As major Australian institutional investors increase their allocation to private investments as part of a broader diversification strategy, comparing the differences between private and public markets can be a complex task for most investors. A bird’s-eye view of key dynamics such as performance, size, inefficiencies and investment horizons can help demonstrate the benefits of private investments and why they make a credible addition to a diversified portfolio.

Consistent outperformance

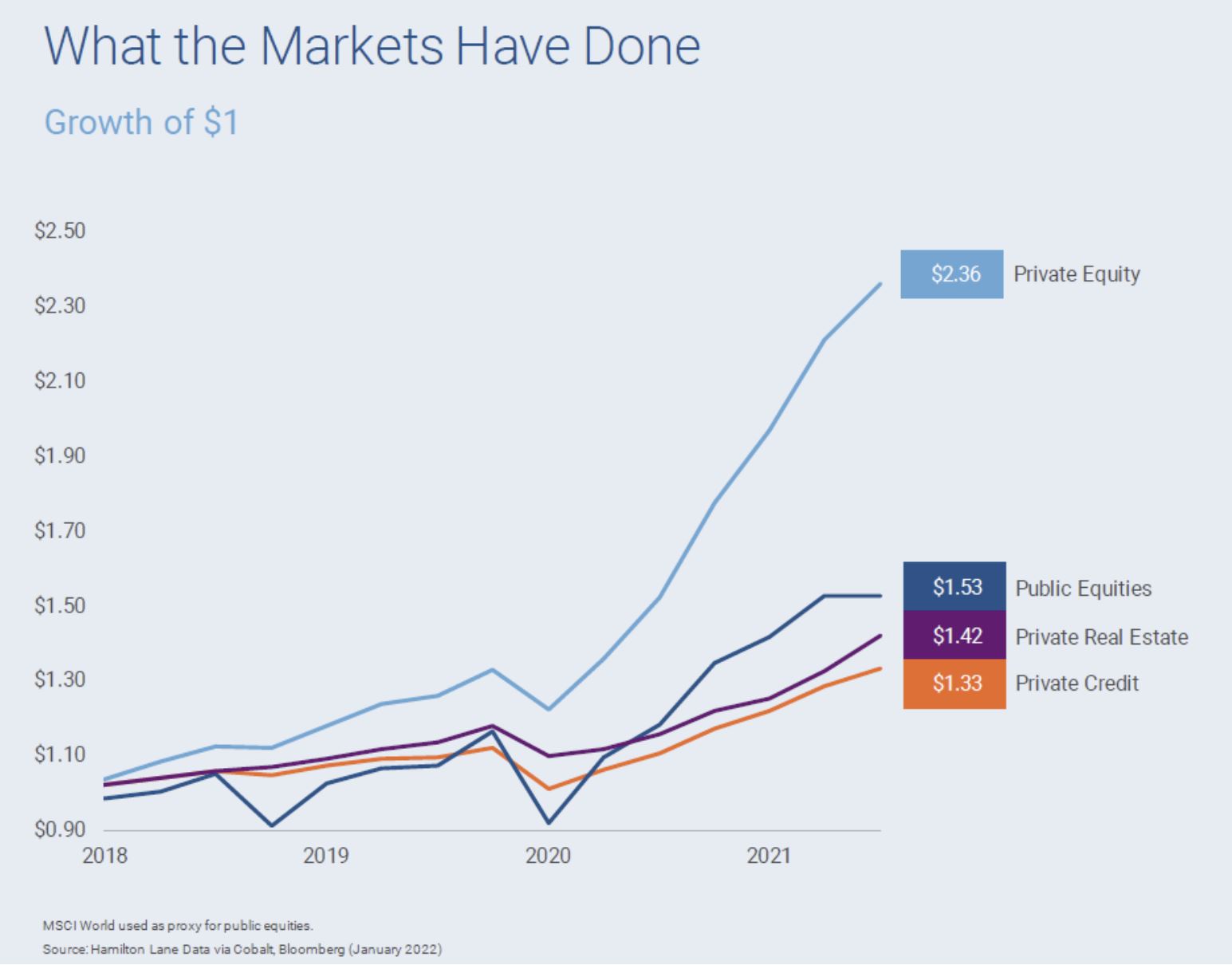

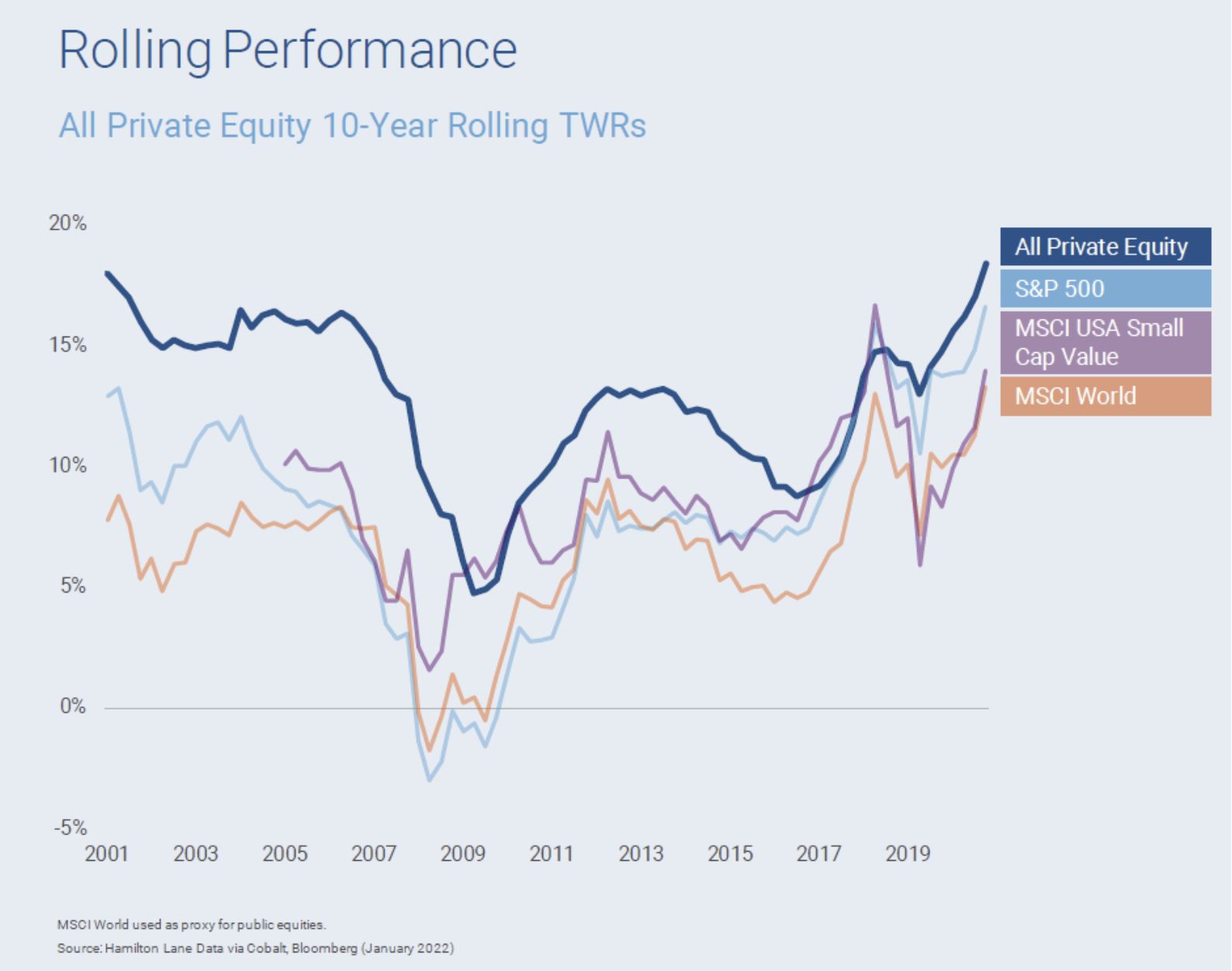

Firstly, the performance speaks for itself. According to the 2022 Hamilton Lane Market Overview, private equity has consistently outperformed public equities since the start of 2018, and performed more strongly over a rolling 10-year period than major equity indices including the S&P 500, the MSCI USA Small Cap Value, and the MSCI World. In fact, a dollar invested into private equity at the beginning of 2018 would be worth around $2.36 today, versus $1.53 if invested in the public markets. Private markets overall, including private credit and private real estate, have also done extremely well performance-wise in comparison to listed equities, with much lower observed volatility.

Breaking this down further, pooled average buyout strategies have outperformed against their public market equivalents in every single one of the last 20 vintage years and by an average of over 1,000 basis points (bps). Private credit has achieved the same, by an average of 600 bps. While private real estate and infrastructure struggled during the GFC, these two asset sectors have performed well in every other period across this timeframe.

