Research conducted by asset consultant Frontier Advisors has found that investors benefit when fund managers have more women in their investment teams.

The report, written by Frontier senior consultant Natasha Kronouer, analysed the results of a questionnaire sent to 100 Australian and global equity managers.

Frontier received 44 responses from international equity managers and 40 responses from Australian equity managers.

Only 21.7 per cent of global equity teams were made up of women, while for Australian equity managers the figure was even lower at 14.2 per cent. Of those surveyed, 57.5 per cent of managers had no women on their investment team at all.

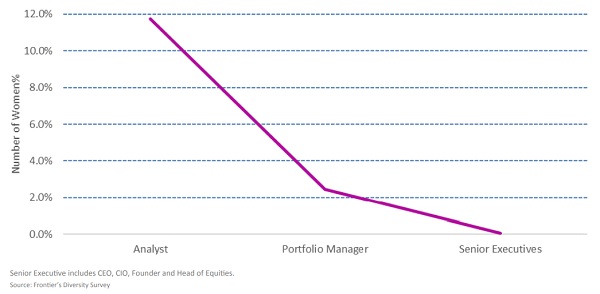

Women tend to occupy less senior investment team roles, with none of the equity firms surveyed having a woman at the head of equity, CIO or founder level (see chart below).

The percentage of women in different investment roles at our surveyed equity managers (Australia and global managers)

Despite the low representation of women in funds management investment teams, the data was encouraging when it came to the relationship between gender diversity and performance.

While acknowledging the shortcomings of the survey’s low sample size, Frontier compared five-year return data alongside the gender diversity data from the surveyed equity managers.

“The risk-adjusted returns (as measured by the Sharpe Ratio and the Information Ratio) of the equity managers surveyed improves as the gender diversity of the investment teams increases,” said the report.

“Our analysis of surveyed managers has shown that investment teams with greater gender diversity have delivered superior risk adjusted returns for their investors,” said Frontier.

“These results are encouraging and we hope they will inspire organisations to think more about the value of gender diversity and its importance in the investment workplace.

“We will use our data and results to form a basis for continued benchmarking of organisations on their progress to improve gender diversity of their investment teams.”