The domestic exchange-traded funds (ETF) industry has “expand[ed] rapidly”, according to the latest Exchange Traded Funds Sector Review by Zenith Investment Partners, with ASX-listed ETFs enjoying 23 per cent growth in the year up to 31 August 2017.

During this time, new entrants to the market and growing sophistication of products have driven growth in the industry and raised the level of competition, resulting in lowered fees.

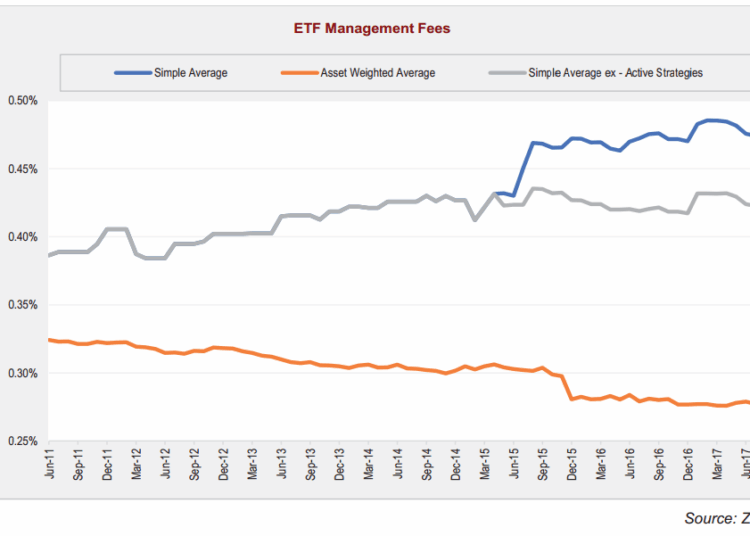

“As evidenced in global ETF markets, the combination of increasing competition and increased investor demand for lower cost products is putting downward pressure on manager fees,” the report said.

“When viewed on an asset weighted basis, ETF fees have declined 14.3 per cent, from 0.32 per cent p.a. to 0.28 per cent p.a.”

Commenting on the results, review author and Zenith senior investment analyst Dugald Higgins said, “We are at an inflection point in the ETF cycle where an array of the more complex and innovative strategies which have come to market are yet to be taken up on a significant scale.

“It will be interesting to see to the extent to which the investing public embrace more complex strategies.”

Though fees are expected to continue to fall, the report said, some products are reaching their limits of fee compression.

Mr Higgins also signalled in the report that while choosing ETFs with the lowest fees was “logical”, there are indications other than fees that needed to be brought into consideration when selecting a product.

“This is especially true if fee differentials are a matter of a few basis points,” Mr Higgins wrote.

“Zenith believes factors such as index selection and methodology, scale, sector and regional weights, tracking error, tracking difference, trading spreads and dividend structures all need to be considered.”

While growth in the industry overall had been “strong”, the ETF market “remains dominated by comparatively few products”, with the top 25 ETFs constituting 70 per cent of the entire industry by market capitalisation, the report said.

“This means that there is a significant industry ‘tail’ of another 138 products whose size as a proportion of the market is relatively minimal at present,” it said.