To solve this conundrum, we seek to unearth investment solutions offering higher yields and diversification for Australian investors within the defensive part of their portfolios, and what we view as the more senior, high-quality segments of the corporate debt and alternative credit markets; we call it the “sweet spot” of credit. This encompasses a $5.7 trillion opportunity set across US and European loans, corporate bonds and alternative credit markets.

Importantly, we believe a dynamic, flexible approach to investing in the “sweet spot” of credit offers:

1. Strong diversification benefits due to varying risk return profiles and low correlation to traditional fixed income and equities

2. Opportunity to generate alpha while mitigating risk by shifting targeted exposures through active portfolio management as value shifts between markets can generate attractive entry points into each asset class

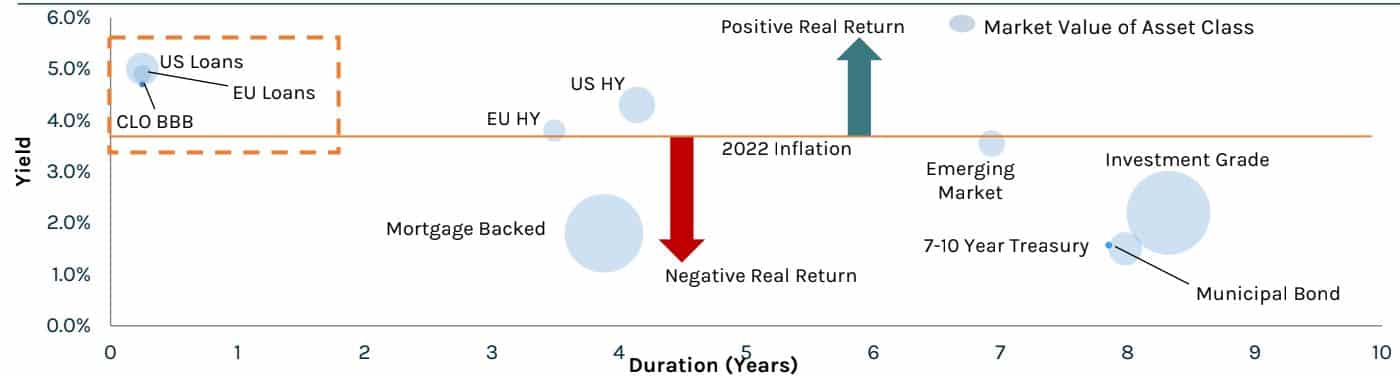

To illustrate the challenges that traditional fixed income investors are facing today, as well as the relative value of opportunities available in the corporate debt and alternative credit markets, Chart 1 plots the current yield against interest rate duration for various fixed income asset classes. The size of the bubbles represents the market value of each asset class.

CHART 1: Bank Loan Opportunity: Attractive Yield Amid Rising Duration Risk

With the outlook of a low default and higher rate environment ahead, we believe certain higher beta, floating rate instruments, specifically bank loans and CLO debt securities, screen attractively from a relative value perspective as these provide high levels of current income and low duration of less than one year. In a rising rate environment, the coupon of floating rate assets adjusts to shifts in short-term interest rates, and as a result, these assets exhibit lower price volatility relative to fixed rated securities.

Looking forward, while we anticipate increased price volatility and dispersion in the credit markets as interest rates and inflation remain at the forefront of policy decision making, we view bank loans and CLO debt securities as attractive allocations within fixed income as we expect retail and institutional demand to remain robust. Additionally, we believe valuations will be supported by strong fundamentals and improving credit metrics, low default expectations and robust capital markets.

Across our multi-asset credit portfolios, including the Ares Global Credit Income Fund (AGCIF), we seek to find the most attractive relative value opportunities in the “sweet spot” of credit in order to deliver higher yields with optimal downside protection and lower volatility. Specific to AGCIF, performance has benefited from tactical asset allocation and credit selection, as illustrated by its annualised since inception net return of 9.2 per cent. In addition to weathering varied market environments, we believe AGCIF is particularly well suited to serve a growing appetite for stable incoming-producing strategies among Australian investors as it targets a per annum distribution of 3-4 per cent. Further, the current ex-ante volatility of AGCIF averages approximately 0.5×2 the volatility of the broader bank loan and high yield bond universe, illustrating our keen focus on downside protection and volatility management.

Active allocation has proven paramount in successfully navigating the volatile market environment during 2020 and remains critical to unlocking value, particularly as market conditions evolve heading into the end of 2021 and early 2022. Informed by quantitative analysis and fundamental research, our demonstrated ability to express relative value across the credit markets continues to drive strong and stable monthly performance year-to-date, as illustrated in Chart 2.

CHART 2: Ares Global Credit Income Fund 2021 Monthly Performance

In summary, as investors seek attractive income solutions in today’s market environment, many may struggle to determine how best to position their credit exposure in order to maximise yield and mitigate risk. By accessing the “sweet spot” of credit, comprised of corporate debt and alternative credit asset classes, we believe investors can overcome these challenges. At Ares, our differentiated approach to capitalising on the best risk-adjusted return opportunities across the investable universe is rooted in the scale and integration of our Global Liquid and Alternative Credit strategies, which allows us to fully leverage extensive research capabilities, proprietary technologies and longstanding relationships.

Teiki Benveniste, head of Ares Australia Management.