New analysis by research house Lonsec has revealed that while emerging markets are volatile they also produce significant real returns over the long term.

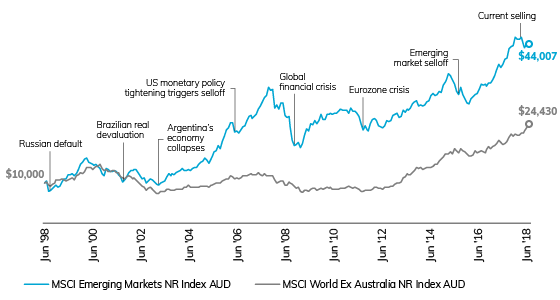

Part of the research compared the MSCI Emerging Market index, which tracks emerging market indices against the standard MSCI World Ex Australia index that tracks developed market indices.

The research found that the emerging market had higher returns over the past twenty years despite the increased volatility.

In fact, emerging markets are currently selling at roughly double the developed markets with $44,007 compared to $24,430 in the developed market.

Lonsec said emerging markets captures a large variety of countries, including places like Turkey that have suffered from uncertainty while other economies like India continue to rapidly grow.

GDP growth does not necessarily translate to strong investment returns but in the case of India, for example, the market performance was correlated with GDP growth.

Because of these aspects, the broader emerging market index often has countries that are outperforming and therefore balancing those that lag.

This has resulted in an increased volatility but also increased returns if investors can stick out the ride.