Equity income investing has become popular in recent years as investors sought alternatives to low-yielding core fixed income assets. Although developed market bonds are currently yielding much more than the historic lows they reached last year, the levels are still not meeting most investors’ income needs, making equity income a staple in many portfolios.

Some investors have chased after companies and sectors that have had historically large dividend payouts in the hopes of boosting total returns. But size may not matter — investors have been stung by high dividend propositions that entice with the headline yield alone but often disappoint when companies reduce or even fail to pay a dividend. This strategy may also expose investors to higher volatility as it is prone to large drawdowns if the offending stock/sector is a large component of the market capitalisation-weighted index or fund.

Whilst diversifying with global equities can help, care must also be taken to ensure that this truly adds value and is not simply delivering the same returns as the Australian market-cap weighted benchmark.

In what could be a volatile, low-growth market this year, we believe that a better way to invest for yield in equities may be to seek alternative global strategies and build a portfolio that balances between high dividend yield, and dividend sustainability and growth.

Sustainability – Why Does it Matter?

A focus on companies that have consistently raised or maintained their dividends for many years, rather than focusing on yield alone, may provide a cushion in volatile markets. Companies that have consistently raised or maintained dividends for many years tend to have strong balance sheets and businesses. Conversely, high dividend payers with more financial leverage and lower earnings growth may be more likely to cut their dividends.

Screening for dividend sustainability and growth, therefore, requires a highly disciplined stock selection process.

The Global Dividend Elite

As mentioned earlier, we believe that investors may find better equity income opportunities by taking a global approach. An easy way to go global is by investing in an exchange traded fund (ETF) that tracks a global market-cap index, say the MSCI World ex-Australia Index or the S&P Developed Ex-Australia LargeMidCap (AUD). However, over the past year, we have seen high correlation of returns between broad global market cap indices and the Australian broad market cap index, suggesting that diversification benefits from such a complementary pairing may not always be as effective. Investors with an existing domestic equity portfolio may seek an alternative global index strategy to achieve different returns and more effective diversification.

The S&P Global Dividend Aristocrats Index, for example, is dividend-weighted and designed to provide exposures to the highest-yielding stocks that have grown or maintained dividends for at least 10 consecutive years. This is a high bar for companies to clear. Out of 11,000 stocks in the S&P Broad Market Index (BMI), only the top 100 stocks based on dividend-yield weights are included in the S&P Global Dividend Aristocrats Index. Together with other criteria, such as a maximum 100% pay-out ratio, which helps to understand the sustainability of dividends in future years (in other words, no company with negative earnings per share), the index’s rules have the effect of lowering portfolio volatility and reducing average drawdown.

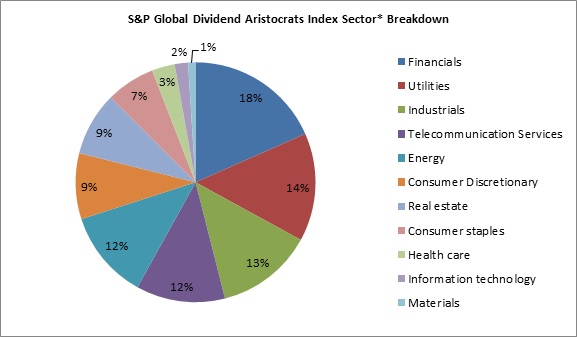

The index criteria also ensure that diversification cuts across sector and country allocations by capping country and sector weights. Domestic high yield equity portfolios tend to have a high Financials sector concentration. In contrast, the chart below shows that no sector in the index has greater than 20% weight. No single stock exceeds 3% weight, whilst sector and country weights are capped at 25% and no more than 20 stocks may be held from any one country. In contrast, in a typical global market-cap weighted index, the US accounts for around 60% of the total index weight.

Investors may find the top 10 constituents stocks of the S&P Global Dividend Aristocrats Index to be relative unknowns (the index holds only four Australian-listed stocks and they are not in the top 10), but the process ensures that the resulting portfolio includes only the stocks that have followed a managed-dividends policy of increasing or stable dividends for at least 10 consecutive years.