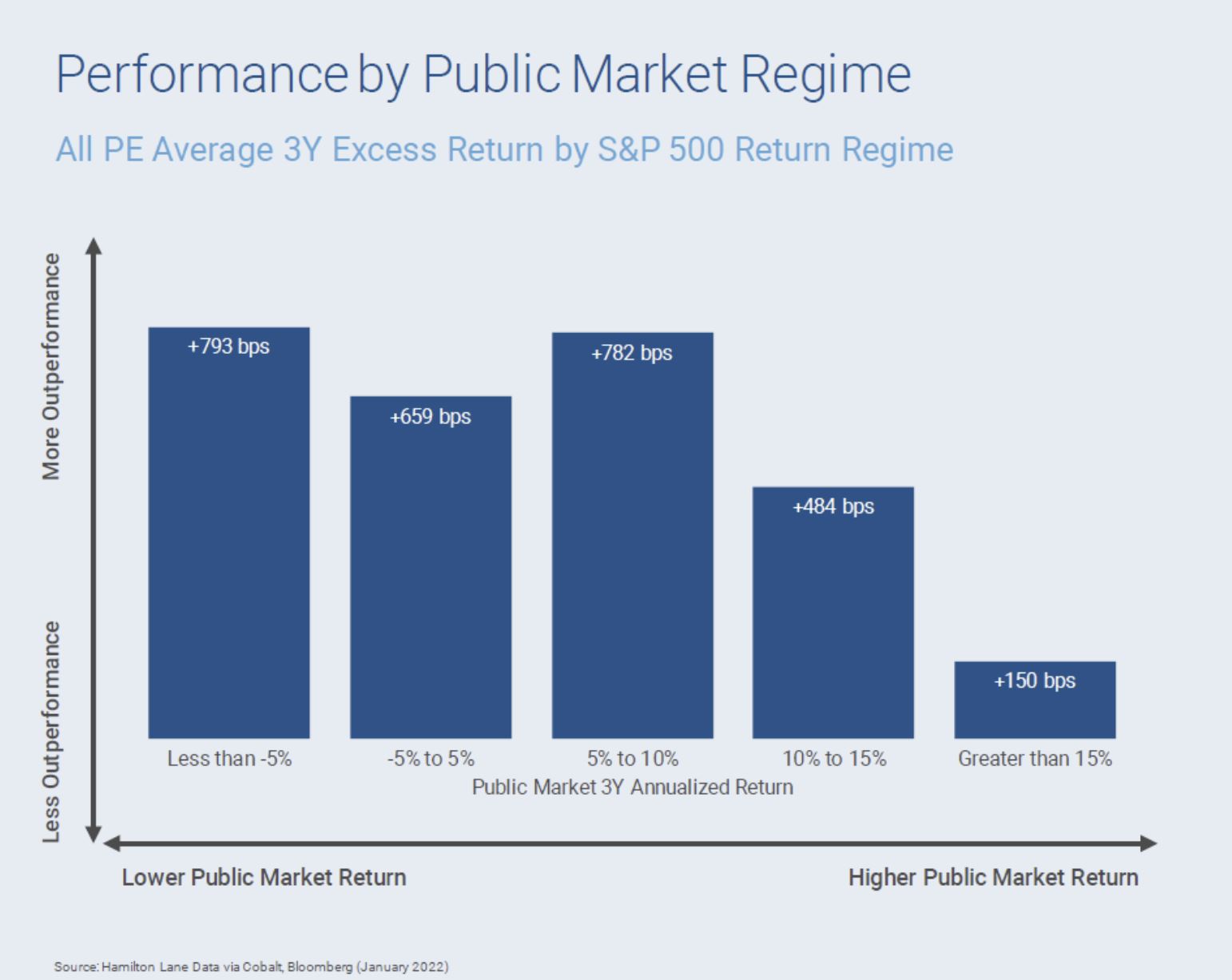

In addition, as the chart below shows, private equity outperformance is narrower in ‘high return’ environments but wider in ‘low’ and ‘average’ return environments - proof of its resilience over time. While we have generally been in a high return environment until more recently, with the shift to lower returns exacerbated by higher inflation and interest rates, evidence shows that private equity has the ability to weather volatility and provide returns which stand the test of time.

Information inefficiencies

All investors have access to listed companies, and a broad range of market and company coverage on them is readily available. Private market information is much more difficult to access, which leads to inefficiencies in information. Similarly, access to investment opportunities is not uniform or equal in the private landscape. And where there are inefficiencies, there are often greater opportunities for outperformance. The catch though, is that the ability to unearth the hidden or unknown value from private market investments takes an extensive amount of access, resources and experience.

