According Zenith’s latest annual global long-short sector review, investors paying premium fees for global long-short funds have been “sufficiently rewarded’ with higher returns.

“Although investors can pay significantly more to invest in global long-short funds, the associated absolute and risk-adjusted returns are typically superior to their global long-only counterparts,” the report said.

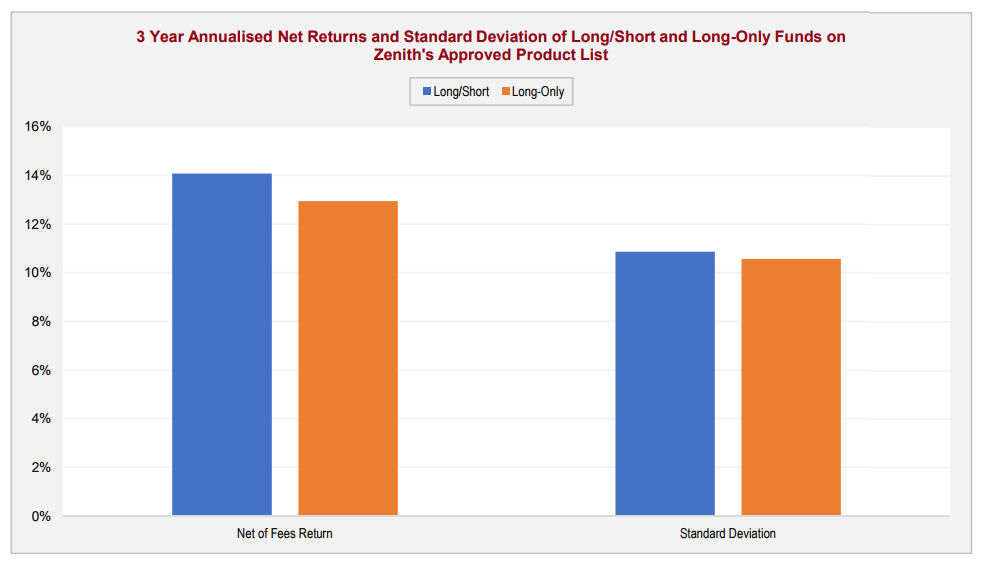

“Zenith found that global long-short funds, annualised for the three years to 30 June 2017, achieved higher net of fee returns (14.1 per cent relative to 12.9 per cent) than their global long-only counterparts with a similar level of risk (10.9 per cent relative to 10.6 per cent).

“Overall, Zenith believes the benefits of global long-short funds justify the premium in fees charged to investors.”

In exchange for higher fees, investors were paying for “stronger capital protection in falling markets” and positive returns offered by “declining share prices through short selling”, whereas long-only fund managers were limited to buying stocks expected to rise over time.

Short selling, “when executed successfully”, was a specialised skill worth paying for, the report said.

The premium fees were also going towards an additional “number of operating costs” in order for a manager to short sell stocks.

“Costs include the fees paid to intermediaries like prime brokers who source and supply the stocks which the managers short sell,” the report said.

“This cost is not insignificant and contributes towards the higher fees charged in managing a global long-short fund.”

Fees have become a “highly sensitive” and a significant consideration for investors when choosing funds, the report said, with a “high level of fee compression across the industry”.

“Given the common perception that global long-short funds can be expensive from a fee standpoint, Zenith believes it is important to focus on whether the average fees charged by the peer group remain attractive based on their realised investment outcomes,” the report said.

While fees are important, it should not be the only factor investors take into consideration, the report stated.

“That is, we believe investors should focus on after-fee outcomes and not be deterred by perceived higher fees,” it said.