Source: S&P Dow Jones Indices, as of 31 January 2017 *based on GICS sectors

The weightings for each sector of the index are rounded to the nearest tenth of a percent; therefore aggregate weights for the index may not equal 100%.

Liquidity is also an important consideration when choosing equity income strategies. A large market capitalisation and average daily volume are important so that large fund inflows or outflows do not impact the value of the underlying investment holdings. Constituents need to have a minimum market capitalisation of USD1 billion and a three-month average daily volume of at least USD5 million.

The dividend growth and lower long-term volatility characteristics of such a strategy may command a premium in an uncertain market, while the relatively high weights within Utilities, Financials and Industrials could also benefit performance in a reflationary environment. ETFs such as the SPDR S&P Global Dividend Fund, which tracks the S&P Global Dividend Aristocrats Index, offer investors an easy and cost-efficient way to access this opportunity.

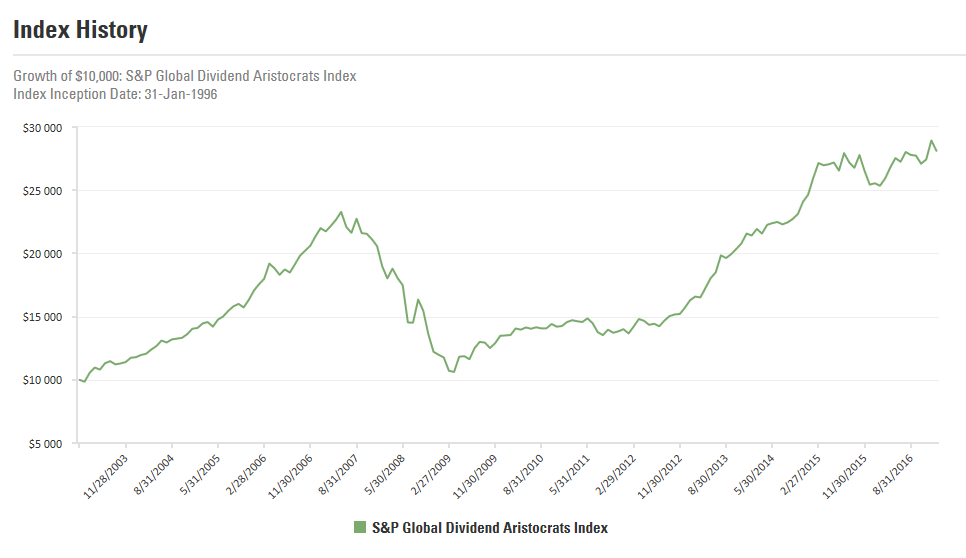

Below shows how $10,000 invested in a portfolio that tracks the index would have grown over the last 13 years.

Source: SSGA, 31 January 2017

Performance quoted represents past performance, which is no guarantee of future results.

Index returns reflect capital gains and losses, income, and the reinvestment of dividends.

Reaping the Benefits

Equity dividends have long been an important part of investors’ toolkits. In what may be a persistently volatile and low-growth market, investors should consider a more balanced approached to equity income investing to harvest both growth and volatility protection benefits.

For meaningful diversification, investors should look for global equity strategies that deliver returns that are uncorrelated to their existing Australian equity portfolio.

With more sophisticated ETF strategies able to screen for both attractive and sustainable yield characteristics across global equities, investors now have access to highly diversified portfolios that better fit their risk and return objectives.

Learn more about SPDR S&P Global Dividend Fund (WDIV).

Issued by State Street Global Advisors, Australia Services Limited (AFSL Number 274900, ABN 16 108 671 441) ("SSGA, ASL") www.ssga.com. This material is of a general nature only and does not constitute personal advice. It does not constitute investment advice and it should not be relied on as such. It does not take into account any investor's objectives, financial situation or needs and you should consider whether it is appropriate for you. You should consult your tax and financial adviser.©2017 State Street Corporation —All Rights Reserved. AUSMKT -3377 | Expiry date: 30 April 2017.