9:00 AM Monday, 23 March

Australia tightens social gathering restrictions, closes businesses

Last night, the government confirmed certain businesses would be restricted from operating from midday today.

These businesses are:

Pubs, registered and licenced clubs (excluding bottle shops attached to these venues), hotels (excluding accommodation)

- Gyms and indoor sporting venues

- Cinemas, entertainment venues, casinos, and night clubs

- Restaurants and cafes will be restricted to takeaway and/or home delivery

- Religious gatherings, places of worship or funerals (in enclosed spaces and other than very small groups and where the 1 person per 4 square metre rule applies).

The restrictions will be in place for six months.

Schools will remain open, but they will be encouraged to implement online and distance learning.

Prime Minister Scott Morrison said the measures had been implemented after members of the community had disregarded social distancing measures.

Weekend recap: Monday, 23 March

Government unveils second stimulus; state lockdowns and border closures

The federal government launched its second stimulus package on Sunday, worth $66.1 billion.

It includes:

- A further $750 payment to social security and veteran income support recipients and eligible concession card holders, except for those who are receiving an income support payment that is eligible to receive the coronavirus supplement. This is in addition to the $750 stimulus payment announced last week.

- Early release of superannuation, where the government will allow individuals in financial stress as a result of the coronavirus to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21. This measure is estimated to cost $1.2 billion over the forward estimates period.

- The temporarily reduction of superannuation minimum drawdown requirements for account based pensions and similar products by 50 per cent for 2019-20 and 2020-21. This measure is aimed to benefit retirees by providing them with more flexibility as to how they manage their superannuation assets.

- A reduction of the deeming rates by a further 0.25 percentage points to reflect the latest rate reductions by the RBA. As of 1 May 2020, the lower deeming rate will be 0.25 per cent and the upper deeming rate will be 2.25 per cent.

- Boosts of up to $100,000 to eligible small and medium sized businesses, and not‑for-profits (including charities) that employ people, with a minimum payment of $20,000, so they can keep operating.

- Regulatory protection and financial support for SMEs, with a new Coronavirus SME Guarantee Scheme seeing the government guarantee 50 per cent of new loans issued by eligible lenders to SMEs. The Government will guarantee up to $20 billion to support $40 billion in SME loans.

- Support for the aviation industry: the government is also providing up to $715 million in support for Australian airlines and airports.

At a state level, NSW and Victoria have indicated they will be moving to a shut-down of "non-essential" services within the next couple of days. Services deemed essential such as supermarkets and petrol stations will remain open.

South Australia and Western Australia both have signaled border closures, with tightened travel restrictions for both domestic and international travelers.

4:00 PM Friday, 20 March

Stage set for strong recovery: BlackRock

“Markets, in our view, will ultimately settle down if three conditions are met: 1) visibility on the ultimate scale of the coronavirus outbreak and evidence the infection rate has peaked over the long term; 2) deployment of credible and coordinated policy packages; and 3) confidence that financial markets are functioning properly,” BlackRock said in a note.

“Once we better understand the scale and impact of the outbreak, the policy response is setting the stage for an eventual – and strong – recovery. This is why we stay neutral on risk assets and believe investors should take a long-term perspective.”

3:30 PM Friday, 20 March

Who is hurting from the collapse in oil price?

“Oil prices are hitting new lows, dragging down energy companies’ stocks and bonds, as well as bonds and currencies of the oil-producing countries,” writes Marija Veitmane, multi-asset class research senior strategist at State Street Global Markets.

“We are yet to see any sign of the Russia-Saudi Arabia price war abating. It is also too early for the oil importers to realise any boost from falling oil prices as economic activity is heavily restricted by attempts to contain the virus. Efforts by central banks and governments are likely to keep most energy producers and equipment companies solvent and can ease some sovereign risks. However, their earnings outlook and ability to invest is a concern. Shareholders may as well abandon any hope of receiving dividends from energy stocks, which have historically been the best payers in the market. The collapse in the oil price will also have a substantial knock-on effect on overall investment spending and will be felt particularly hard by industrial companies. Stocks in both sectors have underperformed substantially and a rapid turnaround is unlikely.”

2:30 PM Friday, 20 March

Federal budget delayed

The Prime Minister has announced that the federal budget will not be handed down until later this year amidst the coronavirus outbreak.

“Forecasting for budgets is difficult at the best of times, let alone when we’re in the middle of a global pandemic,” said Treasurer Josh Frydenberg.

