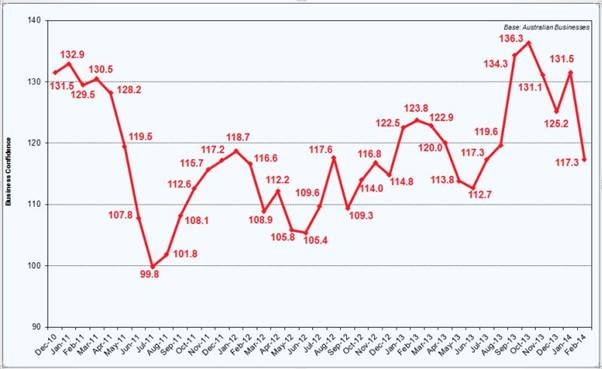

The February Roy Morgan Research Business Confidence survey showed business confidence fell by 12 per cent to 117.3 – down from 131.5 in January – back to below the level in August (119.6) 2013 in the month prior to the federal election.

The fall in confidence among business in February was caused by a decrease in positive feelings about where the economy is heading in the next 12 months and the next five years, according to the report.

“The decline in business confidence in February was anticipated given the number of very negative high profile stories during the month,” Roy Morgan Research industry communications director Norman Morris said.

“These included the federal government’s decision not to support SPC, the plans by Qantas to reduce their workforce by 5,000, Toyota announcing that it was ceasing car manufacturing in Australia and the very big impact this will have on the parts suppliers as it was the last car manufacturer, Alcoa announcing that it was closing several smelters, and the Telstra decision to cut employment in its directories division,” Mr Morris said.

February’s decrease in business confidence was greatest among micro business, down 14.9 points to 115.2 and small business down 9.0 points to 131.0.

Source: Business Confidence, Roy Morgan Business Single Source, average monthly sample n = 2,200.

“With nearly 90 per cent of businesses in Australia being classified as micro (annual turnover below $1 million), it is of major concern that they have shown the biggest drop in confidence in February, and as a result are now clearly the least confident business sector,” Mr Morris said.

“This has major implications for employment levels in the near to medium future,” he said.

Medium and large businesses – those with a turnover greater than $5 million per annum – were fairly steady (down 4.3 points to 143.9).

The report notes that medium and large businesses have clearly been the most confident over the last three years, and in February they remain well above their three-year average.

All states except Tasmania have shown a decline in business confidence during February, with the biggest drop being in Victoria, where it fell to 115.8 (down from 134.3 in January).

The other negative movers were Queensland (down 15.3 points to 118.6), New South Wales (down 14.3 points to 118.2) and South Australia (down 9.1 points to 124.4).

Over the last quarter, mining has remained the most confident sector (165.3), with the other industries well below, such as construction (135.1), manufacturing (120.6), retail (118.3) and agriculture (106.6).

In the last month all of these industries have shown further declines, according to the report.