The corporate regulator has conducted a review of 57 retail derivatives issuers offering margin foreign exchange (FX), contracts for difference (CFDs) and binary options.

ASIC has previously labelled the retail OTC derivatives market as ‘non-compliant’ and has taken action against providers of binary options, which tend to be the riskiest and least transparent products in the sector.

One of the regulator’s main concerns is that actual client profits are inconsistent with the marketing materials produced by product providers.

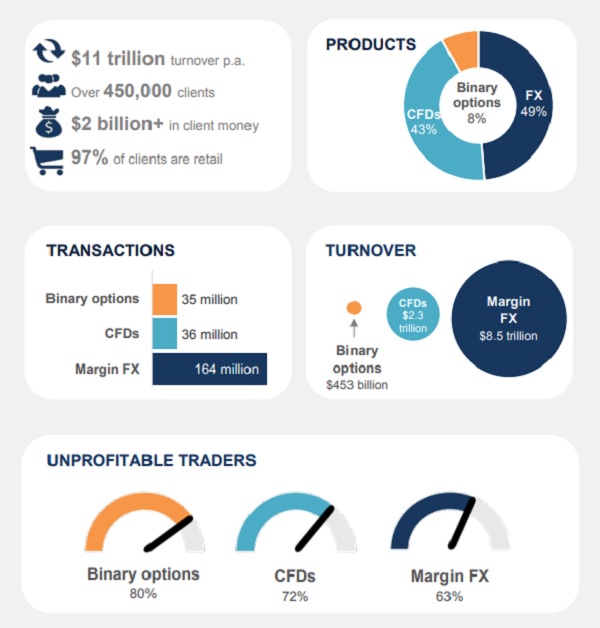

The review found that 80 per cent of binary options traders are ‘unprofitable’ (ie, they are long-term losers). Seventy-two per cent of CFD traders and 63 per cent of margin FX traders are unprofitable, said ASIC.

Other concerns include a lack of transparency when it comes to pricing as well risk management practices that rely on the use of client money – a practice that was banned by the government in November 2016, following the collapse of stockbroking firm BBY in May 2015.

ASIC also said some referral arrangements could be in breach of conflicted remuneration requirements, and white labelling practices are also under scrutiny.

Source: ASIC

The regulator called on issuers to review and update their risk management and client money practices, and to assess whether their arrangements with counterparties and referrers are meeting their AFSL obligations.

ASIC commissioner Cathie Armour said: “The retail OTC derivatives sector in Australia is an active and growing market, with an annual turnover of $11 trillion and over 450,000 investors.”

“The integrity of the retail OTC derivatives sector is a key focus for ASIC. ASIC expects licensed issuers to conduct themselves appropriately and ensure consumers trade in retail OTC derivatives with a clear understanding of the products and the risks to which they’re exposed,” Ms Armour said.

“We will be working with issuers to raise industry standards and improve compliance with their Australia[n] financial services licence obligations,” she said.