The budget is now planned for the first Tuesday in October.

1:50 PM Friday, 20 March

‘We are in global recession territory’: Fitch

The coronavirus crisis is crushing global GDP growth according to Fitch Ratings in its latest quarterly “Global Economic Outlook” (GEO) published on Friday.

“The level of world GDP is falling. For all intents and purposes we are in global recession territory,” said Brian Coulton, chief economist at Fitch Ratings.

Fitch has nearly halved its baseline growth forecast for 2020, to 1.3 per cent from 2.5 per cent in its December GEO.

The revisions leave 2020 global GDP US$850 billion lower than in the previous forecast.

But, Fitch has warned there could be a more outright decline in global GDP if more pervasive lockdown measures have to be rolled out across all the G7 territories.

Emergency macro policy responses are about damage limitation at this stage but should help secure a V-shaped recovery in the second half, the analysis has said, although that is based on the assumption that the health crisis eases.

1:40 PM Friday, 20 March

Coordinated government and regulator actions not a panacea: S&P

The movements from the government, Reserve Bank and APRA should alleviate immediate risks posed by the outbreak to the banks in Australia and New Zealand, S&P Global Ratings has said.

But while the actions have supported the financial system’s stability, the ratings agency does not expect the measures to fully insulate the Aussie and Kiwi banks from coronavirus outbreak pressures.

“Lower interest rates are likely to further erode interest margins of the banks, although access to funding at low cost from RBA should help,” S&P said.

“In addition, despite the subdued consumer sentiment and pressures on employment, low interest rates could further drive up property prices, which would heighten risks to financial system stability.

“The resilience of domestic and global economies and markets would remain key to the performance of the banks, in our view. We expect the lenders’ earnings will be significantly weakened by increased credit losses on top of depressed interest margins and ongoing customer remediation costs.

“Bank earnings would also be squeezed by forbearance they extend to hardships suffered by households and businesses.”

11:50 AM Friday, 20 March

Aus dollar collapse, government stimulus is ‘peanuts’: Saxo Bank

The Australian dollar has hit its lowest level in almost 20 years. As at 11:30am today, it sat at $0.58 cents, having collapsed by 9 per cent in the last three days.

Eleanor Creagh, Saxo Markets Australian strategist commented: “The AUD has outpaced GFC lows falling to levels last seen in 2002.”

She added the domestic outlook and anticipation of the monetary easing package from the RBA have weighed on the currency over the medium term.

Speaking on the coronavirus hit for SMEs, particularly for the services and hospitality sector, Ms Creagh said many small businesses will desperately need a lifeline to maintain wages, rent and other costs.

“So far the Australian government’s starter package is welcome, but insufficient,” she said.

“The size of the stimulus is peanuts relative to the 4 per cent of GDP stimulus package outlined by the New Zealand government."

Potential cash flow support could be key in “allowing business to provide goodwill payments to casual workers who lose shifts, extended sick pay for those unable to work and preventing lay-offs for those businesses facing a material impact from the COVID-19 outbreak,” Ms Creagh said.

For the second stimulus that the Morrison government has hinted will be coming, she said: “The government must move quickly and in size to prevent the cascading effects of economic shutdowns, liquidity issues and plunging share markets from sparking a deeper economic downturn.”

11:30 AM Friday, 20 March

Banks have enough capital, but may need larger buffers: Morgan Stanley

APRA on Thursday told their banks to tap into their current large capital buffers to enable ongoing lending to the economy. The regulator expects that if the banking system uses some of its current buffers, it will still be operating comfortably above minimum regulatory requirements.

It has required the banks to meet a Common Equity Target 1 (CET1) ratio benchmark of at least 10.5 per cent since January.

Morgan Stanley has calculated the major banks have around $16 billion of excess capital: with ANZ: holding approximately $4.4 billion; CBA, around $7.6 billion; NAB, $1.6 billion; Westpac, $2.5 billion.

However, the APRA target includes a minimum capital requirement of 9.5 per cent and a “capital surplus” of at least 1 per cent, which equates to an additional $17 billion.

In Morgan Stanley’s view, the banks have enough capital, but it may be prudent to provide a larger buffer for a bear case scenario and to support lending to customers.

Thus, the analysits have forecast NAB and Westpac will need ongoing capital build.

11:15 AM Friday, 20 March

Banks launch small business relief package

Australian Banking Association CEO Anna Bligh has announced a small business relief package from the banks.

