offer no such ability to offset losses from falling values in growth assets.

Risk and return

Many investors take comfort in the security offered by term deposits. The payment of interest and the return of capital are supported by the quality of the bank and an Australian government guarantee, which covers up to $250,000.

However, bond portfolios can offer a low-risk alternative for investors seeking higher returns. When invested across the variety of fixed income sectors that make up the US$100 trillion-plus global bond market, a bond allocation can provide an attractive, low-risk anchor for a portfolio, supporting capital preservation and income.

Download a pdf version of this paper here or visit pimco.com.au to find out more.

|

|

|

|

Adrian Stewart, Executive Vice President & Head of PIMCO Australia |

John Valtwies, Vice President, Investment Due Diligence Group |

This publication is issued by PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862 (PIMCO Australia) and is intended to provide general information only. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. Investors should obtain a copy of the product disclosure statement in relation to any financial product mentioned in this publication before making an investment decision. The PDS for the PIMCO Global Bond Fund (ARSN 093 530 486 is available at www.pimco.com

Investment management products and services offered by PIMCO Australia are offered only to persons within its respective jurisdiction, and are not available to persons where provision of such products or services is unauthorised.

Past performance is not a reliable indicator of future results. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Neither PIMCO Australia nor any of its related bodies corporate make any representations or warranties, express or implied, as to the accuracy or completeness of any of the information contained in this publication. To the maximum extent permitted by law, neither PIMCO Australia nor its directors, employees, agents, representatives or advisers accepts any liability whatsoever for any loss arising from the use of information in this publication. This publication contains the opinion of PIMCO Australia and such opinions are subject to change without notice. The content in this publication remains the

property of PIMCO Australia. No part of this publication may be reproduced in any form, or referred to in any other publication, or conveyed to a third party without express written permission of PIMCO Australia. PIMCO is a trademark or registered trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©PIMCO, 2016.