By Arif Husain

Head of International Fixed Income

Portfolio Manager for the Dynamic Global Bond Fund

July 2016

Over the past 12 months, the slump in commodity prices, China’s slowdown, and intense speculation about central bank actions have made for a highly volatile and uncertain period for the global economy. Then last month, the UK unexpectedly voted to leave the European Union (EU), sending markets worldwide into a short-term tailspin until order was restored. If “Brexit” encourages other EU member states to hold their own referenda, the existence of the bloc itself could come under threat, the impact of which would be felt across the globe.

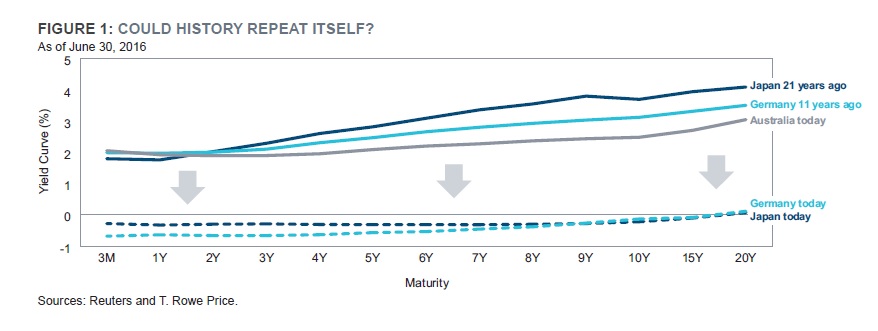

Events like these are only adding to the pressures felt by fixed income investors already dealing with the impact of a major deleveraging cycle that began following the 2008 financial crisis. Yields are at record lows: At the end of June, the total amount of government bonds with negative yields reached USD 11.7 trillion. Australian bond yields are currently comfortably above those of most of the rest of the developed world but could fall as the Reserve Bank of Australia is expected to cut interest rates further. As the experiences of Japan and Germany show, the impact of deleveraging on bond yields should not be underestimated.

A DIFFERENT APPROACH TO BOND INVESTING

Traditional benchmark-based approaches to fixed income have been popular for a reason: They have worked. But the upheavals that have taken place in the global economy over the past few years, and their subsequent impact on bond markets, have raised serious doubts about whether the traditional approach will continue to work as well in the future.

Investors have typically looked for their bond allocation to achieve three things: income, downside risk management, and diversification from equities. Income is provided by the coupon on the bond and is the most certain source of return as it is a contractual obligation. Protection against the downside cannot be guaranteed because there will always be risk, but any losses should be infrequent and limited in size—nasty surprises should hopefully be avoided. Diversification from equities is vital because, arguably, the main reason investors buy bonds is to derive potentially positive returns when equity markets suffer losses.

In the past, an investor looking for these three qualities from their fixed income portfolio would probably have found themselves a large, broad global index and hired a manager to manage against that. The Barclays Global Aggregate Index is one of the most widely used indices and has a very rich history, having been established more than 26 years ago. It composes around 54% global government bonds and 18% corporate bonds, with the remainder split by government-related and securitized products. Geographically, it has 41% exposure to the U.S., 32% exposure to Europe, and 20% exposure to Asia Pacific.

The Barclays Global Aggregate Index has done a very good job of delivering the three main qualities that investors require from bond portfolios over a long period of time. However, there is good reason to believe it will not do so in the future: First, while the coupon return averaged 6.02% over 26 years, at the end of last year it stood at 2.96%—less than half its historical average—meaning that income has been significantly reduced; second, the Barclays Global Aggregate Index’s current record-low yield and record-high duration make it far less likely to manage downside risk than in the past; and third, yields are so low that they have very little scope to fall further, reducing the potential for price rises in periods of stress and, hence, offering little diversification from equities.

LOOSENING THE BONDS

However, while the Barclays Global Aggregate Index may no longer be able to do as good a job as it has in the past of delivering income, downside risk management, and diversification from equities, this does not mean giving up seeking these qualities from our fixed income portfolios. Doing so, however, will require adopting an unconstrained approach to bond investing—one that considers the full spectrum of the fixed income universe, including government bonds and credit instruments, and countries that are less correlated to major markets.

The good news is that fixed income investors today have more choice than ever before. In countries where interest rates are rising, for example, steepening yield curves can offer income opportunities, while rising volatility on foreign exchange markets can lead to currency opportunities. Emerging markets can offer the higher yields that investors look for but may come with added risk, while lower-yielding, less risky securities still offer benefits in a period of highly volatile equity markets.