Australian banks will defer loan repayments for six months for small businesses that need assistance because of the impacts of COVID-19.

The package will apply to more than $100 billion of existing small business loans.

Ms Bligh said depending on customer take-up, it could place as much as $8 billion back into the pockets of small businesses as they battle through the period ahead.

“This is a [multibillion-dollar] lifeline for small businesses when they need it most, to help keep the doors open and keep people in jobs,” Ms Bligh said.

“Small businesses are the most vulnerable part of the economy and have the most urgent need for assistance. Small businesses employ 5 million Australians and this package is designed to help them keep doing just that.”

The ABA has developed the small business relief package following discussions with APRA and ASIC to provide the appropriate regulatory treatment. The package is subject to authorisation by the ACCC.

11:05 AM Friday, 20 March

Tracking the COVID-19 impacts on equities, bonds

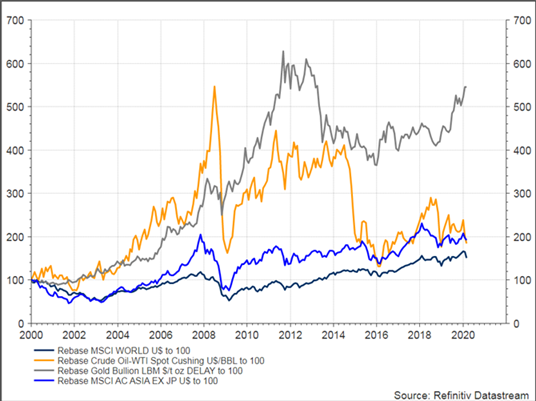

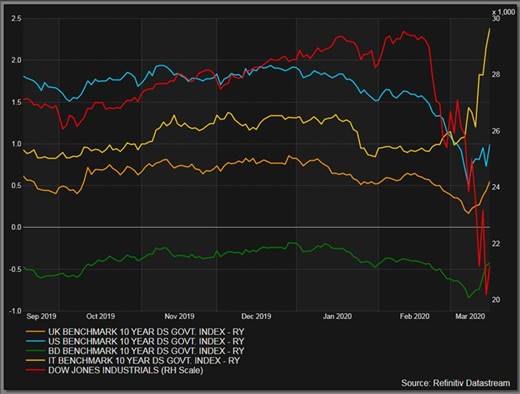

Refinitiv has monitored the effects of the virus on the equity and bond markets, collating the following charts.

The chart below shows the performance of global stock market (MSCI World), Asian stock market (MSCI AC Asia), oil and gold throughout the SARS outbreak, the global financial crisis in 2008 and the current coronavirus outbreak. The pattern of the equity market falling first, followed by gold and oil during the financial crisis is reappearing.

Government bonds fell sharply on Wednesday, and the following chart outlines the performance of UK, US, Germany and Italy bond markets as well as the Dow Jones Index.

11:00 AM Friday, 20 March

Time to think innovatively: UBS

“We view the announcements made by the government, RBA and APRA in recent days positively, as they attempt to support the economy and employment during very difficult time. We were also encouraged by RBA governor Lowe’s comments that Australia will do ‘whatever is necessary’ to support the economy and bridge the gap until the impact of the COVID-19 pandemic passes,” UBS said.

“We believe it is absolutely critical to support SMEs during this time. We estimate that small and medium-sized businesses employ around 60 per cent of Australians. Unless these businesses survive the economic shock of the pandemic, Australia’s recovery will be extremely challenging.”

5:30 PM Thursday, 19 March

RBA left longer term bonds in limbo: Schroders

The Reserve Bank, alongside its emergency rate cute, said it would implement measures to support the banks in transmitting lower rates to the economy.

ADIs will be able to borrow from the RBA, for three years and for up to 3 per cent of their outstanding credit, at 0.25 per cent. They will have access to additional funding on these terms if they increase lending to small and medium-sized businesses.

Stuart Dear, deputy head of fixed income at Schroders has said while the RBA measures are substantive and will help lower the cost of funding to the domestic economy, what is less clear is how the actions will support the good functioning of the domestic bond market.

“Liquidity in government bonds in recent days has been dire,” Mr Dear said.

“While the RBA has committed to buying government and semi-government securities across the curve, it appears its focus on the short end has left longer term bonds in limbo, especially as we know the fiscal demands of the government will require significant new bond issuance.

“Extended repo measures are supportive, but probably the bond market was looking for more specific measures. These may come in due course.”

