However, the very definition of “infrastructure investments” is shifting. Historically, listed infrastructure companies were heavily regulated utility companies that enjoyed a monopoly in their market. But over time, investors have expanded the definition of what constitutes infrastructure to more and more exotic businesses most of which have been unregulated and thus have offered the potential for higher returns. The downside of this expansion of the definition is that these companies also typically have a more volatile business model and consequently are riskier investments.

The distinction between “core” infrastructure in the strictest sense and infrastructure in a wider sense is accordingly a very important one.

In order to qualify as a core infrastructure investment, a company should meet the following criteria:

- It must have consistent and predictable cash flows, often arising from long-term contracts and regulated revenue stream.

- Cash flows should be inflation-linked, either through regulation, contractual arrangements or pricing power within the area of its operations.

- It should have high operating margins and low operating leverage in order to not be too dependent on economic and market conditions.

- It should occupy a natural monopoly, either through regulatory guarantees within a region or country or through a dominant market position.

As a result, the company’s earnings should be non-cyclical and have low correlation with overall economic activity.

In contrast with this, companies that are typically included in common infrastructure indices and the wider definition of listed infrastructure include:

- Power producers and power retailers that are operating in unregulated markets and thus are subject to substantial price volatility.

- Contracting and concession businesses that are reliant on debt financing and subject to shorter contract maturities, exposing them to higher share price volatility.

- Logistics and shipping companies, which we consider to be industrials rather than infrastructure and that are often operating with low margins in a cyclical environment.

- Bus and railway companies that don’t own the tracks but only the rolling stock. The contract lengths for these operators are typically shorter in nature exposing them to more volatile cash flows.

- Companies operating in emerging markets where operational, regulatory and ESG risks are higher.

- Data centre operators and telecommunications service providers which don’t have a real monopoly position and are subject to market competition.

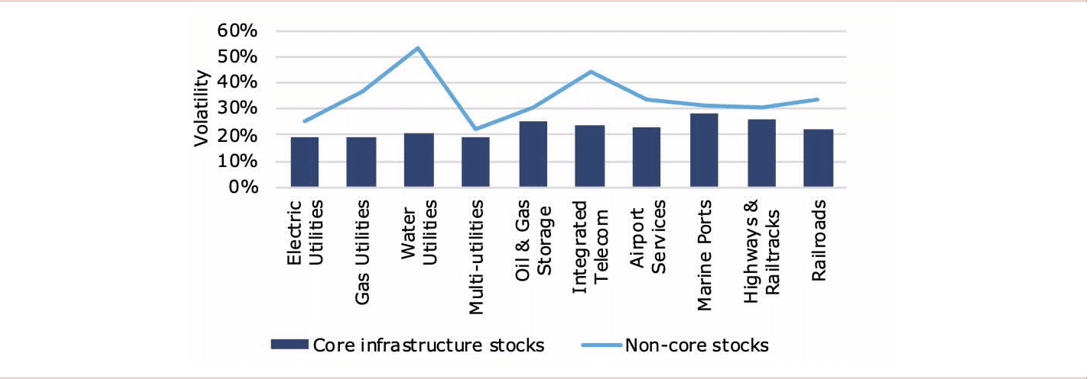

Figure 1: Average stock volatility of core and non-core infrastructure stocks

Source: Bloomberg, Whitehelm Capital. Data as at 31 July 2019. Past performance is not a reliable indicator of future results.

The benefit of a strict selection of core infrastructure companies can be seen in Figure 1. For every industry within the broader infrastructure universe, the companies classified above as non-core infrastructure have higher stock price volatility than the core infrastructure companies. This shows, that a strict definition of core infrastructure can be effective means of reducing investment risks.

Does lower volatility result in lower returns?

With all that talk about the reduced volatility of core infrastructure stocks one might wonder if we are not putting too much emphasis on the “risk” side of the coin while ignoring the “return” side. For traditional finance theory predicts that in order to achieve higher returns an investor must accept higher systematic risks. Accordingly, in this case according to theory, the higher beta of non-core infrastructure companies should be compensated by higher returns in the long run. Interestingly, however, over the last couple of decades it has become clear that there are systematic deviations from the predictions of traditional finance.

