According to the Institutional Investor Outlook for 2018 report by Natixis, which surveyed 500 institutional investors across 31 countries, investors forecasted “plenty of risk on the horizon” for 2018, naming geopolitical uncertainty, potential asset bubbles and rising interest rates as key concerns.

“Institutional investors have been telling us that the long period of artificially low interest rates has distorted asset prices and increased systemic risk in the market as a whole,” said Natixis chief executive, Australia Damon Hambly.

The report labels the shift as “the end of the world as they know it”.

Across all regions of the UK, North America, the Middle East, Latin America, Europe and Asia, geopolitics was named as the top risk concern at 74 per cent globally, with Brexit, Trump, “a nuclear-armed North Korea”, and investigations about Russia’s role in the US elections pinpointed as geopolitical risk factors.

“While none has resulted in market upheaval to date, it appears that institutions are more concerned about the question of when it will happen, rather than if it will happen at all,” the report said.

Furthermore, more than three-quarters of all respondents (77 per cent) felt the low interest rate environment had created potential asset bubbles, particularly in bitcoin (64 per cent), bond (42 per cent) and stock (30 per cent) markets.

Rising interest rates, too, were seen as a performance risk for the next year by 60 per cent of investors, with the speed of rate hikes an additional area of interest.

“In essence, when rates finally go up, many are worried that the ensuing drop in value of current bond investments could upend portfolios built on traditional assumptions about fixed income,” the report said.

Mr Hambly added that rising rates were leading institutional investors “to view current bond market valuations with suspicion”.

“Consequently, investors are increasingly looking for alternatives and uncorrelated investment solutions that can help them to ride out market challenges in 2018,” he said.

However, forecasted market volatility has not caused investors to “run from it”, but “based on their allocation calls, they were actually doubling down on risk”, with 75 per cent of investors identifying active managers as better at accessing opportunities than passive investment.

“There is an expectation that global growth will continue and there is no reason to reposition portfolios defensively just yet,” Mr Hambly said.

“Volatility can boost returns for those able to take advantage; however, there is a need for true portfolio diversification to avoid simply reacting to market corrections.

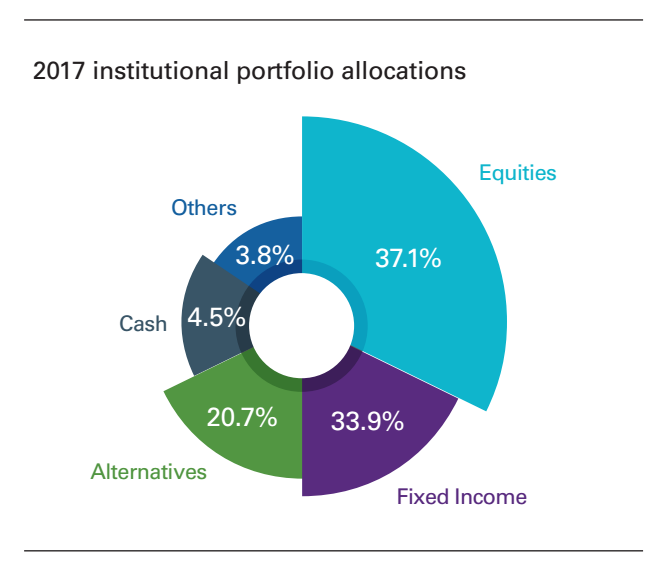

“This is where active investment management becomes so important – tactical allocations to equities will be key, as will the use of alternatives to manage risk, and replace the yields institutions fear they may struggle to get from fixed interest going forward.”

Despite the number of risks ahead associated with changing market conditions, investors are not actually making significant changes to their wholesale strategies.

“About half plan no changes to allocations to US (50 per cent), European (47 per cent), Asia-Pacific (52 per cent) and emerging market equities (48 per cent),” the report said.

Investors were staying close to their allocation plans and only making “moderate adjustments”.

“They are looking to alternative investments to generate yields needed to meet long-term obligations,” the report continued.

“Their portfolio plans for 2018 look very much like their plans for 2017 and they feel fine about it.”

“Despite the expectation of market volatility and change this year, most institutional investors are confident that their portfolios are structured to meet the challenges head on, that their return expectations are realistic, and that any changes to portfolio allocations will be moderate,” Mr Hambly concluded.