Global microcaps are considered companies with market caps of up to US$1 billion.

To provide context for the Australian investor, think Kogan, Nearmap, Domain Holdings and Blackmores. These stocks are in the ASX200 and domestically are commonly classified as small-caps, not microcaps.

As an asset class, global microcaps offer some very attractive characteristics.

A perfect match with large cap exposures

According to the Credit Suisse, microcaps are the best performing segment of the equity market over the long run. Further, given the large universe of overlooked stocks, the potential for outperformance by an active manager is far greater than in larger stocks.

However, this enhanced return is often perceived to come with greater risk. The volatility of returns for the World Microcap Index, in isolation, is indeed slightly higher than the Large Cap Index. However, in a portfolio context, world microcaps have relatively low correlation to other assets.

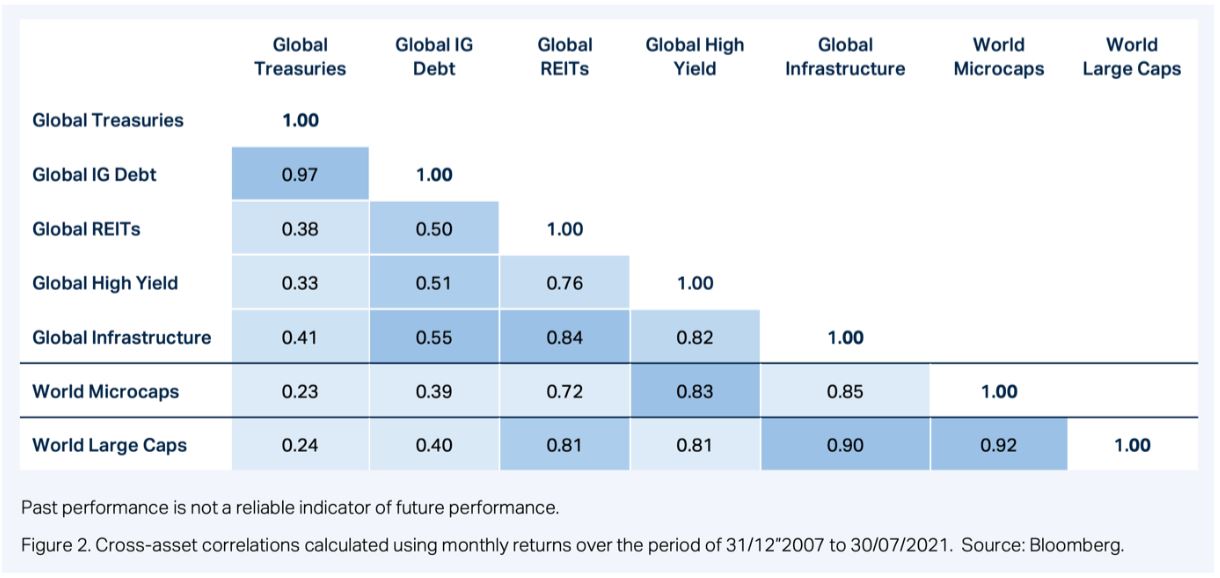

The table below shows the correlation between various asset classes. Firstly, it is worth noting that the correlation between world Microcaps and world large caps is well less than one, at 0.92. The table also shows that the World Microcaps Index has a lower correlation to other asset classes than large caps. The only exception is global high yield.

These low correlations show that adding global microcaps can function to reduce a portfolio's systematic risk. Focusing on equities specifically, global microcaps can help lessen an equity portfolio's volatility and yet enhance returns.

Furthermore, global microcaps have their own distinct cycle that oscillates around larger stocks, fluctuating with the pace of economic growth. This cycle disparity enhances their diversification benefits when paired with large caps and other asset classes.

Global microcaps help you avoid the crowd

The US market has led global indices higher since the GFC. The MSCI World Index is now dominated by the country, accounting for 67.7 per cent.

The MSCI World Small-Cap Index is only slightly more diversified, with the US constituting 58.8 per cent. Magnifying this lack of diversity is the increased concentration of the US market, which is as extreme as it’s ever been in most investors' careers.

For those worried about this concentration risk, global microcaps offer a compelling alternative. The World Microcap Index has only a 25.6 per cent weighting to the US market. Spheria's actively managed global microcap fund, has an even lower weighting of only 20.3 per cent as we have identified better opportunities elsewhere.

Less reliance on the US market makes way for meaningful allocations to highly innovative countries such as the UK, Germany, Japan, Sweden, Norway, Finland, Switzerland and Israel.

Furthermore, the US outperformance of other global markets (fuelled by the rise of passive funds) has stretched the earnings multiples for US large caps and investors are paying a significant amount to the rest of the world and smaller peers.

High quality microcap companies can provide significant discounts on valuation multiples, without a trade-off in quality. This is because the global microcap universe is so vast and the companies so poorly covered, astute investors does not need to compromise when selecting microcap exposures.