The bad news is that greater choice does not necessarily make the job of fixed income investors any easier— with more options comes the need for more research, due diligence, and risk management. However, investors who actively embrace this wider opportunity set are ultimately likely to find their efforts rewarded, while those who do not seek access to different country’s bond markets could miss potential performance enhancement and diversification.

And the opportunity set continues to expand and evolve. Since the 2008 financial crisis, more companies in Europe are accessing the public debt markets for their financing needs, which is fueling the growth of the euro high yield asset class. Similar trends are occurring among companies in the emerging markets—indeed, the emerging market corporate debt market is one of the fastest-growing fixed income asset class.

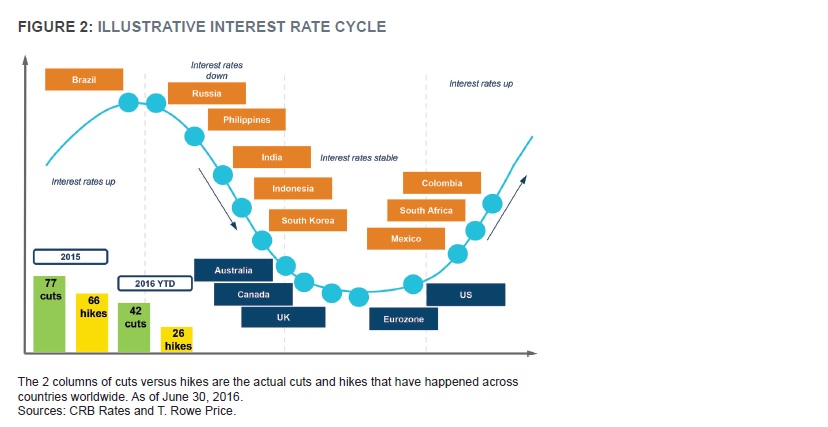

Investors with access to a broad range of markets can derive returns by taking positions in countries at differing stages of the interest rate cycle. Figure 2 illustrates a hypothetical interest rate cycle between a selected number of developed and emerging markets. It shows how an investor can take advantage of relative country exposures in markets where interest rates are falling or stable versus countries where interest rates are rising. This enables investors to not only exploit interest rate differentials between countries, but also adjust duration (price sensitivity to changes in interest rates) and yield curve exposures within individual countries. If yields are attractive but currency valuations are not, currency risk can be neutralized to focus exclusively on country selection and interest rate direction.

SEEKING TO GENERATE RETURNS ACROSS THE MARKET CYCLE

Let’s see how this works in practice. Our Dynamic Global Bond Fund seeks to achieve the three key qualities that we believe investors look for from their fixed income allocation: sustainable income, downside risk management in times of stress, and diversification away from risky markets. With regard to the first of these, most of the attribution of our strategy over the past 12 months came from long- and short-duration bets in high-quality companies. This differentiated us from most of our competitors, who traded more in credit markets or emerging market countries. One of the advantages of an unconstrained approach is that it gives us the freedom to move quickly in and out of major short- and long-duration positions as the markets change.

A major influence on markets over the past 18 months has been speculation about central bank moves, in particular the European Central Bank’s (ECB) quantitative easing (QE) measures and the timing—and frequency—of any Fed rate hikes. We modified our positioning throughout 2015 in line with our own expectations. For example, ahead of the launch of the ECB’s QE program in March 2015, we bought a basket of peripheral European countries in the expectation that spreads on peripheral sovereign bonds would tighten because they would be perceived as less risky given the extra stimulus.

When the details of the QE measures were announced on March 10, 2015, spreads on peripherals duly tightened as we expected, benefiting the strategy. A benchmark-constrained strategy would have been stuck with large weightings to countries on the other side of the trade, such as Germany, which would have detracted heavily from performance.

Other “conviction” positions that generated returns over the past year included short positions in the UK and Canada—the former performing well because the market had priced in Bank of England rate hikes that never occurred and the latter because of the slump in the price of oil.

More recently, we have benefited from long positions in perceived “safe haven” countries, such as Sweden and Australia, and in countries that have cut interest rates, such as South Korea and Malaysia. We have begun to adopt positions further along the yield curve in the hunt for income against a backdrop of very low inflation.

DOWNSIDE RISK MANAGEMENT

However, while such trades are an essential part of what we do, even more important is how we manage our clients’ assets during periods of equity market volatility and offer diversification from equities. The past year has provided three major tests of our ability to do this. The first came in August last year, when equity markets plummeted following the People’s Bank of China’s decision to devalue the renminbi. In response, we quickly exited a number of long positions in Asian currencies such as the South Korean won and the Malaysian ringgit. We had previously felt that these countries were relatively immune to a rise in volatility, but in reality, the situation in China put pressure on local bond markets. Subsequently, we adopted short positions in a number of Asia ex-China currencies, which proved beneficial for performance during the fall.