4:30 PM Thursday, 19 March

Kerry Craig, global market strategist at JP Morgan Asset Management, comments on the RBA’s announcement.

“The most important line in the statement today was that the RBA was working with government,” Mr Craig said.

“Markets are desperate for a coordinated approach after too long a period of having the government and the RBA looking at each other for economic support. There should be some reassurance that support is coming in tandem and there is scope to do more on both fiscal and monetary policy if needed. While the 25 bps rate cut will most likely be passed on to borrowers through the banks in full, that does little to help those needing income in what was an already constrained environment.”

4:00 PM Thursday, 19 March

PM announces travel ban

Prime Minister Scott Morrison said an indefinite travel ban will be implemented from 9pm Friday, blocking non-citizens and non-residents from entering Australia.

It has replaced earlier bans on foreigners coming from China, Iran, Italy and South Korea.

3:45 PM Thursday 19 March

RBA ‘fired its last bullet’

BetaShares chief economist David Bassanese has said the RBA can only do so much in the face of “virtual self-inflicted depression conditions”.

“The RBA has fired its very last cash rate bullet and must now resort to quantitative easing,” Mr Bassanese said.

“But the decision to target three-year rather than 10-year bonds may disappoint the market, which I think was hoping for greater downward pressure on funding costs all along the yield curve.

“We are living in unprecedented times given we are effectively destroying our own economy to take pressure of the health system assuming COVID-19 cases spike. The cost in lost jobs, wealth and other forms of related ill-health will now also be immense.”

2:30 PM Thursday, 19 March

RBA cuts rate, launches QE

The Reserve Bank has made an emergency cut, leaving the cash rate at a historic low of 0.25 per cent.

It has also committed to buying government bonds in the secondary market, a form of quantitative easing.

“At some point, the virus will be contained and the Australian economy will recover,” RBA governor Philip Lowe said in a statement.

“In the interim, a priority for the Reserve Bank is to support jobs, incomes and businesses, so that when the health crisis recedes, the country is well placed to recover strongly.”

2:20 PM Thursday, 19 March

Unemployment to rise to 7.5%: AMP Capital

Australian jobs rose by a better than expected 26,700 in February, above market expectations of around 6,300. Annual growth in employment remained steady at 2 per cent.

Full-time jobs were up by 6,700; while part-time jobs rose by 20,000. The unemployment rate fell to 5.1 per cent, from 5.3 per cent in January.

However, as noted by AMP Capital senior economist Diana Mousina, the data appears to be out of date, given the disruption to the economy from the coronavirus over the past few weeks.

“The impact on the jobs market will start to be felt from March as some businesses are forced to close and lay off staff and delaying hiring,” Ms Mousina wrote.

“Hopefully some staff will be switched to part-time work, or put on leave, but this won’t be the case for all firms and we have revised up our unemployment forecasts along with even lower growth forecasts (which were already predicting a recession).”

AMP Capital has forecast the unemployment rate will rise to 7.5 per cent or higher in 2020 with GDP growth to fall by 0.6 per cent (year-on-year average).

1:00 PM Thursday, 19 March

Super funds will ‘need to cut services or increase fees’

Rice Warner has released a report looking at the impacts of the coronavirus-prompted market downfalls for super funds. The sector is set to be hit with rising levels of member inquiries, which will be a challenge if funds’ staff are largely working from home and outsourced service providers are operating less effectively than usual.

Further, most funds subsidise their operational costs from asset-based fees on their investment portfolio. Contributions to fee income will have fallen considerably, and a number of funds will now be in a position where they “need to cut services or increase member fees”.

“At the same time, demand from members for services will be spiking due to the current volatility and uncertainty,” the report commented.

“We expect this might tip some of the smaller funds into merger negotiations – but they may find the climate a lot less amenable than a year ago”.

Further, the funds will be impacted by members losing jobs – some will be forced into early retirement.

“We might find the level of hardship withdrawals from funds grows quickly – and the rules might need to be made more lenient to put cash into the hands of consumers,” Rice Warner warned.

11:30 AM Thursday, 19 March

Spotlight on the oil sell-off

One consequence of the coronavirus outbreak has been a massive oil price war between Saudi Arabia and Russia as global demand plummets.

“Saudi Arabia [has] very aggressively changed policy, opting for a price war, which raises huge questions about the recent IPO of Saudi Aramco,” said Daniel Sullivan, head of global natural resources at Janus Henderson.