Recovery, without the downside

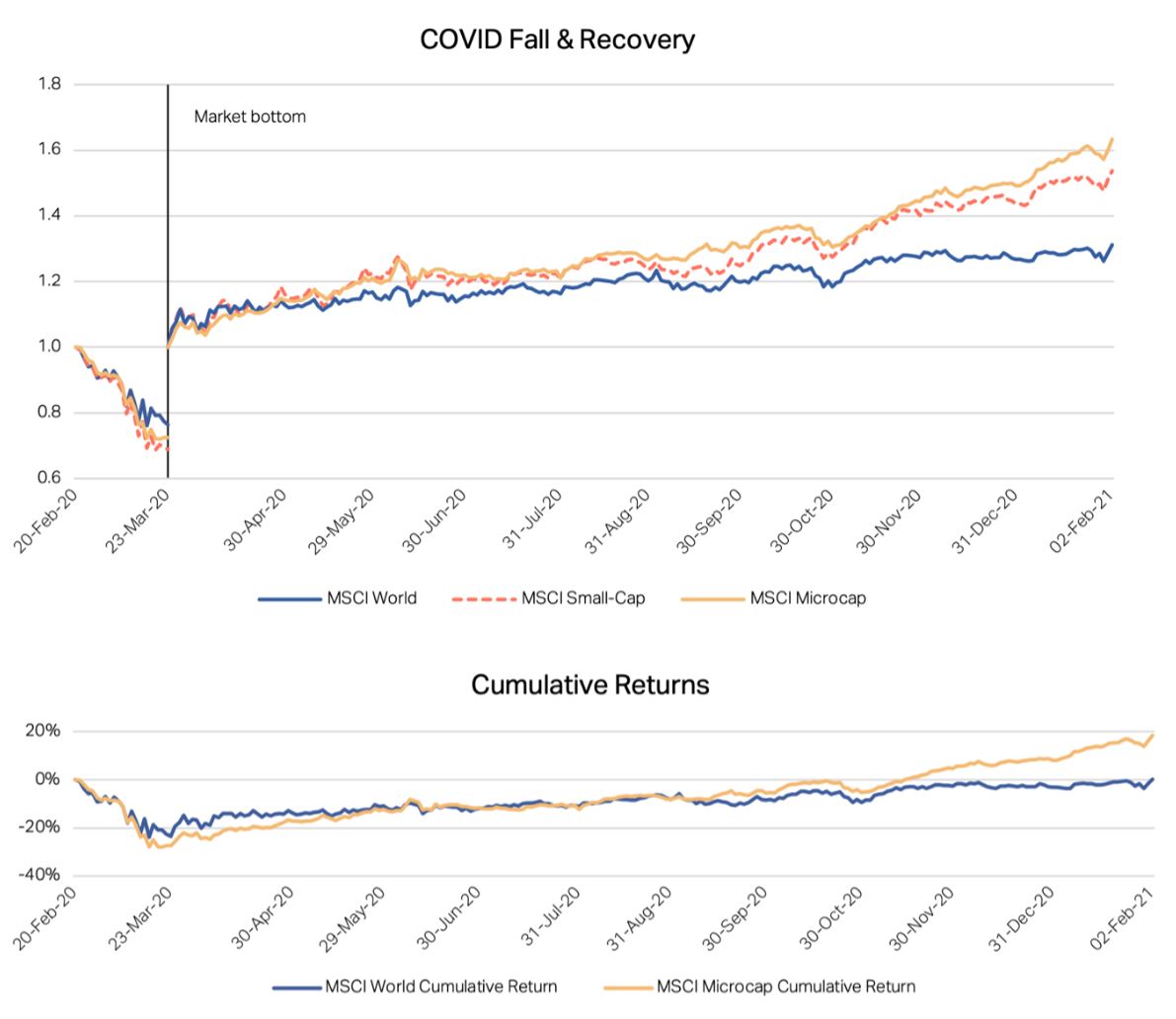

Global microcaps offer investors an unparalleled opportunity to invest in an economic or market recovery.

It’s an asset class that has led markets out of the dotcom crash, the GFC and COVID. But, what's most remarkable, is that throughout these crises, the World Microcap Index underperformed only marginally on the way down.

The asymmetry global microcaps experience around large market events provides investors a powerful asset allocation enhancement.

By adding global microcaps to an equity portfolio, returns can be enhanced by simply “riding it out”. This helps alleviate some of the burden investors may face in trying to time allocations to equities during such volatility.