Some of our risk-hedged positions worked well during the August/September rout, but others did not. Our short euro position, for example, did not deliver as expected, and we reduced it during the month. On the other hand, our long-volatility position through put options on the S&P 500 was highly effective in mitigating market impact on performance. As the cost of volatility increased during the month, we took profits on the put options. In situations like these, the ability to be nimble in order to quickly adapt and exit positions is essential.

The second test came in January 2016, when equities slumped again on the back of renewed fears over China and the spectacular collapse in the price of oil. However, we had begun the year with a strong defensive stance, having added a number of hedges to the strategy during November and December. These included short positions in credit derivative instruments, long-duration positioning in high-quality government bond markets, and short positions in specific emerging market currencies versus the U.S. dollar. Most of these defensive positions paid off in January.

Then came the Brexit vote. In the month running up to the UK’s referendum on European Union membership on June 23, it became clear that volatility would rise and that the cost of insurance against that volatility was fairly cheap. While we did not necessarily predict a “leave” vote, we saw the outcome as asymmetric: The potential downside impact of a “leave” vote on the financial markets would be much greater than the upside response to a “remain” vote. Our positioning, therefore, reflected this asymmetry so that in the end we benefited from the outcome. At the same time, we implemented some positions that would have benefited from a “remain” scenario. This scenario never materialized, however, and the premium paid for these positions lost its value after the referendum.

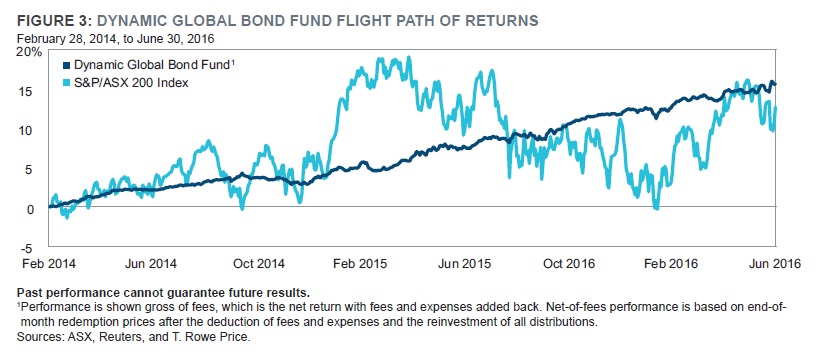

Figure 3 shows how the Dynamic Global Bond Fund has performed since its inception on February 18, 2014. It clearly demonstrates that the fund has achieved its objective of seeking to generate consistent returns across the market cycle, providing downside risk management, and diversification against equities.

OUTLOOK FOR THE REST OF 2016

Looking ahead to the rest of this year, we remain fairly defensive. Further volatility is likely while the consequences of the Brexit vote at the European-wide level are still not fully understood. There is much uncertainty about the path events will take, and liquidity is likely to remain challenged. Away from Brexit, the world is still not an altogether stable place. China remains a concern. U.S. and Italian politics will gain focus as we move into the fall, with a referendum on constitutional reform in Italy expected in the second half of the year and the U.S. election due in November.

Instead, risk will be taken on a more idiosyncratic basis, on specific countries, currencies, and issuers where analysts have strong convictions. Some of these opportunities are likely to be found in emerging market countries where the growth dynamic is improving, but also within specific credit securities where prices have become more attractive and where the fundamental story remains sound. So, for the time being, we are positioned to manage our clients’ assets against spikes in volatility and add idiosyncratic alpha as and when we find it.

Click here to learn more about our unconstrained approach to fixed income.

Important Information

The views contained herein are as of July 2016 and may have changed since that time.

Equity Trustees Limited (“EQT”) (ABN 46 004 031 298/AFSL 240975) and T. Rowe Price International Ltd (“TRPIL”) (ABN 84 104 852 191) are, respectively, the responsible entity and investment manager of the T. Rowe Price Australian Unit Trusts. TRPIL is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides in Australia and is regulated by the Financial Conduct Authority under UK laws, which differ from Australian laws. For Wholesale Clients only.

Past performance is not a reliable indicator of future performance. The price of any fund may go up or down. Investment involves risk including a possible loss to the principal amount invested. For further details, please refer to each fund’s product disclosure statement and reference guide which are available from EQT or TRPIL.

T. ROWE PRICE, INVEST WITH CONFIDENCE and the Bighorn Sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc. in the United States, European Union, and other countries. This material is intended for use only in select countries.

2016-GL-4406