“While this type of total breakdown was discussed within the Global Natural Resources Team, it was considered unlikely given Saudi Arabia is cited as needing an oil price of US$80/bbl to balance its budget. A knock-on from this event will be weakness for many nations heavily reliant on oil production, along with the possibility of unrest. Meanwhile, consumers globally will have access to cheaper fuels.”

The collapse in the oil order saw oil reprice around 25 per cent in 24 hours, the biggest daily price move since Gulf War One in 1991.

“Markets have very quickly priced a lower-for-longer regime for oil prices where potential demand reductions (based upon COVID-19-induced demand shutdowns) and the potential for an increase in production [drop] the price along the whole curve,” said Mathew Kaleel, a portfolio manager in the diversified alternatives team.

“With lower prices, higher inventories, and a lack of catalysts for the next 12 months for increased demand, only one thing is certain – volatility will remain elevated and the market will trade towards a price resistance level of US$45-50/bbl.”

11:25 AM Thursday, 19 March

70% chance of world recession as China begins to stabilise

Capital Group’s economists has placed equal odds for a world and US recession at 70 per cent.

The team has also noted that the average market decline when accompanied by a recession has been 31 per cent.

Meanwhile China is starting to stabilise two months after the outbreak of COVID-19, with new cases declining and the economy slowly restarting.

“Before the outbreak of COVID-19, there was mounting evidence that the global economy was starting to recover as the headwinds of 2019 defined by a protracted slump in industrial and export activity faded,” David Polak, equity investment director at Capital noted.

While it may be reasonable to ask if anyone may holiday in a cruise ship again, he added, the virus is unlikely to have a great impact on consumer-facing sectors over the long term.

“Broadly speaking, our portfolio managers and analysts believe that consumer behaviour patterns are unlikely to change much for travel and hospitality industries,” Mr Polak wrote.

“When disposable income increases, we drive farther, fly farther, take longer vacations, spend more, etc. The events of 9/11 did not derail this megatrend, and it is unlikely that COVID-19’s impact will over the long term.”

10:30 AM Thursday, 19 March

Light on the horizon, but may still be a long way

State Street has remained optimistic, saying market volatility should be close to beginning to subside and it has called the current speculation of a global recession “premature”.

Tim Graf, head of macro strategy for EMEA at State Street Global Markets has pointed to governments and central banks taking action, with France, Spain and the US preparing to offer “wartime levels of fiscal support” and the UK rolling out an “enormous business lending scheme”.

“Much as spring 2009 was a seminal moment in the financial crisis, when governments began to pick up the baton from central banks, we are nearing the time when market volatility should begin to subside,” Mr Graf said.

“There is still a long way to go – our price-based measures of risk still suggest a very fragile market environment and our real-time gauges of inflation speak to a demand side shock underway that could last [for] months. Nevertheless, we are in the midst of a ‘whatever it takes’ moment from policymakers. We are still a long way from the end of this crisis, but perhaps, just perhaps, we are closer to the end of the beginning.”

This Friday, Frédéric Dodard, head of portfolio management – EMEA at State Street Global Advisors noted, will mark three weeks of the crisis. But he doubts it is about to end.

“Crises typically last three and a half weeks, so in theory we should be close to the end of this episode,” he said.

“However, given the specificities of this crisis, it feels likely it will last longer. The market should have confidence that it has hit the bottom once financial stabilisation is tangible, which means less volatile market moves and at the end, some positive return for risky assets, and when other conditions are met.”

10:15 AM Thursday, 19 March

‘How should investors position for the coming recession?’

“With stock market volatility above the peaks it reached in the GFC, we turn overweight infrastructure stocks with defensive dividends, consumer staples & REITs and increase our negative position in other financials to reflect ‘lower for even longer’ interest rate,” UBS said in a note.

“We also still think investors should position for growth over value. The recent sell-off has demonstrated that the market remains willing to pay up for companies with genuine defensive growth opportunities, with PE dispersions now at record highs.”

9:30 AM Thursday, 19 March

‘No game changer’

“We agree with the consensus view that fiscal solutions are now needed,” writes Paul O’Connor, head of multi-asset at Janus Henderson Investors.

“A range of targeted measures such as credit guarantees, wage subsidies, tax holidays and direct payments to households [has] been announced in many countries recently, but the overall fiscal impact of these has been fairly modest, so far. While measures like this have a useful role to play in addressing specific tensions, a much bigger fiscal thrust will be required for policymakers to have a sizeable impact on broader economic and market sentiment.”