But there’s more than the size of the private credit markets that has captured investors’ attention.

There is also an increase in the number of private credit strategies. There are strategies that offer potentially higher yields versus traditional credit vehicles, downside protection, attractive covenant protections (i.e. senior credit) and more.

With the growing interest in private credit, many investors are asking, “What can private credit do for my portfolio?” To answer this question, we’ve outlined the key characteristics that make senior private credit unique relative to other private credit strategies, along with the importance of market data when building portfolios.

Senior credit and private credit: What’s the difference?

Broadly speaking, private credit, including senior private credit, can be either loans, bonds or other credit instruments that are privately issued by companies or through private offerings. They are referred to as “private” because they are not listed on security exchanges nor available through public markets. Instead, private credit assets are held in a fund.

In instances where private credit is tied to a corporate asset, repayment is derived from cash flows that are generated by an actual operating company in the form of principal payment and distribution yield. Meanwhile, if the private credit exposure comes from a different type of company asset, repayment is typically derived from a physical asset or a complex, esoteric asset such as securitised debt or mortgage-backed securities.

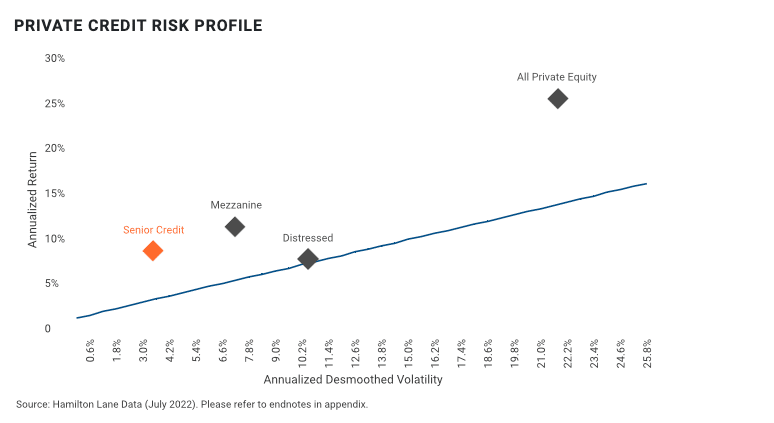

When thinking about incorporating private credit, or specifically senior private credit, as part of an overall investment strategy, you should know that they can offer opportunities across the risk/return spectrum, including capital preservation or return maximisation.

Capital preservation strategies, such as traditional sponsor-focused mezzanine and senior debt funds, aim to provide predictable returns while protecting against losses. Return-maximising strategies, on the other hand, include distressed corporate credit funds and funds that focus on capital appreciation and may offer the potential to generate equity-like returns, albeit at greater levels of risk.

So, what makes senior private credit different? These loans tend to be the senior-most debt in a private company’s capital structure. This affords senior private credit investors a first- or second-lien claim on those assets that were used as collateral. Senior private credit can also include unitranche loans, which package both senior and subordinated debt into one hybrid debt instrument.

The opportunity today

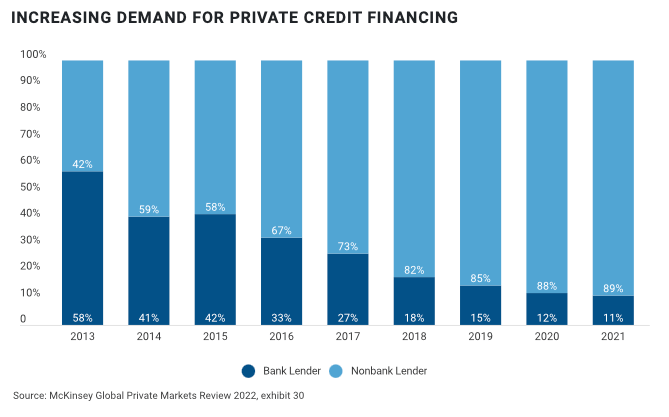

One of the most significant drivers of growth in the private credit markets is the change taking place across the banking industry. With changes in regulations and an increasing number of banks deleveraging, the net result is that the major banks are retreating from the credit space. This has created an opportunity for private debt to step in to fill that void.

When people talk about the private credit market opportunity, you often hear that there are no more opportunities or there’s too much money flowing into private markets. Those statements are generally driven by anecdote versus actual data. We have the data. And we’re more convinced than ever that there’s still room to grow. For example, if you look at growth in private markets year over year, the numbers are compelling. But on a macro basis, private credit continues to represent a very small segment of the overall credit market.

Data is key to understanding the role private credit can play as part of a broader investment strategy. For example, investors who are interested in private markets often focus on how private credit has historically been resilient in the face of market volatility and has consistently performed through both up and down markets. But historical performance is only one part of the overall story.

While the idea of choice for investors is good, investors inevitably need the data to make great decisions. We’re able to see how private credit has performed both on an absolute basis and on a risk-adjusted basis.

Private market investors today have better access to due diligence information and can structure and negotiate deals, while actively managing their investments.

Nayef Perry, managing director and co-head of direct credit, Hamilton Lane