Size, scale and a multidisciplinary skillset on a global basis are must-haves – not only to discover and act upon the expansive and growing opportunity set within private markets, but to also develop and actively manage a portfolio of differentiated products to help meet the needs of a wide range of investor types and preferences.

Comparative size of the investable universe

Let’s pick up on the point about access. Being able to tap into a much larger and broader investable landscape can lead to more opportunities for investment outperformance. For example, consider companies that produce AUD$100 million in revenue or greater - there are hundreds of thousands of private companies around the globe that fit this category. Taking the same statistic and applying it to the number of public companies which fit this profile, the results are closer to the several thousand range.

But why is the public market universe smaller? For one thing, not all companies want to list. The process takes up a huge amount of resources to keep up with public listing requirements and regulations, and especially today, there are many alternative sources of funding for a company that don’t involve accessing listed share markets.

Playing the short term against the long term

For most listed investments, expected returns are usually generated across a one to three-year timeframe, so most portfolio management investment decisions are based on this shorter investment outlook. For example, investment managers often revisit decisions across shorter-term quarterly earnings announcements, and this can have an impact on their longer-term strategy and management approach.

On the other hand, looking at the buyout world for example, which is the largest sector in private markets, there’s a much longer-term viewpoint to investing and managing those private companies. By having 10 to 12 years to work with, investment decisions can be more strategic and less reactive to external influences such as intermittent market volatility. There is enough historical evidence to suggest that active investment decision making over a wider time horizon with a focus on long-term value creation can be vastly beneficial investment-wise, leading to stronger returns and less risk than a short-term investment mindset.

Degree of investor control

Company control and influence are also key points of difference in private versus public companies, and these can impact performance. For listed companies, much of the control and influence comes down to the CEO and other top management. In private markets the General Partner management team, together with the company’s management, are the key decision makers.

As an investor in a public company, shifting employee incentives, creating greater alignment or changing ESG goals or criteria can be a slower, more difficult process. But within the private markets, there is an opportunity for key investors to have a much more impactful strategic input around these critical matters alongside management, with a focus on making the best decisions for the long term.

A range of investment techniques and structures

Within the private market investment landscape, there are a range of sub-asset classes that may be leveraged within a portfolio. For example, a well-rounded portfolio will have an allocation not only to buyout investments but also to private real assets, private credit and secondaries, which have their own risk and return profiles, and can be structured innovatively to increase the potential of maximising returns. Within private credit, for example, prioritising more senior portions of the transaction structure can help enhance downside protection.

Another strategy is in relation to top-tier venture, growth equity companies and secondary investments where the ability to leverage long-standing relationships allows investors to gain access to more attractive opportunities at ideal stages through efficient structures. For example, working with buyers and sellers in a now sophisticated secondary market provides opportunities for liquidity which in turn provides flexibility and the potential for enhanced performance. On the buy side, it allows access to concentrated amounts of investor capital, performance and cashflows. The secondary market is often viewed as a lower risk category – given an orientation towards an existing pool of seasoned assets – which can complement the rest of the private markets portfolio.

Typical investor portfolios tend to stick to a more standard 60/40 listed debt and equity. However, this conventional model may not be ideal from a long-term performance perspective, with expected diminished returns from traditional portfolios over the next decade. This is in part due to equity valuations being at or near historical highs, which could potentially limit stocks’ return potential going forward. Additionally, low yields offer a poor starting point for future bond returns.

Managing performance volatility

While it's important to understand and frequently track what's happening in public market movements during volatile investment conditions, this is where the long-term, active-management nature of the private markets offers a distinct advantage. It’s highly unlikely that investors would be forced to sell at any given point in time or realistically even consider selling their private markets exposure to generate liquidity. This means the risk of selling too early in a falling market or needing to buy back too late in a rising market, a significant contributor to underperformance in listed markets, is much less of a likelihood in the private markets sector. At the same time, the ability to control outcomes of those private companies through active, controlled oriented management can create different value creation levers over the longer term.

In summary

While the differences between private and public markets are numerous, a deep dive into factors such as performance size, inefficiencies and investment horizons can help explain the unique investment qualities associated with private markets and demonstrate why they are becoming a critical part of an investor’s diversified portfolio.

Drew Schardt, global co-head of investments, Hamilton Lane

Neil Griffiths

Neil is the Deputy Editor of the wealth titles, including ifa and InvestorDaily.

Neil is also the host of the ifa show podcast.