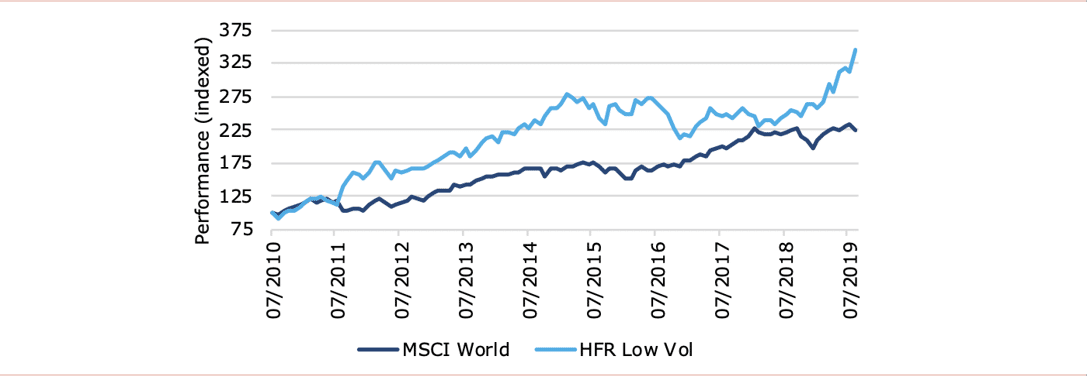

One such systematic risk factor that is compensated with excess returns is the low beta or low volatility factor. Historically, stocks with lower volatility or lower market beta have outperformed stocks with higher volatility. Since 2010, Hedge Fund Research has calculated the performance of a systematic approach to invest in low volatility stocks. Figure 2 shows the performance of this approach relative to the MSCI World. Since inception, the performance of the low volatility stocks was 4.5 per cent per year higher than the performance of the MSCI World.

Figure 2: Low volatility stocks vs. MSCI World

Source: Bloomberg, Hedge Fund Research, Whitehelm Capital. Data as at 31 August 2019. Past performance is not a reliable indicator of future results.

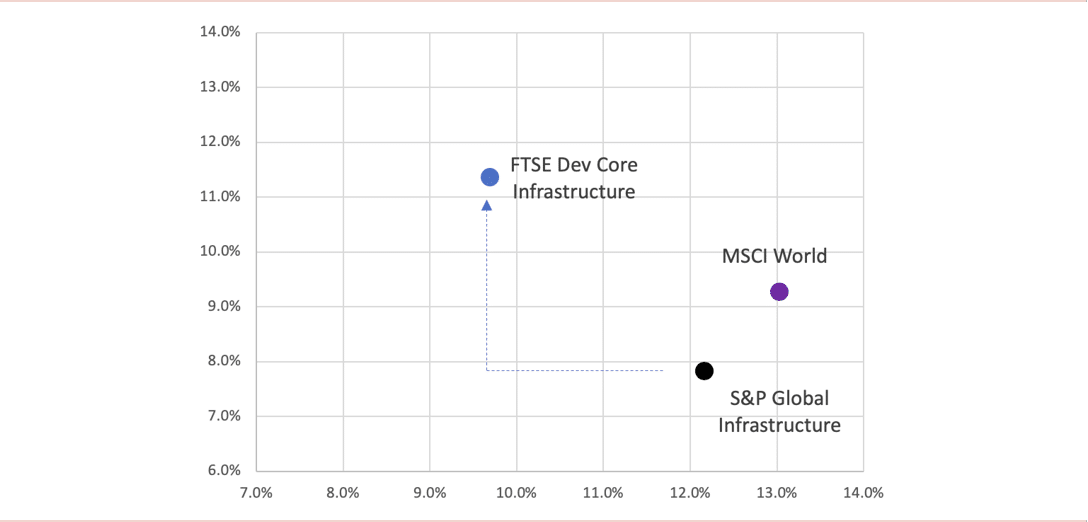

This low volatility anomaly can also be observed in the listed infrastructure market. Since 2009, the more defensive FTSE Core Infrastructure Index has persistently delivered higher returns at lower level of volatility than a broader S&P Global Infrastructure Index. The risk return profile is in Figure 3.

Figure 3: Risk/return of market indexes since September 2009

Source: Bloomberg, Whitehelm Capital. Three years monthly returns of benchmark data as at 30 September 2019. Past performance is not a reliable indicator of future results. All index returns are in USD.

Conclusion

A strict definition of what is and is not “core infrastructure” provides two main benefits:

By restricting an investment universe to companies with stable cash flows that are linked to inflation and enjoy a natural monopoly, the investor can generate stable returns in a portfolio and suffer lower drawdowns than stock markets overall as well as more conventional approaches to infrastructure investing.

Secondly, by exploiting the low volatility anomaly in stock markets the investor has the potential to generate higher returns than conventional infrastructure investments.

In our view, core infrastructure investments are clearly superior to non-core infrastructure and worthy of serious consideration for investors trying to diversify existing equity holdings.

Ursula Tonkin, portfolio manager, Whitehelm Capital