As a passionate AFL Hawks supporter, I was reflecting on the power of the big 'V' in the psyche of many Aussie rules footy fans.

For more than 100 years the blue jersey with the oversized white V dominated the inter-colonial and interstate Australian rules scene. Sadly for many Vics, the last outing of the jersey was in 2008.

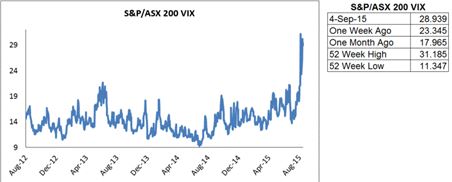

On the financial markets front the big V is dominating once again..

Volatility has become the byword for describing our local market following the correction in the Chinese bourses, which has impacted severely on markets around the world including ours.

At PM Capital there is another V word that figures prominently with us, in fact it drives everything we do.

As fundamental stock pickers we focus on valuations with a capital V. As a result, we are not averse to a little, or for that matter a lot, of volatility.

We seek to buy good companies at less than their intrinsic or fair value.

We run concentrated portfolios and our approach is to seek to make good returns over the medium to long term.

Consequently volatility can be an opportunity rather than a cause for teeth gnashing.

One of the critical issues in operating in an actively fluctuating market or markets is to seek to understand the causes of the volatility.

For instance over recent weeks following the Chinese government’s somewhat crude, and ultimately futile, attempt to exert control over their market we look beyond the headline moves to explain what’s actually happened.

The key issue for us is: has the dramatic drop in the market been as a result of a change in the fundamentals? Or, is it sentiment driven?

I should point out we have long been sceptical of official figures coming out of China.

We have held the view that growth is considerably lower than the announced numbers.

We have also been extremely sceptical of the massive run up of the Shanghai and Shenzen stock markets over the last 12 months.

To our mind the rises have been momentum driven and the falls are not unexpected.

In short, we believe there has not been a radical change in the fundamentals.

China’s economy is continuing to slow. Further falls in the market would not surprise us. Commodity prices are showing no signs of any upward trend.

Global growth is slow and possibly slowing. This we already believed and formed the backdrop for our investment decisions both local and globally.

At the same time we believe the US and Europe are well past their worst and continue to provide opportunities.

Part of the new normal for us, though, is mispricing hangovers from the GFC are passed and organic earnings growth will be the new source of performance.

Single digit equity returns may be the new order of the day. High single-digit equity returns may well be seen as a strong outcome for investors.

So in deciding what investment action to take on the ASX we factor in these opinions.

In short our views on the Chinese situation have not changed as a result of the big market falls.

Accordingly we have taken the opportunity to purchase good Aussie stocks at attractive prices where they represent value.

In the few days since commencing this commentary the ASX has fluctuated wildly. But at, and below, 5,000 it is presenting opportunities for us.

Uday Cheruvu is a portfolio manager at PM Capital.