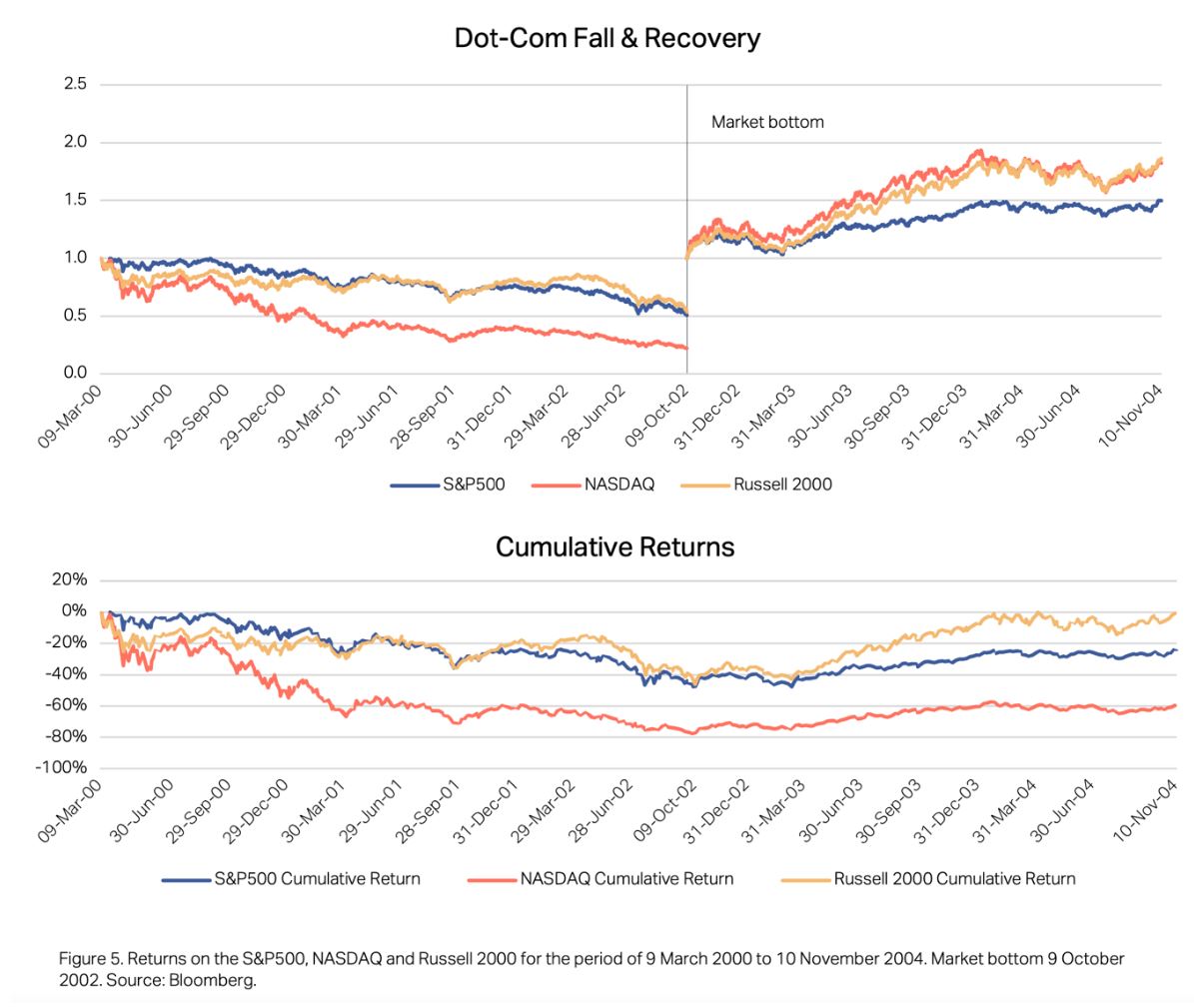

Consider the dotcom bust in the early 2000s.

The World Microcap Index began in November 2007, but we can use the Russell 2000 in the US as a proxy for smaller companies. The chart below demonstrates that the Russell 2000 fell by less than the leading S&P 500 during the dotcom bust, and considerably less than the NASDAQ (-78 per cent).

Despite this outperformance on the way down, the Russell 2000 also led the rebound. The Russell 2000 had recouped any losses by November 2004. However, the S&P500 remained 23.9 per cent under water and the Nasdaq 59.7 per cent in the red.

The dotcom experience shows that microcaps are particularly appealing during a period of heightened market valuations since they typically trade at a discount to larger stocks. However, the drawback of microcaps can be a heightened sensitivity to economic shocks.

The GFC, and more recently, COVID-19 demonstrate similar microcap outperformance.

Uncovering the world’s best microcaps

The large global microcap universe provides significant opportunity for those who specialise in identifying robust microcap businesses.

When investing in global microcaps, we focus on capital preservation, with valuation discipline being a critical component in protecting capital. We believe a discounted cash flow framework is required when assessing microcaps, and investors are best served favouring growing and innovative businesses with strong cash flow conversion.

It is this investment discipline that could help bolster your investment portfolio, or even uncover the next big microcap success story.

Remember, many of today’s most successful listed companies were once microcaps.

Gino Rossi, portfolio manager, Spheria Asset Management

Neil Griffiths

Neil is the Deputy Editor of the wealth titles, including ifa and InvestorDaily.

Neil is also the host of the ifa show podcast.