Over a quarter of all SMEs plan to use a non-bank lender to fund new business investment. While banks are still the largest lenders to SMEs, the share of lending to SMEs provided by non-bank lenders has increased dramatically and will continue to do so. Why is this the case?

SME requirements for security over residential property

For many years, small businesses have reported difficulties in accessing finance on terms that suit their needs. Small businesses tend to face several difficulties accessing finance associated with their smaller scale, less diversified nature and lack of collateral. They are therefore often required to provide collateral such as personal guarantees secured by residential property to receive finance from banks.

There are several reasons why an SME may find the provision of property as security to be challenging, including:

-

a young entrepreneur may not own a home, or hold much equity in it, even if they do

-

a business owner with an existing household mortgage may not have enough equity headroom to support a business loan

-

general reluctance among business owners to borrow against their family home, and

-

using a residential home as business security concentrates the risk the business owner faces.

Non-bank lenders are addressing this issue by providing financing solutions to SMEs that do not require security over directors’ residential property. This is an example how, in many cases, non-banks are now able to offer SME clients a better risk/reward package than the incumbent banks.

In part, this is because banks need to operate at scale and provide a customised product whereas non-bank lenders, enormously enabled by new financial technology and with a less onerous cost base, can provide a more bespoke offering with customised pricing to SMEs. In many cases, capital and regulatory requirements have resulted in bank pullback from certain sectors of the SME market.

This is obviously compelling for borrowers but does raise the question as to whether non-bank lenders may be taking on excessive levels of risk in their pursuit of a new market. Private credit funds as funders to non-bank lenders need to address this risk by considering whether the appropriate underwriting guidelines are in place and are being followed.

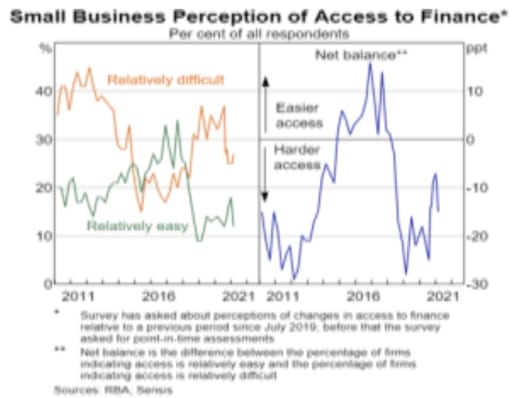

The RBA chart below shows a recent improvement in small business perceptions of access to finance (albeit slightly COVID-interrupted). In our view, this reflects the impact non-bank lenders are having on SME lending.

Non-banks are more competitive with incumbent banks in SME lending

The democratisation of financial technology via cloud-based systems provides an almost level playing field from a technology perspective. This means that a new non-bank can easily and cheaply use Xero to seamlessly have sight of activity on its borrowers’ receivables while scrutinising their bank accounts with bankstatements.com.au. Borrower due diligence is also facilitated by information now being much more freely available to lenders as a result of the open banking initiatives.

Secondly, non-banks have been able to access cost-effective term funding from the private credit market. They have done this by utilising securitisation structures which accommodate funding tranches of different seniority and pricing depending on the risk appetite of the private credit funder.

Private credit funds in turn have relished the deployment opportunity that well-structured, diversified pools of receivables provide. Institutional and private investors have also increased portfolio allocations to private credit in pursuit of the attractive yield that the asset class offers when compared to the minimal returns from traditional fixed income in the low interest rate environment that has been experienced for a while now.

This investor demand has provided funding capacity for private credit funds seeking appropriate opportunities with non-bank lenders. The result is a virtuous circle between private credit funders and non-bank lenders and a private credit market that has now come of age with an estimated corporate private credit market of $109 billion.

More non-bank lenders are funding insured receivables of SMEs

There are many non-bank lenders to SMEs. Some provide general purpose facilities (e.g. lenders such as Shift) while others focus on specific asset classes – for example, real estate (e.g. Think Tank), equipment (e.g. FlexiCommercial) or trade receivables (e.g. Scotpac).

There are also the new neobanks, some of which are focusing on servicing SMEs (e.g. Judo and Avenue). These non-bank lenders are competing with the banks with lending products more attractive to the borrowers.

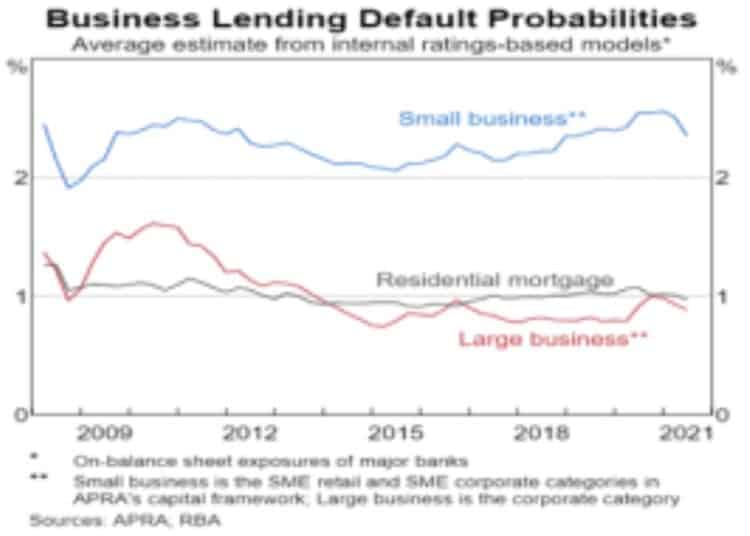

The higher default probabilities one can expect from SME lending compared to other forms of lending (see below) also indicate that caution and careful selection of the right non-bank lender with the appropriate risk and business model is essential for private credit investors. In this regard, SME lenders obtaining credit insurance for the receivables their funding is secured by can be particularly attractive.

Conclusion

Due to the increase in non-bank lending to SMEs, there is a significant opportunity for private credit investors in funding opportunities with non-bank lenders where:

-

there is a structural reason why the underlying borrower pool will perform well (i.e. have a low default rate), and

-

the management team has an extensive track record.

As a result, investments in SME funding by non-bank lenders, particularly those obtaining credit insurance on the underlying receivables, can create attractive stable income returns for clients.

Rob Hamer, portfolio manager, Wentworth Williamson